UniCredit Bank Austria Business Indicator:

Recovery off to flying start in Austria

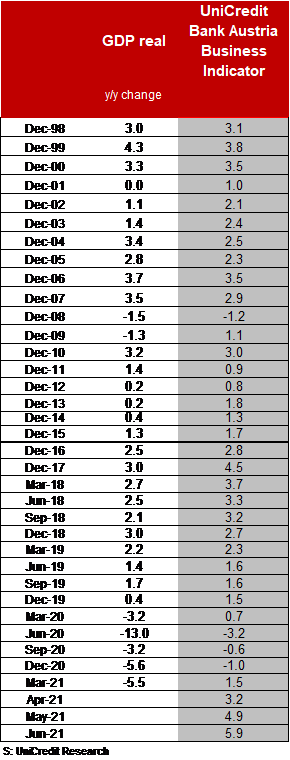

- UniCredit Bank Austria Business Indicator climbs to 5.9 points in June, reaching another all-time high

- Strong rebound from opening up of retail and hospitality set to tail off after summer, with pace of recovery slowing throughout rest of year

- Sustained recovery of Austrian economy likely, despite further obstacles during summer owing to higher infection rates: GDP expected to increase by 3.2% in 2021 and by as much as 5.5% in 2022

- Unemployment rate expected to return to pre-crisis levels by end of 2022, but progress on labour market slowing

- Inflation forecasts for 2021 and 2022 increase slightly to average of 2.4% and 2.1% respectively: Oil prices in particular temporarily driving up inflation

The economic mood in Austria continues to improve. "There has never been such a positive assessment from the Austrian business community in terms of economic situation and immediate outlook as we are seeing in mid-2021", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The highly optimistic mood is reflected in the increase in the latest UniCredit Bank Austria Business Indicator, which has achieved a new record value of 5.9 points."

The indicator continues to improve strongly, demonstrating that the Austrian economy has been steadily gathering momentum throughout the spring. "Thanks to the strong rebound, it is likely that the second pandemic-related economic slump experienced over the winter months will already be offset as Q2 comes to a close. The process of economic recovery in Austria will slow as summer comes to an end, however, given that increased infection rates are likely to be prevailing once again by this stage. That said, we are working on the assumption that there will be sustained recovery. Economic output in Austria is likely to return to pre-crisis levels by the end of 2021. As things stand, we are still around 3.5 percentage points below pre-crisis levels", says Bruckbauer. Given the strong rebound in the spring, the Austrian economy is now expected to get back to pre-pandemic performance levels a little earlier than the UniCredit Bank Austria economists had previously anticipated.

Further improvements in sentiment across all sectors of economy

The mood is currently positive across all sectors of the Austrian economy. Industrial businesses have even managed to offset the slump in production triggered by the pandemic, and expectations have increased again as we reach the mid-year point. While support from the international environment is beginning to dwindle somewhat, the significant improvement in the domestic order situation is cause for further optimism. The full order books in the construction sector confirm that, here too, recovery is surging ahead. Momentum in the services sector has been good since all areas reopened mid-May, and economic sentiment is currently at a three-year high. In addition, the improvement in consumer sentiment following the continued easing on the labour market is set to shore up future prospects in the services sector over the coming months.

Growth in domestic demand follows recovery in foreign trade

Strong growth in the export sector, which benefited from the recovery in global trade, prompted a significant economic upturn from the spring onwards. Investment activity began to ramp up as a result, driven initially purely by the capital goods sectors. Since the economy began to open up more in general, including the service sectors, investment activity has become more widespread and consumption has been increasingly driving the restart of the Austrian economy. Alongside catch-up effects, consumption will increasingly become a mainstay of the recovery over the coming months - people are now beginning to spend the additional savings they accumulated during the pandemic when there were limited opportunities for consumer activity, and this is likely to give demand a lasting boost. "The extremely dynamic recovery of the Austrian economy is set to continue, following the countermovement seen in the spring. As we head into autumn there is a risk that increasing infection rates could cause the recovery to slow temporarily. We do not expect the recovery to be interrupted by another wave of infections, however, so economic growth of 3.2 percent is achievable for 2021. Thanks to the high statistical overhang, an increase of 5.5 percent is even within grasp for 2022", says UniCredit Bank Austria Economist Walter Pudschedl.

Large number of vacancies despite sharp increase in supply of labour

The recovery of the domestic economy is reflected in the positive trend being seen on the labour market. "Employment rates in Austria have been steadily increasing since the start of the year; there are more than 3.8 million people in employment at the midway point of 2021, which is only just below the absolute record level achieved before the outbreak of the pandemic. That said, around 50,000 more people are still seeking employment in Austria than before the pandemic. As a result, the seasonally adjusted unemployment rate at the midway point of 2021 is also around one percentage point above the pre-pandemic baseline, at 8.1 percent", says Pudschedl.

The current higher unemployment rate points to increasing structural problems on the Austrian labour market. It is clear that many sectors do not have access to adequate numbers of appropriately qualified, locally accessible employees, although the supply of labour in Austria has increased by more than 60,000 people or 1.5 percent since the start of the pandemic. This increased supply of labour cannot be accommodated on the Austrian labour market without further measures to boost qualifications, as the record number of open positions shows. "The number of open positions in Austria at the midway point of the year has reached a high of over 100,000. By extension, the number of unemployed people for every vacancy is significantly higher than before the pandemic at an average of 2.7 open positions per job seeker; and there is a clear East-West divide - with the highest value of 7.8 in Vienna and the lowest in Upper Austria at just 1.1", says Pudschedl.

Given that the recovery is maintaining its pace, the average unemployment rate of 9.1 percent for H1 2021 in Austria is likely to drop to an average of 8.7 percent for 2021 as a whole. The economists at UniCredit Bank Austria expect the unemployment rate to fall further in 2022, to an average of 7.8 percent. By the end of 2022, the unemployment rate will have returned to pre-crisis levels.

Inflation at around 3 percent year-on-year until the end of the year

The economic recovery has caused inflation in Austria to rise in recent months. After a moderate start to the year, inflation accelerated to almost 3 percent year on year by mid-2021. The main factor behind the increase was the significant rise in oil prices, with the energy price group accounting for around two-thirds of the inflation increase in H1. Due to the low oil prices during the pandemic, inflation is set to continue its upwards trend in H2 as a result of the current elevated energy prices. Increased prices for foodstuffs and services will also drive up inflation in Austria in the coming months.

The inflation trend is likely to reach its peak in late autumn with values just above the 3 percent mark, even though the oil price differential will be at its highest compared with the previous year. Inflation should begin to drop off again in Austria around the end of 2021, supported by an end to the delivery bottlenecks that are driving up prices. The inflation increase should therefore be classified as temporary, as there are no real grounds to expect a wage-price spiral. "Against the backdrop of oil prices that are currently higher than we had anticipated, we have slightly increased our average inflation forecast for 2021 to 2.4 percent. In 2022, based on a slight decline in oil prices, we expect inflation in Austria to fall to an average of 2.1 percent”, concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at