UniCredit Bank Austria Business Indicator:

Economic recovery slowing, but still marching at pace

- UniCredit Bank Austria Business Indicator down to 5.5 points in August following all-time high in previous month

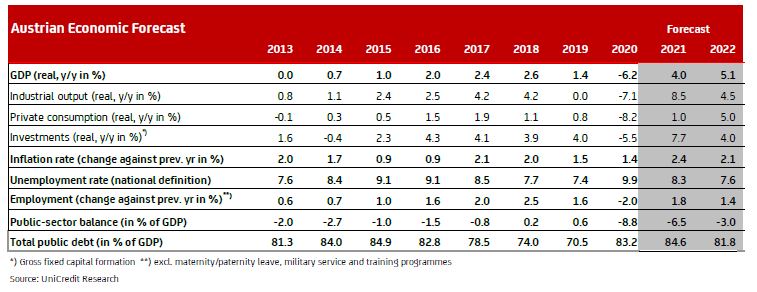

- Following exceptionally strong start to recovery in spring, growth forecast for 2021 increased from 3.2% to 4.0% and GDP forecast for 2022 adjusted to 5.1%

- Pace of recovery slowing as expected due to catch-up effects tapering off, production bottlenecks and renewed burden from infections

- Return to pre-crisis levels possible as early as 2022 following drop in average unemployment rate for2021 to 8.3%

- Average inflation set to decline slightly in 2022 to 2.1%, following increase to 2.4% in 2021, but risks on the up

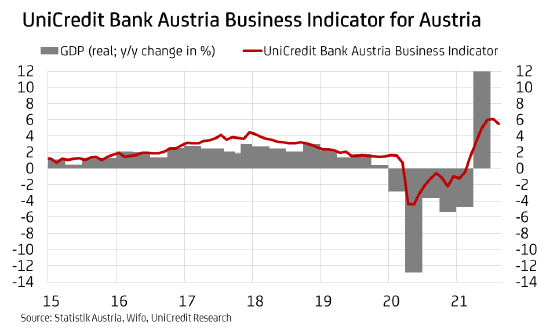

With the Austrian economy quick out of the blocks back in spring, economic sentiment has climbed to an all-time high over the summer months. "As autumn approaches, the Austrian economy is starting to slow a little. The UniCredit Bank Austria Business Indicator fell to 5.5 points in August from its all-time high of the previous month. That said, the indicator was still at its third-highest value since the survey began some 30 years ago, suggesting that the domestic economy continues to recover at a brisk pace", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

Austrian economy caches up faster

Following the recession of the winter months, Q1 2021 brought a trend reversal that saw the Austrian economy launch quickly into a recovery phrase in spring. There was even record growth in Q2, with an increase of 3.6% on the previous quarter. By mid-year, economic output in Austria was thus only 1.5% below the pre-crisis level. The Austrian economy had more ground to cover than the rest of the eurozone heading into 2021, having been worse affected by the crisis, but particularly brisk momentum has led to an outperformance in recovery. Average economic output for the eurozone at the mid-year point of 2021 was still 2.5% below the level seen at the end of 2019.

"The Austrian economy lost a little momentum as summer came to a close, and economic growth for Q3 is likely to be down on the performance seen back in spring. We expect to see GDP increase by 2% on the previous quarter, putting economic output in Austria almost back at pre-crisis levels. The post-pandemic catch-up process has therefore taken a little less time than we originally anticipated", says Bruckbauer.

Only sentiment in construction has improved further

The economic slowdown reflected in the latest UniCredit Bank Austria Business Indicator is being played out across a broad stage. The supply problems and high cost dynamics influencing the business outlook in the construction industry have now eased somewhat, with construction now the only sector of the Austrian economy in which the mood has actually improved. The full order books, courtesy primarily of the public sector, are a key driver here.

By contrast, international support for the export-heavy domestic industrial sector has weakened considerably, with additional momentum from global trade now waning as a result. Positive indicators from Asia and the US are gradually tailing off. Supply bottlenecks affecting semiconductors, for example, are putting a strain on the domestic industrial sector, though the outlook remains unusually optimistic thanks to the ongoing stability of the European environment. The mood in the services sector also remains very positive, despite concerns about new restrictions in the wake of the rising infection rate.

Pace slowing but recovery holds firm

The slowdown in the economic recovery in Austria is likely to continue over the coming months. This is due largely to the gradual tapering off of catch-up effects and will be evident in particular in the dynamic of the services sector — an area that is still benefiting the most from the momentum the catch-up effects provided when the economy opened back up again in spring. The services sector is also likely to be particularly affected by the risk of renewed restrictions for retail and hospitality from autumn onwards, in the wake of the rising infection rate. Nevertheless, the rapid recovery on the labour market and a reduced savings rate should ensure positive development over the coming months.

While the pace of growth in the construction sector is unlikely to slow a great deal thanks to the full order books, the upwards trend in the industrial sector is set to tail off considerably. The rapid upturn, which has led to bottlenecks across global supply chains and triggered a high cost dynamic, is increasingly beginning to suffer the effects of the surprisingly high pace and its own momentum.

"After a strong summer, there will be a marked reduction in the pace of recovery in Austria through until the end of the year. This is due primarily to the catch-up effects from consumers and investors tapering off. That said, the problems in the supply chains and the economic risks presented by the rising infection rates are becoming more significant in terms of the strain they place on the domestic economy and this will have an unfavourable impact over the winter months", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "Following the speed with which the recovery took hold in H1 2021, we have revised our growth forecast for 2021 upwards, from 3.2% to 4%. We still expect GDP to rise by more than 5% in 2022."

Labour market improvements slowing

Supported by the rapid economic recovery, the situation on the labour market continues to improve more quickly than originally anticipated. The seasonally adjusted unemployment rate fell to 7.8% at the end of August. The unemployment rate will continue to close in on the pre-crisis level of just over 7% over the coming months, aided in particular by a record number of vacancies (more than 110,000) that indicates the trend of strong employment growth is continuing.

"Despite the slowdown in the economic recovery, the situation on the domestic labour market will continue to ease over the coming months, albeit at a slower pace. After dropping to an average of 8.3% for 2021, we expect the average unemployment rate for 2022 to sit at 7.6%, with the pre-crisis level being achieved around mid-year", says Pudschedl.

Oil prices causing inflation to move

In August, inflation in Austria exceeded the 3% mark for the first time in almost ten years. The increase in prices since the start of the year is due primarily to the rise in the oil price. Rapid economic recovery in the industrialised nations over the summer months has further increased global demand, and the oil market still has a demand excess for Q3 despite the expansion of output. The oil market will soon have a surplus problem, however, if the scaling back of OPEC+ output cuts continues at the planned pace. Supply will outstrip demand by as early as Q4 2021, causing inventories to increase again and prices to fall as a result.

"We believe that the price of crude oil has reached its peak and will drop below EUR 60 per barrel as early as Q4; we therefore expect inflation in Austria to ease at around the end of the year. While average inflation for 2021 increased to 2.4%, we expect the level to tail off to 2.1% for 2022", says Pudschedl. Not only will the situation on the oil market ease, but the price hikes in the construction and industrial sectors caused by supply bottleneck are set to taper off in H1 2022. Pressure from the wages side is also likely to remain low, although the positive developments on the labour market have made a slightly stronger increase more likely.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at