UniCredit Bank Austria Business Indicator:

Recovery in Austria rapidly gathering pace

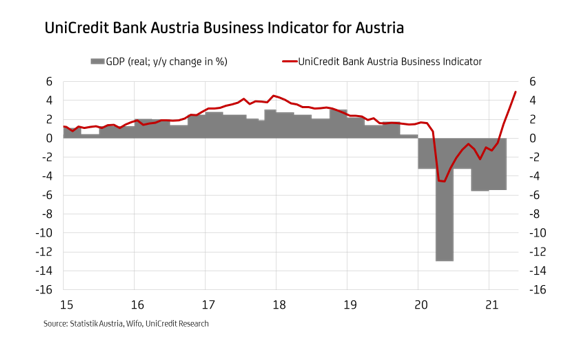

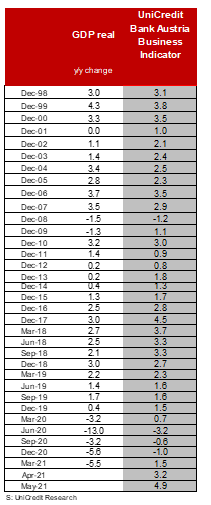

- The UniCredit Bank Austria Business Indicator rose to new record of 4.9 points in May

- Reopening of Austrian economy picking up pace: Particularly strong rebound in sight for summer following winter recession

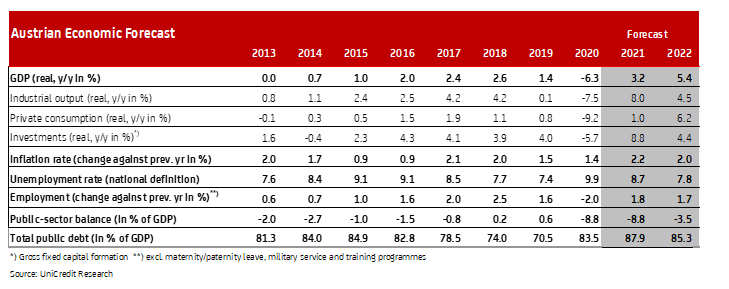

- Broad and sustained recovery despite COVID-19 safety measures: GDP growth of 3.2% expected for 2021; as much as 5.4% for 2022

- Labour market benefitting from rapid pace of recovery: Unemployment rate forecast reduced to 8.7% for 2021 and 7.8% for 2022

- Stronger demand for certain services and strongly dynamic pricing for raw materials following supply bottlenecks temporarily driving up inflation in Austria. Inflation set to reach highest level since 2012 with annual average of at least 2.2%

- Despite higher inflation, monetary policy to remain supportive for the time being

The recovery of the Austrian economy is progressing, propelled by the easing of pandemic measures in many service sectors. "The UniCredit Bank Austria Business Indicator rose to a new record of 4.9 points in May, confirming that the recovery of the Austrian economy has gained considerable momentum in recent weeks. The reopening of the economy has delivered lively results following the recession over the winter months", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, sharing his positive view of the situation.

The broad basis of the recovery in Austria has become a key feature and the foundation for the improved outlook. "The global recovery triggered in Asia and the USA has for months now been driving demand for export products, delivering the basis for the economic recovery we are currently seeing among Austrian industrial businesses. In addition, the construction industry is reporting impressive growth thanks to well-filled order books swelled by public contracts and increasing demand for housing", says Bruckbauer, adding: "When the relaxation of the measures to contain the pandemic began in mid-May, retail, hospitality and many other service sectors switched suddenly to recovery mode; bolstered by pent-up demand and unusually high savings accrued by consumers, these sectors are now making a strong contribution as the Austrian economy reopens."

Record level driven primarily by improved mood among service providers and consumers

The record level of the latest UniCredit Bank Austria Business Indicator is due in part to a continued brightening of the mood in the industrial economy. The international picture has improved once again. The sentiment indicator for the global industrial economy, weighted by the Austrian share of trade, is at an all-time high due to brisk demand for exports. Optimism among domestic industrial businesses is now at its highest level since the start of 2007, driven by strong demand from abroad and, more recently, the significant improvement in orders from within Austria.

While confidence in the construction sector has altered very little, changes in the framework conditions for service providers in May generated the strongest positive influence on economic sentiment in Austria. "As all service sectors began to open up in general, subject to certain conditions, the Austrian economy has benefited from an initial spark to ignite and accelerate recovery. As is the case in the industrial and construction industries, optimism has now returned to the services sector, fuelled by a clear improvement in consumer sentiment based, among other things, on the rapid improvement in the situation on the labour market", says Bruckbauer.

Strong rebound

In recent weeks there have been increasing signs that the Austrian economy is emerging from the recession it re-entered during the winter months. "Current sentiment indicators and real data indicate that the recovery of the Austrian economy is rapidly gathering pace. After a somewhat muted start to the year, the recovery is likely to begin accelerating over the summer period. These beginnings of a sustained recovery, supported by strong expansion in export and domestic demand, should provide the framework for strong economic growth of as much as 3.2% for 2021 as a whole. For 2022, we even expect GDP to increase by as much as 5.4%", says UniCredit Bank Austria Economist Walter Pudschedl.

Rapid progress on the labour market

Since the economy began opening up from mid-May onwards, there has been a clear improvement in the situation on the Austrian labour market. The seasonally adjusted unemployment rate fell to just over 8% at the end of May, which is only around one percentage point above the pre-crisis level. The rapid pace of recovery over the coming months—provided there are no pandemic-related setbacks—should drive further improvements on the labour market.

"We have downgraded our average unemployment rate forecast for 2021 by half a percentage point to 8.7%. Now that the economy has opened up and the recovery is gathering pace, we anticipate a rapid improvement in the situation on the Austrian labour market. That said, existing structural challenges such as high long-term unemployment will mean that any further improvement will be very much a gradual process. As before, we expect the unemployment rate to fall by less than one percentage point in 2022 compared with the previous year, to an average for the year of 7.8%", says Pudschedl.

Raw materials prices, supply bottlenecks and demand for services continue to drive up inflation

After a moderate start to the year, inflation in Austria has now increased noticeably, as expected. The decisive factor was the increase in raw materials prices, especially oil, as a result of the global recovery. The recent shortages of various primary materials due to supply bottlenecks and the fact that production capacity is ramping up only gradually are also factors. Finally, the opening up of the economy and the corresponding demand for various services means that the services sector is also seeing a sharp increase in prices, which has already caused inflation to increase to 2.8% year on year in May. The last time inflation was this high was the end of 2012.

"Over the coming months, inflation in Austria will continue to track above the 2.5% mark year on year, driven by higher raw materials prices and strong demand for various services, such as those in the hospitality sector. That said, supply problems are set to run their course later in the year and dynamic pricing in the services sector is likely to be only temporary, all of which means that following average inflation of 2.2% for 2021, we expect the figure to drop slightly to an average of 2% for 2022", says Pudschedl.

Monetary policy expected to remain unchanged despite higher inflation

The European Central Bank has so far characterised the rise in inflation as a temporary trend. As such, the PEPP securities purchase programme—introduced by the ECB in response to the coronavirus crisis—is expected to continue into Q3 with a scope of around EUR 80 billion per month. "We do not expect the ECB to make any decision about reducing the monthly volume of securities purchases under the umbrella of the PEPP crisis programme until September at the earliest, ahead of the programme potentially being phased out in March 2022. Monetary policy will therefore support economic recovery in Europe and Austria well into the upswing period, as will fiscal policy in the form of EU recovery programme NextGenerationEU and various national packages", concludes Bruckbauer.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at