UniCredit Bank Austria Purchasing Managers' Index in July:

Austrian industry still at summer high despite slight slowdown in pace of recovery

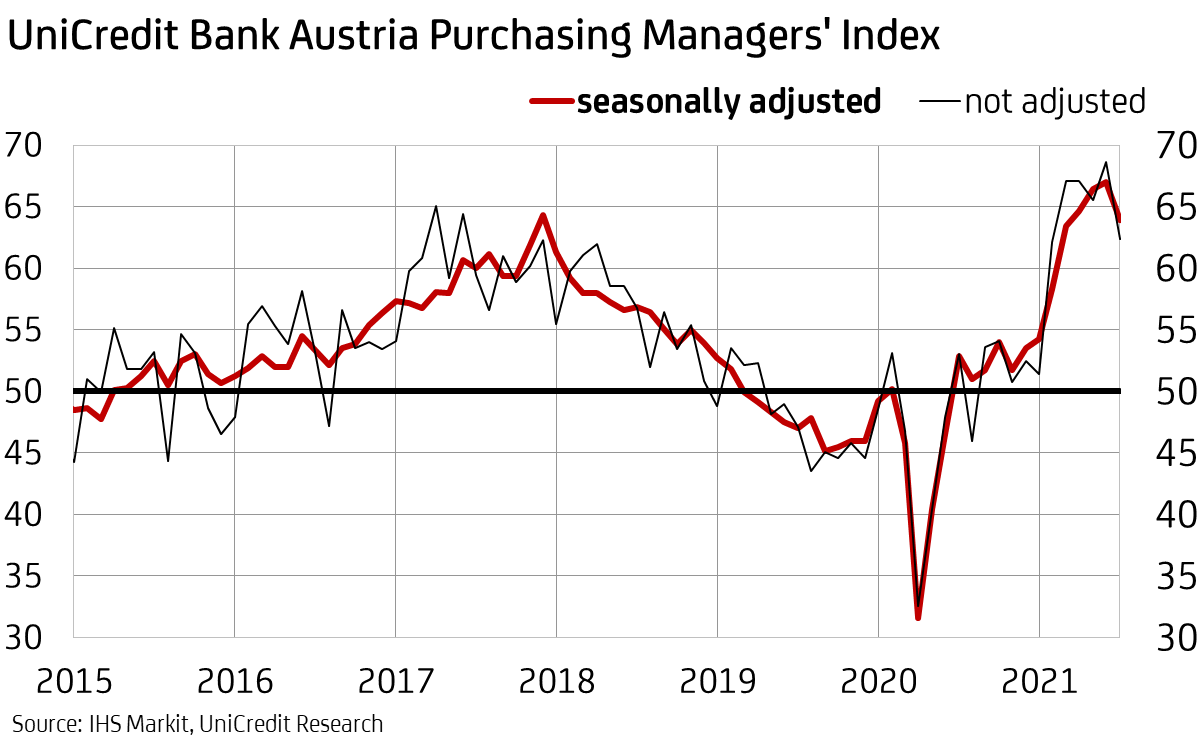

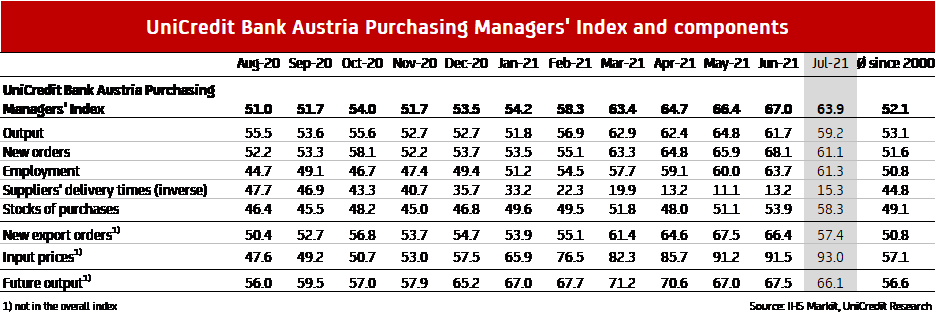

- The UniCredit Bank Austria Purchasing Managers' Index fell to 63.9 points in July: The economic peak seems to have passed, but growth momentum in Austrian industry remains very high.

- Noticeable decline in new business and supply bottlenecks slowed production expansion.

- Capacity and transport restrictions again limited the availability of primary materials and caused a further spike in both input and output prices.

- The pace of hiring in firms remains high, but is slightly slower than in July.

- Economic optimism remains high: The expectations index for production in the next 12 months fell only slightly to 66.1 points at the beginning of H2 2021.

