UniCredit Bank Austria Business Indicator:

The recovery emerges

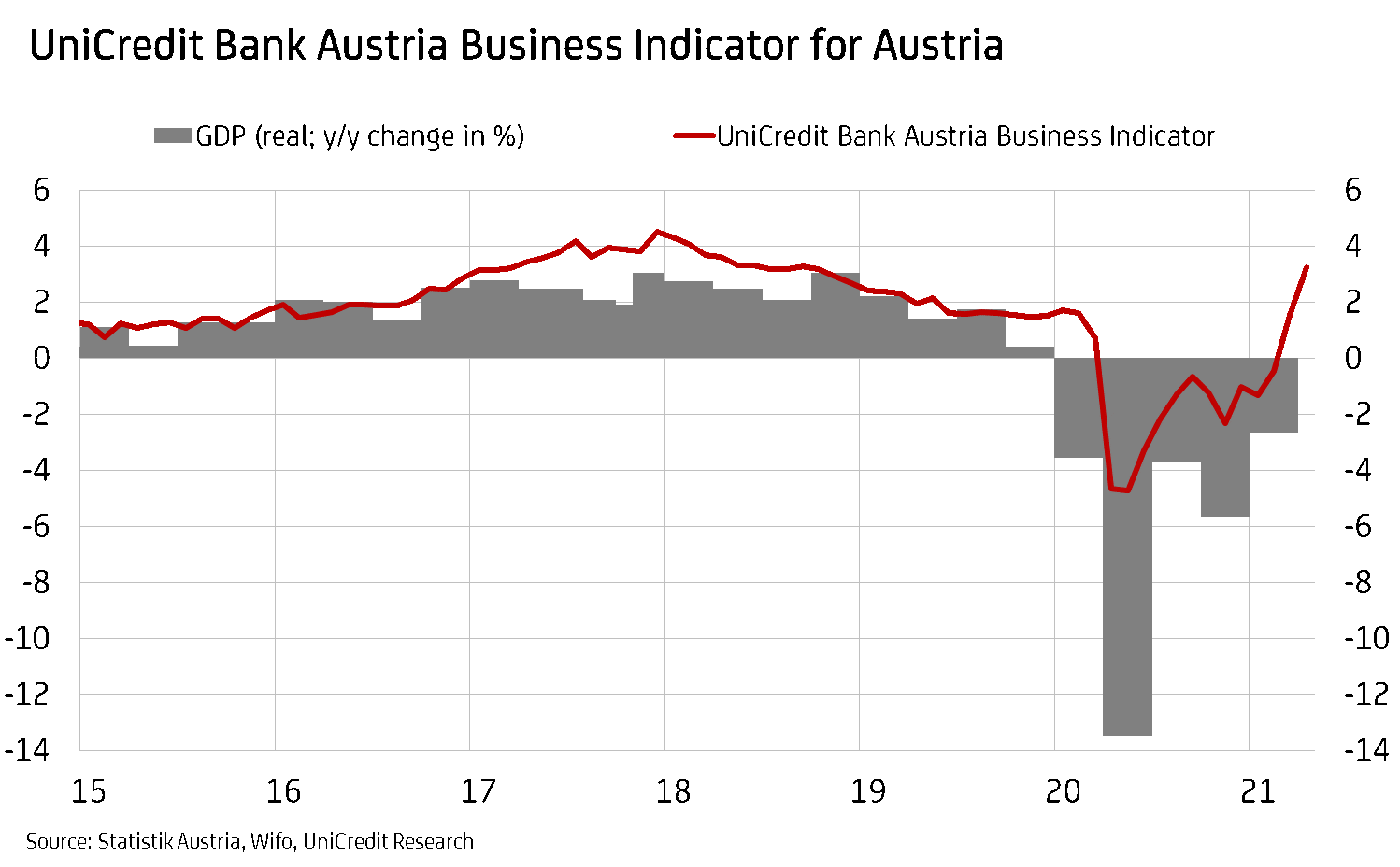

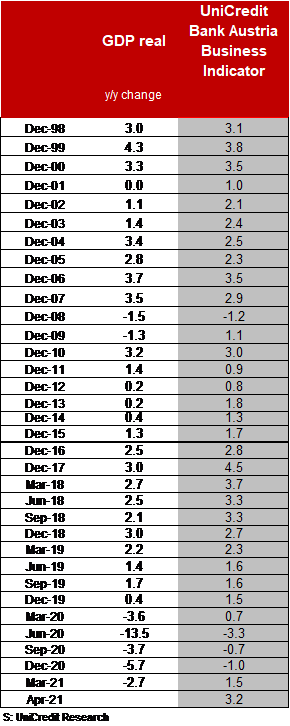

- UniCredit Bank Austria Business Indicator climbs to 3.2 points in April - its highest level in two and a half years

- Stabilisation of GDP at start of year saw economy open up, triggering strong rebound in Q2 2021

- Broad and sustained recovery in H2 despite COVID-19 safety measures: Growth forecast for 2021 increased to 3.2%; forecast for 2022 adjusted to 5.4%

- Easing on labour market continues, but unemployment rate not expected to return to pre-crisis level of around 7.5% before 2024

- Higher raw materials prices and stronger demand for certain services set to temporarily increase inflation to over 2.5% during 2021

- Monetary and fiscal policy to remain expansionary in 2022

The recovery of the Austrian economy is taking shape. "The marked improvement in economic sentiment at the start of spring signals a strong growth comeback. The UniCredit Bank Austria Business Indicator rose to 3.2 points in April, reaching its highest level in 30 months. Following the stabilisation of the economy in the first quarter, the apparent suppression of the third wave of infections and the general opening up of the economy will herald a strong rebound in Austria in the second quarter", predicts UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

En route from unilateral growth to balanced growth

Current indicators of economic sentiment also point to a return to more balanced economic growth within the individual sectors in Austria. "While there has already been extremely positive growth in domestic industry and construction in recent months - helping to drive a level of economic development that compares favourably with the rest of Europe since the start of the year - the services sector is now also gaining momentum. This will lead to a broader recovery of the Austrian economy taking hold over the coming months", says Bruckbauer.

