UniCredit Bank Austria Business Indicator:

Economic upswing in Austria at its peak

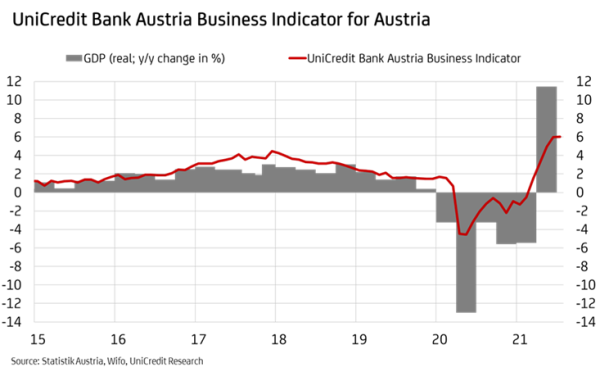

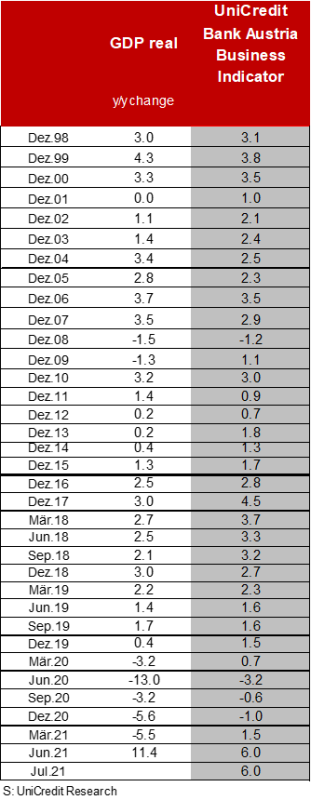

- The UniCredit Bank Austria Business Indicator in July equaled the previous month's record result of 6.0 points

- Sustained recovery with GDP expected to rise by 3.2 percent in 2021 and even 5.5 percent in 2022

- However, expiring catch-up effects and renewed adverse effects from higher infection figures will slow the pace of recovery after the summer

- The shift in growth drivers indicates that the peak of growth momentum has already been reached this year: construction and industry are losing momentum, services sector still benefiting from catch-up effects

- Rapid recovery on the labor market: Unemployment rate falls to 8.3 percent on average in 2021. Pre-crisis level will already be reached in the course of 2022

- Inflation will again be above the euro zone average at 2.4 percent in 2021 and 2.1 percent in 2022: Inflation premium since 2008 already reaches over 7 percentage points

At the beginning of the second half of 2021, the Austrian economy is in unbroken high spirits. “The UniCredit Bank Austria Business Indicator maintained the previous month's all-time high of 6.0 points in July. The recovery of the domestic economy is thus expected to continue at a high pace over the summer. However, the zenith of growth momentum this year now seems to have been reached,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding, “In the meantime, a change in the drivers of the recovery is discernible. While momentum in industry and construction is starting to slow down, consumption and, based on that, the service sector is still picking up speed.”

Services sector continues to benefit from catch-up effects

In recent months, starting with industry and construction and following the easing of pandemic containment measures in the spring, sentiment in the Austrian economy has also risen steadily in the service sector. However, even if economic sentiment is at its peak overall, signs of fatigue are becoming apparent in parts of the economy at the beginning of the second half of the year.

International support for export-oriented domestic industry is losing some of its force, and the additional stimulus from global trade is weakening. Supply bottlenecks, for example in the semiconductor sector, are also weighing on the momentum of industry, which remains above average despite a slight decline in sentiment this summer.

Due to supply problems and a dynamic cost trend, business sentiment in the construction industry also slowed down somewhat at the beginning of the second half of the year, although order books are currently filling up even faster, mainly thanks to public-sector orders.

“The service sector will gain strongly in importance for the pace of economic recovery in Austria in the coming months. After the opening of many industries only in spring, the sector is still benefiting from catch-up effects that have already largely run their course in industry or construction,” says UniCredit Bank Austria economist Walter Pudschedl. Sentiment in the services sector is therefore still on an unrestricted upswing, especially since consumer confidence has even risen to a 2-year high.

