UniCredit Bank Austria Purchasing Managers' Index in June:

Consolidation of upwards trend for Austrian industrial businesses at midway point of year

- UniCredit Bank Austria Purchasing Managers' Index increases to new all-time high of 67 points in June, signalling further improvement in industrial economy

- New business growing at record rate but pace of production growth somewhat slower than in previous month due to supply bottlenecks

- Cost explosion for many primary materials causing output prices to increase considerably

- Second-strongest employment growth for business since survey began at end of 1998

- Sustained optimism: Expectation index for production over next 12 months climbs to 67.5 points

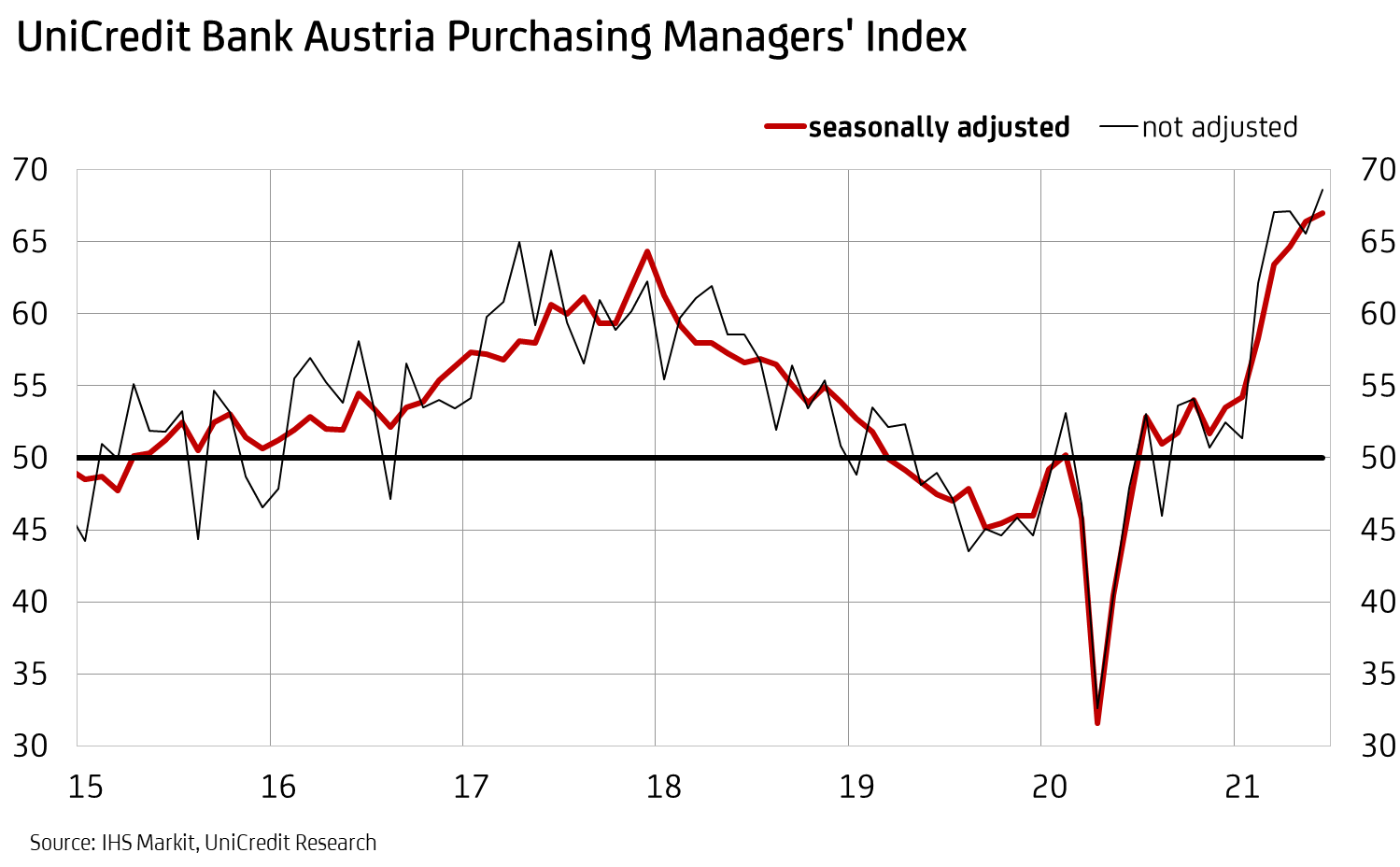

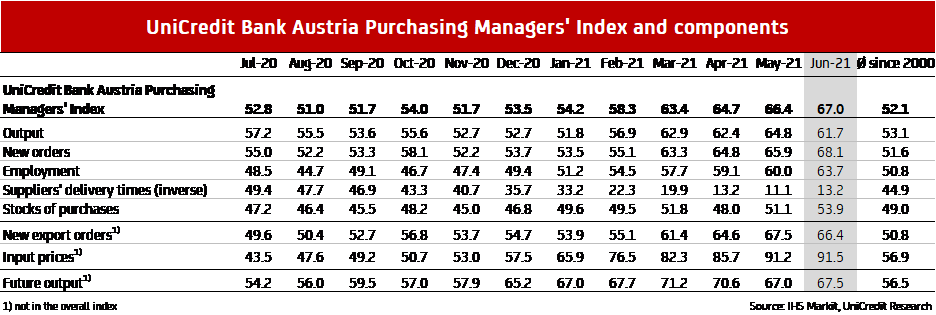

The upturn among Austrian industrial businesses gathered pace again in mid-2021. "The UniCredit Bank Austria Purchasing Managers' Index increased to 67.0 points in June. This is the third month in a row that the indicator has reached a new record level since the first survey was carried out over 20 years ago", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Domestic industrial businesses are once again benefiting from a strong international tailwind. This is being driven in particular by powerful momentum from the German industrial economy, which has seen the preliminary Purchasing Managers' Index rise to a new record level of 64.9 points."