With certain regions beginning to open up again and the announced wholesale opening of all sectors from mid-May, the mood in the services sector is much brighter and is even outperforming the long-term average. Confidence is also fuelled by strong consumer sentiment, which is benefitting from the gradual easing of the situation on the labour market. The improvement in the services sector accounts for almost half of the increase seen in the UniCredit Bank Austria Business Indicator in April.

A further improvement in the business outlook for domestic industry also made a strong contribution to the increase, as demand from abroad continues to grow. The global mood in the industrial sector - weighted by the Austrian share of trade - is even at a record high, driven by the recovery in Asia and the USA. Favourable weather conditions have seen optimism increase to an all-time high in the construction sector, with order books full.

Increased growth forecast for 2021

The Austrian economy has made a surprisingly strong start to the year, particularly in light of the stringent measures taken to contain the pandemic throughout the first quarter of 2021. The recovery of the industrial economy off the back of global development and the injection of public investment to boost the construction industry aside, it has become apparent that many sectors of the economy have adapted well to lockdown conditions and have been successful with alternative concepts, such as pick-up and delivery services.

This also boosts the prospects of a further recovery of the Austrian economy. In addition, some federal states took their first steps out of lockdown in April. Subject to certain conditions, the economy will be fully opened up from mid-May and this move is likely to shore up the current economic turnaround over the coming months. The Austrian economy is therefore likely to see strong upwards momentum in the second quarter, driven by further recovery of investments and consumption - the latter of which will benefit from catch-up effects in particularly badly impacted sectors such as tourism, some sections of retail and personal services.

Assuming that the rate of infection continues to develop favourably and that no further tightening of measures to contain the pandemic is required, the second quarter of 2021 is set to herald the start of lasting recovery in the domestic economy. "Following a stronger-than-expected start to the year, we currently expect the Austrian economy to grow by 3.2% over 2021 as a whole. We also still expect GDP to increase significantly in 2022, with the forecast figure now 5.4%. That would be the biggest economic growth in around 50 years", says UniCredit Bank Austria Economist Walter Pudschedl.

Opening up of economy in May eases pressure on labour market

As the economic recovery takes hold, the situation on the Austrian labour market is also improving. The seasonally adjusted unemployment rate was down to just 9.2% in April, compared with an average of 9.9% in 2020.

The opening of the economy from mid-May will prompt a continuation of the positive developments on the domestic labour market, particularly given the ongoing recovery in the industrial and construction sectors. In addition to around 340,000 job seekers and almost 80,000 people engaged in training, businesses have also reported short-time working for at least 300,000 people.

"Given the noticeable improvement in the situation on the labour market, driven by factors such as a large number of people switching back from short-time working to their normal working conditions as the economy opens up from mid-May, we expect unemployment to decline only gradually looking ahead. The Austrian economy is not expected to return to its pre-crisis level until after the end of 2021 or the start of 2022, and the effects will only be felt on the labour market after a delay", says Pudschedl.

The economists at UniCredit Bank Austria expect the unemployment rate to fall to an average of 9.2% in 2021, accelerating to 8.4% in 2022 as recovery gathers pace. However, unemployment will not return to the pre-crisis level of around 7.5% until sometime in 2024.

Inflation to trend upwards until autumn

By year-on-year comparison, inflation has doubled since the start of this year to around 2%. Rising raw materials prices, in particular the higher oil price, have triggered this noticeable acceleration.

Energy prices, which suppressed inflation in Austria throughout 2020, have been providing an additional boost since March of this year. The expected increase in the price of oil from EUR 38 per barrel in 2020 to an average of over EUR 50 will see inflation in Austria increase by around 0.2 percentage points on average this year alone. Higher prices for other raw materials will also impact prices for consumers, although industrial businesses are unlikely to be able to fully offset the significant price increases that are being triggered by supply chain shortages by passing them on to their customers.

Service prices are expected to have a particularly big impact on inflation. As the economy starts back up, pent-up consumer demand from the past few months will unfold, mostly likely leading to significant price increases. The effects will be seen in particular in the sectors that have been most affected by the pandemic, such as hospitality and personal services, but will be mitigated by discount campaigns in certain retail sectors.

However, the rise in prices as a result of both the higher raw materials prices and the improved demand situation is likely to be only temporary given that existing under-utilised capacity since the major economic slump during the pandemic ultimately limits price dynamics. "The upwards trend for inflation will continue in Austria over the coming months, albeit at a slower pace. We still expect average annual inflation of 2.2% for 2021, with highs above the 2.5% mark from late summer onwards. As the year draws to a close, inflation should gradually slow as the base effect from the oil price ceases to be an issue. We expect average inflation of 2.0% for 2022", says Pudschedl.

This means that in both 2021 and 2022, inflation will surpass the expected reference figures for the euro zone of 1.7% and 1.5% respectively, making it 12 years in a row that inflation in Austria has exceeded that in Europe as a whole.

"Despite the strong recovery and the higher inflation rates, however, the economy is still not realising its full potential and this situation is set to continue into 2022. We therefore expect monetary and fiscal policy to remain expansionary for 2022, though with lesser intensity", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957

Email: walter.pudschedl@unicreditgroup.at