UniCredit Bank Austria analysis:

The COVID basket of goods and its influence on inflation

- Toilet paper, pasta, yeast and more — the impacts of pandemic consumption on inflation

- Consumer behaviour changed suddenly during the first lockdown in March 2020

- Purchases of products such as food and toilet paper increased sharply, while meals at restaurant and hotel stays were no longer possible due to nationwide closures

- The basket of goods used for the official calculation of inflation therefore differs greatly from actual consumer behaviour since the first lockdown

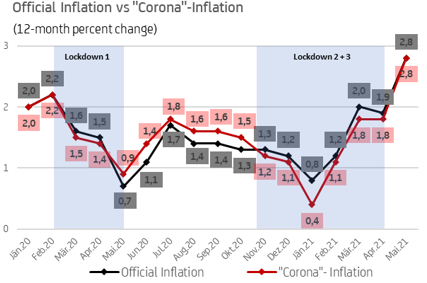

- Using the "COVID" basket of goods as a basis, the inflation rate in 2020 was 1.6%, which is 0.2% above the official Statistics Austria rate of 1.4%

- Between January and April 2021, however, COVID-related inflation was invariably lower than the official rate of inflation. This should reverse again in the second half of the year once lockdown measures are eased — especially those regulating restaurants and hotels

The scenes from March 2020 of shopping trolleys filled with toilet paper, pasta and tinned food are still fresh in everyone's mind. In stark contrast, spending on meals at restaurant or new haircuts, for example, plummeted when nationwide closures meant that these were no longer possible. The inflation figures published monthly by Statistics Austria are calculated using a weighting formula (also referred to as a basket of goods) that remains the same throughout the year. In an analysis conducted by UniCredit Bank Austria, the consumers' basket of goods, which was different to usual due to the pandemic, was changed each month and the effects on inflation were examined.

"The calculation of the official inflation rate is based on a basket of goods that became partially obsolete from one day to the next at the start of the first lockdown in March 2020", says UniCredit Bank Austria Economist Robert Schwarz.

A sharp rise in spending on food and furniture

The altered consumer behaviour seen since the beginning of the pandemic was assessed as part of the bank's analysis, with weekly card payments, retail data and the Statistics Austria Household Budget Survey 2019/20 all taken into account. All three sources paint a similar picture: Spending on food and household items, such as furniture, increased during lockdown, while spending on meals at restaurants, transport and clothing fell sharply. For instance, in April 2020, food spending rose by more than 60% compared to April 2019, and clothing and footwear purchases fell by more than 70% for the same period.

Actual inflation in 2020 was higher than the official inflation rate

In 2020, the national average inflation rate published by Statistics Austria was 1.4%. In comparison, the COVID-related inflation rate, which is based on the basket of goods that reflects consumer behaviour during the pandemic, was 0.2% higher at 1.6%. "As a result of the strict lockdown measures, in March and April 2020 official inflation was 0.1% higher than this 'COVID' inflation", says Schwarz, adding: "Starting from the first easing of lockdown measures in May 2020 to the second lockdown in November 2020, however, based on the COVID basket of goods—which is updated every month—we can see that inflation was consistently higher, and in some cases by up to 0.3%". In particular, this was due to the fact that, after the end of the first lockdown, the easing of measures led to a heavy weighting of the restaurants and hotels sector, which in turn led to significant price increases.

A similar pattern was observed from the start of the second lockdown in November 2020 to April 2021. In this period, COVID-related inflation was lower than the official rate of inflation, as was the case during the first lockdown. "Just as in 2020, however, we can assume that, when looking at actual consumer behaviour, the reopening of restaurants and hotels will result in monthly inflation rates in the second half of 2021 that are higher than the official values published by Statistics Austria", concludes Schwarz.

Sources: Statistik Austria, UniCredit Research

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Robert Schwarz, Tel.: +43 (0)5 05 05-41974;

Email: robert.schwarz@unicreditgroup.at