UniCredit Bank Austria Purchasing Managers' Index in May:

Austria's industry in record growth phase but hampered by price fluctuations due to supply bottlenecks

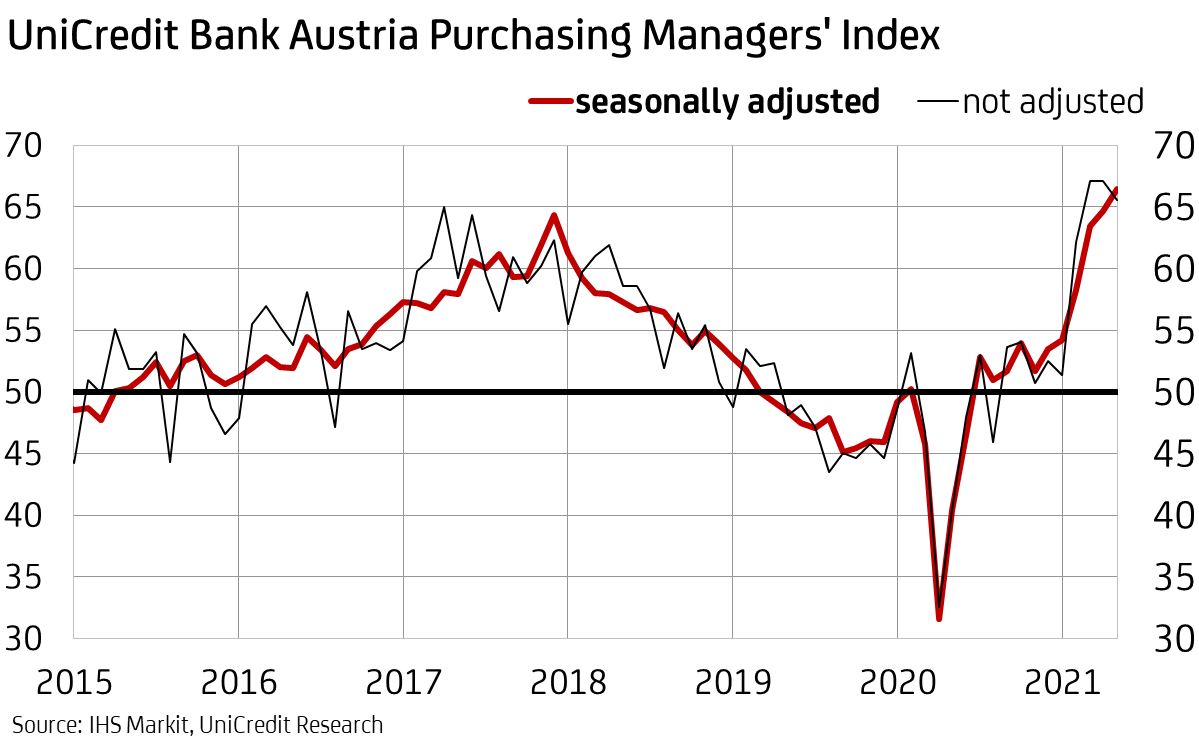

- The UniCredit Bank Austria Purchasing Managers' Index reached an all-time high once again in May at 66.4 points

- The rapid rise in new business is seeing the strongest expansion in production since the survey began in 1998

- Rocketing costs for many primary materials due to worsening of supply bottlenecks

- Increase in capacity is creating new jobs, with employment growth at a three-year high

- Strong growth is expected - Austria's industry will reach 2019 levels this year

- Although the expectation index for production over the next 12 months does fall in May, the high figure of 67 points still promises dynamic industrial development

The recovery of Austrian industry is continuing at an even faster pace than in previous months. "The UniCredit Bank Austria Purchasing Managers' Index increased to 66.4 points in May - the second month in a row that the indicator has reached a new record level since the first survey was carried out over 20 years ago," says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The current survey shows that Austrian industry is now on a very dynamic growth path, after the recovery started somewhat cautiously in the middle of last year. The production slump of up to 25% on average during the first lockdown has already been made up. Now capacity is being expanded again."

