UniCredit Bank Austria analysis of the economies of the federal provinces for 2020 and outlook for 2021:

After a historic slump, recovery is now in sight in all federal provinces

- The pandemic caused a severe recession in all federal provinces in 2020

- The tourism hubs in western Austria were most strongly affected, while Burgenland emerged from the crisis in a better position than other regions

- Industrial business (from the second half of 2020) and the construction industry contributed to recovery from the crisis in most regions

- Massive increase in unemployment rates and short-time working in all federal provinces

- Outlook for 2021: Tourism-oriented regions remain at a disadvantage this year, while federal provinces with high Unemployment rates are expected to fall in all federal provinces in 2021

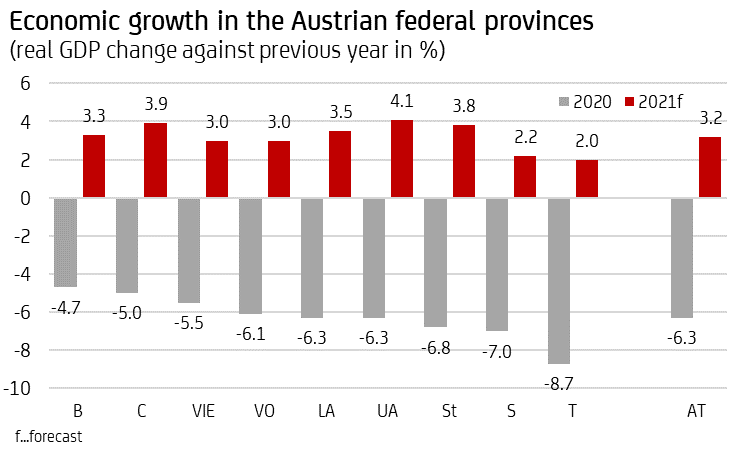

The severe lockdown measures beginning in March and November of 2020 in order to contain the pandemic caused the biggest recession in peacetime in Austria since the global economic crisis at the end of the 1920s, with an economic slump of 6.3%. Personal and physical services and certain sections of retail were most affected. The industrial business and the construction industry adapted well to the new legal conditions, while healthcare, IT services and real estate displayed a positive trend in almost every federal province.

All federal provinces recorded a recession of historic dimensions in 2020. "The severity of the economic downturn varied depending on the structure of the industries in each of the federal provinces. The tourism hubs in western Austria were the most strongly affected by the pandemic measures, while the regions with a higher levels of industry or a larger public sector emerged from the crisis in a somewhat better position than other regions", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

Burgenland and Tyrol witnessed the weakest and strongest decline in economic performance, respectively

Although the coronavirus crisis had a massive economic impact on all federal states, the growth rates varied substantially among each individual federal province. Burgenland, the federal province with the largest share of the public sector, which remained relatively stable throughout the crisis, recorded the lowest decline in regional value added in 2020, at 4.7%. Tyrol, which accounts for the largest share of tourism among all federal provinces, was hit hardest by the pandemic, with a decrease in economic output of 8.7%. In addition to Burgenland, other regions that outperformed the national average economic decline of -6.3% were Carinthia at -5%, Vienna at -5.5%, Vorarlberg at -6.1%, and Lower Austria and Upper Austria at -6.3% each. These provinces benefited from relatively good performance either in the industrial business or in the construction sector in addition to their somewhat more favourable industry structure. In addition to the tourism hubs of Tyrol and Salzburg with a -7.0% decline in economic output, the severity of the recession was above average in the industrial region of Styria at -6.8%. In addition to the pandemic, Styria also suffered from a structural crisis in its key automotive industry.

