UniCredit Bank Austria Purchasing Managers' Index in August:

Upswing continues in Austrian industrial sector but delivery problems impacting progress

- Strong industrial recovery continues in Austria but momentum on the wane: Second consecutive decline in UniCredit Bank Austria Purchasing Managers' Index in August but still at an impressive 61.8 points

- Pace of production growth reduced due to supply chain problems and slowdown in new orders

- Cost dynamics past peak for now: Modest increase in demand for primary materials and raw materials slows progress; delivery delays ease slightly

- Job creation up again in August

- Immediate business outlook remains positive; expectation index for production over next 12 months improves to 67.0 points

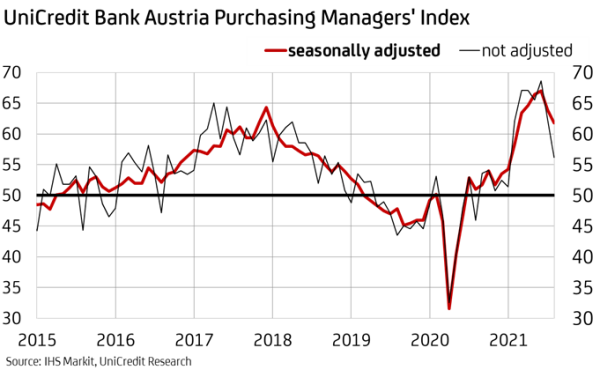

"The Austrian industrial sector remains in good shape this summer, though the pace of recovery is beginning to level out somewhat following the outperformance in the first half of the year", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The UniCredit Bank Austria Purchasing Managers' Index was down slightly in August, for the second consecutive month, though at 61.8 points the indicator continues to point to very rapid growth that is still considerably outstripping any past recovery periods in the Austrian industrial sector." The UniCredit Bank Austria Purchasing Managers' Index has now remained above 60 points for the last six months; since the indicator was first introduced more than 23 years ago, this feat has been achieved only in 2010 during the recovery from the financial crisis and in the economic boom of 2017.

This decline in the UniCredit Bank Austria Purchasing Managers' Index over the past two months from its all-time high of 67 points is due to the drop-off in support from the international economy and further supply chain problems. "Production growth across domestic industrial businesses slowed in August. Increased demand for primary materials dropped off as a result, which had the effect of slowing the high cost dynamics of the previous months. Regardless, the push to increase staffing levels was accelerated because the growing increase in backlogs of work and the noticeable decrease in stocks of finished goods point to the need for a further increase in operational capacity in order to meet demand", says Bruckbauer, summarising the results of the latest survey.

Export demand losing momentum and supply problems impacting production

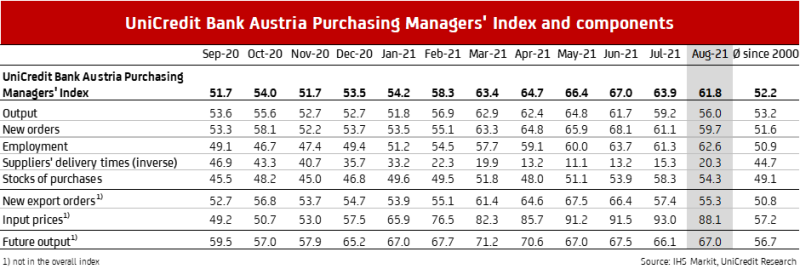

Production output is growing strongly month on month in the Austrian industrial economy, but August saw the extent of this increase in output fall for the third consecutive month. The production index fell to 56 points. "The slowdown in production growth in Austria's industrial economy in August is due in part to the decline in new orders, with demand from abroad in particular losing considerable momentum. Growth this month was significantly lower than in the past six months", says UniCredit Economist Walter Pudschedl, adding: "In addition, problems with global supply chains have affected both production and demand management, as indicated by the parallel fast-growing increase in backlogs of work among domestic industrial businesses."

The index for backlogs of work climbed to 64.8 points, highlighting that the slowdown in production growth is currently being driven primarily by supply problems and not by worsening order dynamics. The fact that lead times among suppliers have recently increased sharply once more backs up this statement. Although the increases in supplier´s delivery times actually dropped off again slightly in August for the third consecutive month, the low index value of 20.3 points clearly reflects the supply problems being experienced in the Austrian industrial sector.

Price dynamics at peak?

In August, delivery delays not only disrupted production but, in combination with increasing demand, also led to a further sharp increase in purchasing costs. "In August, Austrian companies were once again unable fully to pass on to customers the sharp increase in the costs of primary materials and raw materials, due primarily to existing agreements; this resulted in a deterioration of the earnings situation on average. However, the strong demand seen in recent months has generally resulted in pricing power increasing", says Pudschedl, adding: "The upturn in the industrial sector is set to take a hit from the upwards price trend of recent months. Nevertheless, the slight drop-off in cost increases we are now seeing and the declining demand indicate that the inflationary pressure may have reached its peak." That said, supply problems stemming from Asia are likely to continue for a few months, which means that pricing hikes are not expected to ease off particularly quickly.

More new jobs

Since the start of the year, the recovery has been driving an increase in employment in the domestic industrial sector, and in August the pace of job creation even accelerated once more. At 62.6 points, the employment index reached its second-highest level during this recovery.

"The strong recovery of the domestic industrial economy has led to a steady increase in the demand for labour in recent months. The shortage of skilled workers worsened over the summer, with data suggesting that only 1.9 applications are now expected per vacant position in the industrial sector. The shortfall of workers is particularly bad in Western Austria, and in Salzburg there are actually now more vacancies than job seekers in manufacturing", says Pudschedl.

Industrial economy slowing somewhat but medium-term outlook actually slightly better

Although the industrial economy is feeling the effects of waning demand from abroad and slightly worse delays within global supply chains as a result of the spread of new virus variants, the domestic industrial sector is actually benefiting from the relatively favourable situation with infection rates and the smaller-scale restrictions. As a result, the upturn has switched from the export-focused sectors within the industrial economy to the consumer-oriented sectors, setting in motion a strong, broadly based recovery.

"We expect recovery in the industrial sector to remain largely stable over the coming months. This forecast is underpinned by the new order-stock index ratio, which has decreased only slightly and indicates that stocks of finished goods will not be sufficient to service new orders without further ramping up production output", says Bruckbauer. Furthermore, the outlook for the year is once again looking rather more optimistic for Austrian businesses. The corresponding index rose to 67.0 points in August.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at