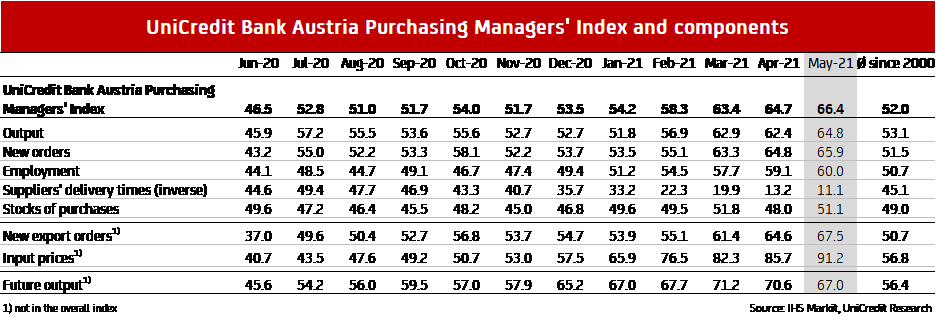

However, in light of the strong recovery in demand from Asia and the USA, which is providing a major boost to the recovery of industry across Europe, the downside is increasingly beginning to emerge. "As a result of the strongest order growth in the survey's history, domestic industry grew at record speed in May, enabling the strongest job creation in three years. Supply-side conditions worsened, though. A shortage of materials and transport problems led to record delivery times and also drove costs to the highest ever recorded by the survey," says Bruckbauer, summarising the key results of the current survey.

Record order growth at home and abroad

In May, all components contributed positively to the strongest-ever increase in the overall index. Accounting for more than a third of this increase, the biggest contribution came from the strong expansion in production. From the second half of the month, the consumer goods industry in particular provided a decisive boost as the Austrian economy opened up following lockdown. "In May, domestic businesses increased their production at a level not seen since the Austrian Purchasing Managers' Index survey began in 1998. The production index climbed to 64.8 points, supported by the strong growth in new business, which increased at record speeds both at home and abroad," says UniCredit Bank Austria Economist Walter Pudschedl. In addition to the opening up of the domestic economy, new business benefited from the revival of investment activity and strong demand from the construction sector.

Transport problems and material shortages extend delivery times

Despite the strong expansion in production, the backlog of orders from domestic companies continued to increase significantly in May, rising at record pace for the second month in a row. Almost half of domestic businesses reported an increase in outstanding orders in May. The capital goods industry was particularly affected by this issue.

"Delivery delays in procurement due to bottlenecks in primary materials, components and raw materials, as well as logistics problems caused by a lack of freight capacity, meant it was not possible to adapt production capacity to dynamic demand and led to a further drastic extension in delivery times," says Pudschedl. The proportion of companies encountering delivery delays rose to 80%. In particular, the market supply of aluminium, electronic components, plastics, wood and steel did not meet the demand of domestic companies.

Slight increase in primary materials, but significant decrease in stocks of finished goods

In light of the expected delivery delays, companies placed large orders at an early stage in order to build up a safety buffer of the required materials. The index for quantity of purchases rose to a new record high of 69.8 points. "In May, Austrian companies tried to create a safety buffer of stock in primary materials because of concerns about supply bottlenecks and future price increases. The slight increase in stock was offset by a sharply accelerated decline in distribution warehouses due to the strong increase in demand," says Pudschedl. Stocks in finished goods have already been falling for over a year but are now falling at the fastest rate in more than ten years, caused in part by a scarcity of raw materials, which has led to production restrictions.

The cost increase is increasing being reflected in sales prices

The shortage of primary materials, long delivery times and rising transport costs have led to a record rise in the average input prices of domestic businesses in May. Output prices also rose at record pace as the number of manufacturers passing on the higher costs of production to their customers has increased. "At 42%, the proportion of industrial companies that raised their output prices in May was only half the proportion of companies that faced higher purchase costs. The effect on consumer prices in Austria is therefore still small, but is increasing slightly. However, with the capacity bottlenecks and transport problems expected to be resolved over the remainder of the year, there is expected to be only a temporary impact on consumer prices," says Pudschedl.

Growth rate remains high

The prospects for Austrian industry, which is currently experiencing strong growth, are also very promising for the coming months. Order books are continuing to fill up and domestic companies are increasing their capacities, supported by the favourable international environment. The preliminary Purchasing Managers' Index for the manufacturing industry in the eurozone has stabilised at a high 62.8 points. With confidence, the employment index climbed to 60 points in the current survey, with the number of employees increasing at the strongest rate in three years. The index ratio between new orders and stocks of finished goods reached a new high in May, promising a continuation of the strong expansion in production over the coming months as existing stock levels are not sufficient to meet the orders received.

The renewed fall in the Purchasing Managers' Index for German industry in May to 64 points can be seen as the first sign of an imminent slowdown in the industrial economy for the strongly connected Austrian economy. Although the exceptionally strong growth dynamics of recent months in Austrian industry will continue for the time being, the strong catch-up process will transition into a dynamic but calmer growth phase in a few months.

"While short-term indicators such as order development mean that a particularly high rate of growth can be expected to continue for the time being, the expectation index for production over the next twelve months has already fallen for the second consecutive month. The high figure of 67 points nevertheless promises dynamic industrial development, which over the year as a whole is expected to increase production by around 8%, exceeding our previous expectations. This is likely to make up for the 7.4% decline in the manufacturing industry in 2020," says Bruckbauer in conclusion.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at