The recovery has been under way for around a year now, and the impressive momentum gained in H1 2021 has led not only to the slump triggered by the first wave of the pandemic being offset but to capacity utilisation among domestic industrial businesses rising above the long-term average. "The sharp acceleration in new business saw further significant production growth in June, creating a large number of new jobs. Conversely, the long-standing supply bottlenecks caused by a shortage of materials and a lack of transport capacity worsened once again, with delivery times again being extended and costs continuing to rise sharply", says Bruckbauer, summarising the results of the latest survey.

New business booms

New business made the biggest positive contribution to the record increase in the UniCredit Bank Austria Purchasing Managers' Index in June. The corresponding sub-index climbed to 68.1 points. "Demand for Austrian industrial products increased at record pace in June. It was new business from within Austria in particular that gathered momentum, while order growth from outside Austria slowed for the first time this year", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "Production growth, however, lagged significantly behind the strong momentum being seen with orders, burdened by problems with the timely procurement of raw materials and primary materials." As a result, backlogs of orders from domestic companies increased at a new record rate and delivery times on both sides of the value chain were longer in June, though for the first time in a year the delays were slightly shorter.

Rapid recovery on the labour market, but many vacancies remain

The upturn in domestic industry is now having an extremely positive impact on the labour market. "The majority of companies surveyed have been increasing their workforce over the last six months. The employment index rose to 63.7 points in June, the second-highest level measured since the survey began in 1998. Since the peak during the pandemic in April 2020, the unemployment rate in the industry sector has fallen by an average of almost two percentage points. It is currently only half a percentage point above the pre-crisis level at just over four percent", says Pudschedl.

It is becoming increasingly difficult for domestic businesses to meet the rapidly increasing demand for labour. While in some sectors many employees are still locked into short-time working, in others there is a shortage of appropriately qualified and locally available employees. "Overall, the number of vacancies in the industrial sector as we hit the midway point of the year has reached a peak. By extension, with an average of 2.5 open positions per job seeker, the number of unemployed people for every vacancy has reached a low. In Upper Austria and Salzburg, this number for the industrial sector is already below the limit of 1.5 that is used by social partners to categorise a field as an understaffed profession, “says Pudschedl.

Given that recovery is continuing at a good pace, the average unemployment rate of 4.5% for H1 2021 in the domestic industrial sector is likely to drop to an average of 4% for 2021 as a whole. Unlike the economy as whole, the industrial labour market is on course to leave the coronavirus crisis behind it completely during this year. The difference in the unemployment rate between the industrial economy and the economy as a whole in 2019, before the pandemic, was four percentage points, and that gap is set to widen. Economists at UniCredit Bank Austria currently expect an average unemployment rate of 8.7% for 2021 for the economy as a whole.

Strong increase in demand plus supply problems continue to drive up costs

Given the strength of new business and in order to hedge against potential production downtimes due to supply bottlenecks, domestic businesses significantly increased their order quantities of primary materials and raw materials in June. Stocks of purchases increased for the second month in a row, and at a much higher rate than in the previous month. "Growing demand and the worsening of supply problems led to the considerable cost increases seen in previous months continuing and even accelerating. The increase in output prices was significantly lower in June, but the strategy of passing on the increased costs to customers is trending upwards", says Pudschedl. As a result of the strong demand, stocks of finished goods have now been being whittled down for exactly a year.

Industrial economy now likely at its peak

The current UniCredit Bank Austria Purchasing Managers' Index rose to a new record level in June after a full year sitting above the growth threshold of 50 points. At the midway point of 2021, the indicator therefore points to the record growth of the domestic industrial economy. International indicators, such most purchasing managers' indices for other countries and export trends, suggest that momentum will dip slightly over the coming months. "The Austrian industrial economy has likely reached the peak of the current recovery as we arrive at the midway point of 2021. Alongside the slowdown in international support, the sharp increase in costs will provide something of an economic stress test in the coming months, especially as the supply bottlenecks being experienced with certain primary materials could continue until the end of the year in some cases", says Bruckbauer, adding: "Despite the growing risks, including the lack of certainty about how the pandemic will develop from autumn onwards, the Austrian industrial economy is set to continue on a strong growth track throughout 2021 and achieve its biggest increase in production in the last 20 years by at least 8%. This will more than offset the 7.5% slump experienced in 2020."

Although international support is likely to tail off somewhat in the coming months, the complete reopening of the domestic economy in mid-May has led to improved general conditions for the consumer goods industry, for example, bringing the promise of the strong catch-up dynamic of recent months transitioning into a sustained economic recovery over the long term. Optimism in the industrial sector remains high. The expectation index for production over the next 12 months rose again slightly to 67.5 points in June and continues to strongly outperform the long-term average.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at