Austrian industry has made a strong start to H2 2021. "Following the acceleration of industrial activity in Austria that lasted throughout the first half of the year, it now appears that we have passed the peak. The UniCredit Bank Austria Purchasing Managers' Index fell to 63.9 points in July. However, it is still at the fifth highest value since records began, which indicates that recovery is continuing very rapidly", says UniCredit Bank Austria's Chief Economist Stefan Bruckbauer, adding: "The fact that the UniCredit Bank Austria Purchasing Managers' Index has never remained above 60 points for so long in its nearly 23-year history shows how strong this recovery is."

Industrial activity slowed slightly at the beginning of H2 2021 — a trend that can be seen in almost all of Europe. "The preliminary Purchasing Managers' Index for the manufacturing industry in the eurozone fell to 62.6 points. Recovery in the industrial sector is losing some momentum, which is driven by the Asian region. The upturn slowed in most eurozone countries. Despite the slight increase in momentum in Germany, Austria's export-oriented industry as a whole lost some of its support from international demand in July", says Bruckbauer.

All components of the Austrian Purchasing Managers' Index have contributed to the current decline in the overall indicator, with one exception: "New domestic and international business increased at a slower rate in July than in previous months, which curbed production expansion and staffing increases. Despite cost-driving supply bottlenecks for primary materials, domestic companies have been able to fill their inventories to a greater extent", says Bruckbauer, summarising the results of the latest survey.

Slower growth in new orders, especially from abroad

The strongest influence on the fall of the UniCredit Bank Austria Purchasing Managers' Index in July was the decline in new business, albeit after an all-time high in the previous month. The incoming orders index decreased by seven points compared with the previous month, while the sub-index for new export orders fell by nine points: at 61.1 and 57.4 points respectively, both indices nevertheless indicate very strong order growth for July. "In view of the declining momentum in new business, Austrian companies reduced the pace of production expansion at the beginning of H2 2021. Although additionally curbed in part by supply bottlenecks for primary materials, the current index of 59.2 points still suggests very strong growth in production in Austria", says UniCredit Bank Austria economist Walter Pudschedl. The further increase in order backlogs underlines the fact that the slowdown in production expansion was also partly due to capacity and transport restrictions.

Capacity and supply bottlenecks continue to cause prices to spike

Backlogs increased at a slower pace in July than in the previous month, which was reflected in the slowdown in the decline in stocks of finished goods. By contrast, inventories in primary material warehouses rose at a record rate in July due to the sharp increase in purchasing volumes. In addition to the further strengthening of the economic upturn, the build-up of financial cushions and concerns about supply bottlenecks and longer delivery times were decisive factors. Around 72% of Austrian industrial companies faced longer delivery times in July, largely due to the lack of availability of primary materials, in particular electronic components and steel.

"In addition to the lack of availability of some primary materials, higher transport costs also caused input prices to rise sharply. For the fourth month in a row, input prices rose at a new record rate in July. In view of the strong demand, the companies were able to pass on some of the increased costs to customers in the form of higher output prices. Overall, the different price trends have, on average, worsened the earnings situation in the domestic industrial sector", says Pudschedl.

Staff levels continue to grow strongly

Since the beginning of the year, the recovery has led to an increase in employment in the Austrian industrial sector. Although employment growth slowed somewhat in July, at 61.3 points the employment index nevertheless reached its second-highest level of the current upturn.

At the beginning of H2 2021, the employment level in manufacturing is already almost at the record level seen before the outbreak of the pandemic. In particular, the gap has already been largely closed in Carinthia, Upper Austria and Vorarlberg. "The strong recovery of the domestic industrial sector has continuously increased the demand for labour in the past six months. As a result, the shortage of skilled workers has worsened significantly. Across the industry, there are currently 2.5 job seekers for every vacancy. In sectors such as mechanical engineering, the production of electrical equipment, the manufacture of electronic products, other vehicle construction and metal processing, the ratio is much lower", says Pudschedl.

Industrial growth peak likely to be exceeded

The pandemic-related catch-up effects that have given the recovery an additional boost in recent months are weakening, and the current UniCredit Bank Austria Purchasing Managers' Index has fallen to its lowest level in five months. Although the Austrian industrial sector has made a very strong start to its second year of recovery, the economic peak has likely already passed. International outlooks, such as most purchasing managers' indices in other countries and, above all, export trends, point to a slowdown in the upturn over the coming months. However, some of the current burdening factors, such as supply difficulties for primary materials and the sharp rise in costs, should ease.

"Backlogs at ports and shipping container shortages should gradually ease during the second half of 2021. In addition, the expansion of production capacities through increased personnel deployment and increased investments in the affected sectors will help balance supply and demand. The production estimates for Austrian companies for the next 12 months fell slightly in July, influenced by greater uncertainty due to the spread of new virus variants, which could at least slow down the recovery process. Nevertheless, at 66.1 points, the business expectations for Austrian industry continue to exceed the long-term average by a very clear margin", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at