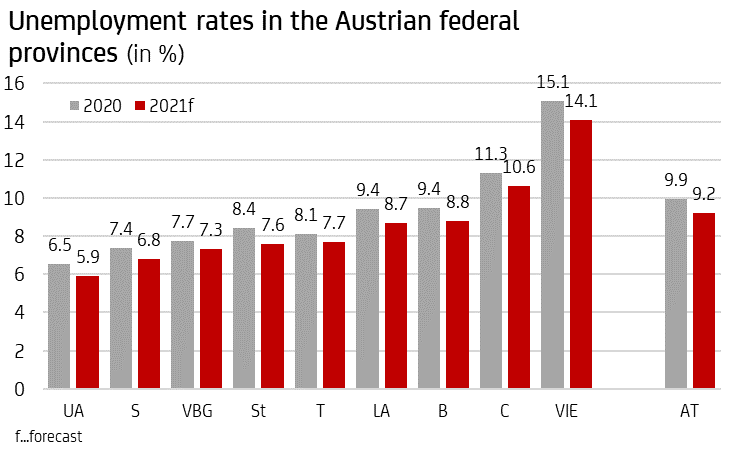

Massive increase in unemployment and short-time working

When the first lockdown began in March 2020, unemployment reached historic highs in all federal provinces. "After a slight recovery last summer, the unemployment rates in the federal provinces rose significantly in the autumn when the second lockdown was implemented", says UniCredit Bank Austria Economist Walter Pudschedl. The labour market usually mirrors economic development. In 2020, the largest relative increases in unemployment levels were seen in Tyrol and Salzburg, which also recorded the largest decline in economic output. New short-time working provisions were introduced to secure as many jobs as possible. From March to December last year, almost 12% of all those actively employed in Austria were engaged in short-time working; the proportion was lowest in Carinthia at just under 9% and highest in Upper Austria at almost 14%.

Global crisis has resulted in declining exports

In total, Austrian exports of goods fell by 7.5% to EUR 141.9 billion in 2020 due to the disruptions in global supply chains caused by the coronavirus crisis. The drop in exports was most severe in the industrial heartlands of Styria and Upper Austria, which were primarily affected by the lack of global demand in the automotive industry, mechanical engineering and the metal industry. In Vienna and Tyrol, on the other hand, exports actually grew or decreased only marginally, primarily due to the crisis-proof pharmaceutical industry, which is of great importance in both states.

Value added in industrial business fell by almost 7% in 2020. "The manufacturing sector in Vienna, Carinthia and Salzburg was relatively strong, while production output in Styria and Lower Austria declined the most", says Pudschedl.

Compared to the industrial business, the Austrian construction industry was better able to cope with the crisis, with a loss in value of 2.3%. The construction sector is less dependent on the global economy and was able to adapt relatively quickly to the changing conditions. Despite the pandemic, there was an increase in value added in the construction sector in Vorarlberg and Salzburg. Construction companies in Vienna and Carinthia reported an above-average decline in production turnover.

Many losers and few winners in the services sector

With a 6.5% decline in value added in 2020 in real terms, the situation within the services sector differed greatly: Depending on the areas of strength of the each of the federal provinces, regional performance in the services sector was vastly different. The tourism hubs Tyrol and Salzburg recorded the largest decline in economic output in the services sector, at -10% and -8% respectively. In federal provinces such as Burgenland and Carinthia, with a relatively high proportion of value added by the public sector, the economic downturn in the tertiary sector was only half as severe. All federal provinces suffered massive losses in value added, not just in tourism but also in leisure industry, some areas of retail and the transport industry. On the other hand, all regions witnessed growth in the IT, real estate and finance industries.

Outlook for 2021: Varying degrees of recovery in the federal provinces

With the economic outlook brightening in Q1 2021 and sentiment improving thanks to, among other things, sectors starting to open up again in May and vaccine progress, the economists at UniCredit Bank Austria expect real economic growth of 3.2% in 2021. All federal provinces are expected to return to the growth trajectory in 2021, with the degree of recovery likely to vary considerably.

"The more industrialised federal provinces such as Upper Austria and Styria with their high export quotas are benefiting from the strongly improved global economy in 2021, while growth in Tyrol and Salzburg will be relatively weak after suffering a de facto overall loss in last winter’s tourist season", says Pudschedl. In addition to Upper Austria and Styria, the economists also forecast significantly above-average growth of almost 4% for Carinthia. The economic growth of the remaining federal provinces is expected to be in line with the national average of 3.2%. This means that no federal province is expected to reach pre-crisis levels in 2021.

Falling unemployment rate in all federal provinces in 2021

"Unemployment rates will fall in all federal provinces in 2021", says Pudschedl. "Nevertheless, they are still significantly higher everywhere than in 2019, before the crisis hit," he adds. As in the previous year, unemployment is expected to be lowest in Upper Austria at 5.9%. According to the expectations of UniCredit Bank Austria economists, unemployment rates in Vienna will remain the highest, at 14.1%.

Source: Statistics Austria, AMS, UniCredit Research

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel. +43 (0)50505 - 41957;

Email: walter.pudschedl@unicreditgroup.at