UniCredit Bank Austria analysis:

Pandemic performance of Austrian industrial sector continues long history of success

- Austrian industrial sector continues 20-year outperformance of eurozone average during pandemic

- Bigger productivity gains see Austrian industrial economy all but maintain employment rate, while eurozone declines sharply on average

- Hourly wages also rise at same rate as eurozone, outperforming Germany and with no worsening of competitive position compared with trading partner average

- All major Austrian sectors outstripped output gains in eurozone (and also Germany), with mechanical engineering as main driver. Metal production, metal processing, electrical sector and automotive manufacturing also made particularly strong contributions

- Climate change and digitalisation present challenges to continued success but also demonstrate ability of Austrian industrial sector to maintain performance even in challenging times

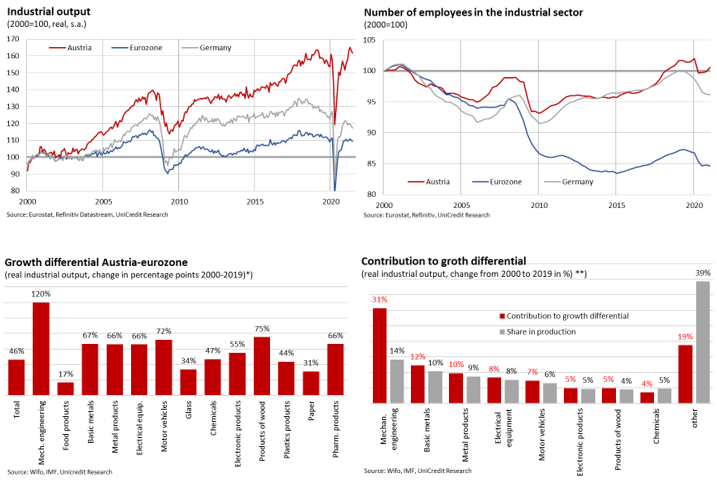

"The Austrian industrial sector made a quicker start to its recovery from the pandemic than its eurozone counterparts on average, continuing the success story of the past 20 years", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, summarising the results of the analysis by the UniCredit Bank Austria economists. He also adds: "The Austrian industrial sector ramped up production by around 60% in real terms in the period between 2000 and the beginning of the pandemic, making it significantly stronger than the eurozone overall, which averaged only 10%. It also generated considerably more momentum than Germany, which saw an increase of around 35%."

The real-terms value added by the industrial sector, i.e. the value of manufactured goods (adjusted for price changes), increased in tandem, resulting in a stronger contribution to GDP in Austria than that seen in most eurozone countries. In the period between 2000 and the end of 2019, the value added by the Austrian industrial sector increased by more than 55% in real terms. This figure was just under 30% for the eurozone in the same period, and around 35% for Germany.

The Austrian industrial sector also outperformed the eurozone average in terms of labour market trends. Although the actual number of people employed in the industrial sector has increased only marginally in Austria over the past 20 years, technical advancements in industry have enabled higher output levels to be generated using increasingly fewer people and increasingly more quickly as a result of productivity gains. The level of employment has also remained stable despite these rising output levels. This is testament to the success of industry in Austria. By contrast, average output gains for the eurozone were too low, with the number of people in employment falling by more than 10% since 2000 — even before the coronavirus crisis hit.

Despite employment levels in the Austrian industrial sector having barely fluctuated, output growth has been strong enough to increase hourly productivity by nearly 70% since 2000, which is actually stronger than the eurozone average. "The sharp increase in industrial production in Austria over the past 20 years has allowed the industrial sector to maintain its level of employment despite strong productivity gains", says Bruckbauer.

The stronger increase in hourly productivity in Austria has also enabled the Austrian industrial sector to increase its hourly wage rates in line with increases in the eurozone. In addition, employment levels have been kept relatively stable, in contrast to the eurozone average. This situation is the reason why the competitive position of the Austrian industrial sector has not worsened compared to its trading partners. Quite the reverse, in fact — over the past 20 years, the unit labour cost position of Austria in the capital goods industry has improved by more than 5% compared to its trading partners in the EU and by around 2.5% compared to all trading partners. When compared to Germany, Austria has a slight competitive disadvantage — owing to economic developments in Austria in the first half of the 2000s and to the financial crisis. Nevertheless, export trends in Austria were similar to those in Germany.

Austria's industrial production growth during the period 2000–2019 was higher than the eurozone average across all major branches of the industrial sector. Among these key branches of the Austrian industrial sector, the difference in growth was particularly apparent in mechanical engineering. While Austria has increased growth by 140% since 2000, average growth for the eurozone was just 20% (Germany +33%). Thanks to growth advantage of 120 percentage points and by virtue of its size (it accounts for 14% of industrial production in Austria), mechanical engineering was responsible for almost a third of the overall growth advantage.

Both the metal processing and metal production industries and the electrical and automotive industries have also generated unusually strong growth and therefore made a comparatively large contribution (considering their size) to the overall advantage of the industrial sector. "What is also impressive about the development of the Austrian industrial sector over the past 20 years is that virtually all branches of industry have achieved a growth advantage over the eurozone, with mechanical engineering alone accounting for one third of the overall growth advantage", highlights Bruckbauer.

The success of the past 20 years does not guarantee success in the future, especially considering the challenges posed by the fallout of the pandemic, by climate change and by digitalisation. In addition, heightened domestic demand compared to the eurozone—particularly in terms of investment—contributed positively to the growth of the industrial sector during this period (driven before the financial crisis due to Germany's weak position and after the financial crisis primarily by countries that were worse affected by the eurozone crisis). "Although it is clear that Austria's considerable success as an industrial nation in the past will not be a guarantee of protection against the major shifts we are currently seeing in the global economy, this history does still attest to the ability of the domestic industrial sector to withstand challenging times", concludes Bruckbauer.

*) All major sectors in Austria, accounting for 87% of industrial production.

**) Contribution of the sectors to the growth differential 2019 to 2000 of Austria's industrial production compared to the eurozone, whereby fixed weights from 2018 were used due to the data changeover, which means that the total rate of change calculated in this way deviates somewhat from the actual rate of change.

Further information in German only: https://www.bankaustria.at/wirtschaft-online-wirtschaftsanalyse-oesterreich.jsp

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Stefan Bruckbauer, Tel.: +43 (0)5 05 05-41951

Email: stefan.bruckbauer@unicreditgroup.at