After the economic jump in the spring, growth loses pace

The current UniCredit Bank Austria Business Indicator points to an extension of the high growth momentum of the Austrian economy over the summer, following the economic turnaround in the spring with a 4.3 percent increase in GDP compared with the previous quarter.

However, the calming of sentiment in individual sectors of the economy already heralds a slowdown in the recovery in the coming months. In industry and construction, the peak in growth has already been passed. The service sector is keeping up the pace of recovery for the time being thanks to catch-up effects. However, the catch-up effects will visibly run out and thus push down the growth rate of the Austrian economy as a whole.

“In the third quarter, the Austrian economy will again achieve high growth. However, the pace will be below that of the flash start in the spring due to the expiry of catch-up effects and the general slowdown in the recovery, particularly in industry. The growth trend will slow down further in the further course of the year, but we expect the recovery to prove sustainable and enable economic growth of 3.2 percent in Austria in 2021,” says Pudschedl.

Around the turn of the year 2021/22, the Austrian economy will reach pre-crisis levels. “Despite increasing challenges due to higher infection figures over the winter, the recovery should continue in 2022, even if the growth momentum during the year will continue to weaken in view of expiring catch-up effects. However, due to the statistical overhang from the pandemic, economic growth will even be able to reach 5.5 percent year-on-year in 2022,” Pudschedl expects.

The main driver in the coming year will be private consumption, which will be able to develop more strongly than in the current year, largely free of restrictions and supported by the increased savings reserves during the pandemic. By contrast, investment activity will be less able to contribute to economic growth in 2021 following the very strong rebound, although the financing environment should remain favorable and exports should provide strong impetus.

Labor market recovery suffers from declining match between supply and demand

The economic upturn has enabled an unexpectedly rapid improvement in the Austrian labor market. At the beginning of the second half of the year, the seasonally adjusted unemployment rate was 7.7 percent, only about half a percentage point above the low point before the start of the pandemic. “Based on the positive development in recent months, we assume that there will be no negative long-term consequences of the pandemic for the Austrian labor market. We currently expect the unemployment rate to average only 8.3 percent in 2021, and it should be possible to return to the pre-crisis level as early as in the course of the coming year,” says Pudschedl.

While the Austrian economy is already scratching at a new employment record, the unemployment rate is currently still higher than before the outbreak of the pandemic. According to the economists at UniCredit Bank Austria, however, it is not the increase in labor supply that is the decisive cause, but the insufficient pace of employment growth. In view of the pandemic, this would not be very noticeable if the number of vacancies had not simultaneously increased to a record level. The vacancy rate, the number of vacancies relative to labor supply, rose to 2.5 percent by mid-2021 from 2 percent before the pandemic and below 1 percent by 2016. The problem of the creeping dwindling match between supply and demand in the domestic labor market has become much more acute in recent months.

Inflation remains above average in Austria

Following the upward trend in inflation in the first half of the year, inflation in Austria remains above the 2 percent mark. Inflation is expected to peak at around 3 percent in late fall. This means that an increase in inflation to 2.4 percent on average for the year is in sight, after only 1.4 percent in 2020. The main source of the increased inflation is the higher oil price. The price of crude oil, which averaged 38 euros per barrel in 2020, is expected to exceed 55 euros in 2021, an increase of almost 50 percent. If the price of oil remained constant, inflation would only rise to an annual average of 1.8 percent in 2021, despite stronger pressure via the demand side since the start of the economic recovery.

“According to our expectations, the rise in inflation is mainly to be classified as temporary,” says Bruckbauer and adds: “First, there is probably no additional upward pressure from oil prices. Second, the effect of the price-driving supply bottlenecks in construction and industry should fade and third, we see only restrained pressure from the wage side. We therefore expect inflation to decline to 2.1 percent on average in 2022.”

However, inflation in Austria will thus remain above euro area inflation for another two years, with inflation rates of 2.0 percent in 2021 and 1.5 percent in 2022. Since 2008, inflation in Austria has been permanently higher than in the euro area. Over this period, the inflation premium has now exceeded 7 percentage points. The price markup in Austria was above average for rents, healthcare services, leisure and restaurant and hotel services.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at