UniCredit Bank Austria Purchasing Managers' Index in September:

Austrian industrial sector steps on the gas again for the short term

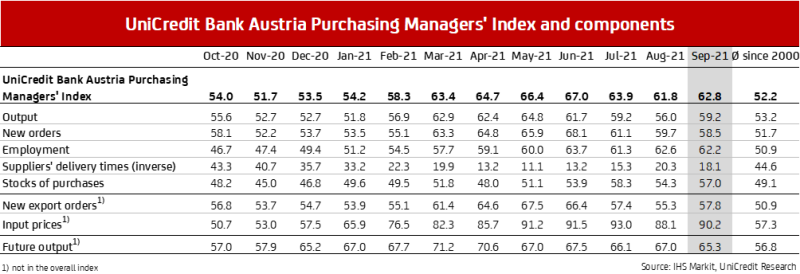

- UniCredit Bank Austria Purchasing Managers' Index rises to 62.8 points in September

- Pace of growth in industrial sector stabilising at unusually high level and on track to deliver real-terms production growth of around 8.5% for 2021 as a whole

- Production growth accelerates in September to whittle down backlogs of work despite order growth tailing off

- Employment growth slows somewhat

- Prices soaring once more despite surge in demand for primary materials and raw materials now slowing; delivery times quickly rising again

- Immediate business outlook looking up slightly but expectation index for production over next 12 months drops to 65.3 points

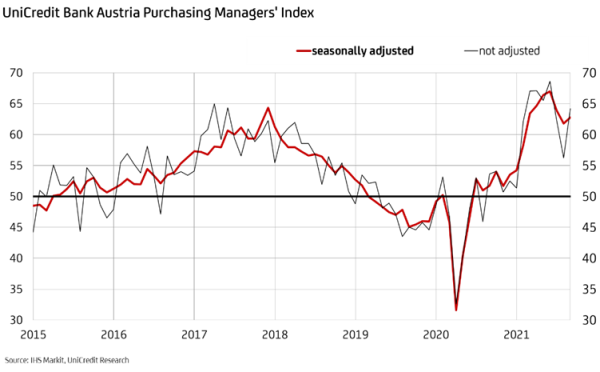

Following a slight lull in recent months in the rampant upswing that has characterised the Austrian industrial sector since spring, the pace of recovery has picked up again somewhat in September. "The UniCredit Bank Austria Purchasing Managers' Index increased to 62.8 points in September, signalling an end to the gradual slowdown of the industrial economy over the summer months. The pace of growth in the Austrian industrial sector is stabilising at an unusually high level and is on course to deliver real-terms production growth of around 8.5% for 2021 as a whole", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. In 2020, production in the manufacturing sector fell by 7.5% in real terms as a result of the pandemic.

The renewed economic impetus in the domestic industrial sector is surprising given the consistently negative international parameters. "Although the provisional purchasing managers' indices for the United States, the United Kingdom and also for the eurozone continue to indicate a high rate of growth, the downwards trend did continue in September. In Europe, the clear decline in the core market of Germany to 58.5 points was the key driver of this trend. As such, we believe that the improvement in the industrial economy in Austria in September, which stands in contrast to the European trend, is simply a temporary hiatus to the economic slowdown and is likely to be due primarily to the accelerated processing of accumulated orders", says Bruckbauer.

Strong production growth despite drop in new business

Austrian companies significantly increased their production output in September. Following three months in decline, the production index rose to 59.2 points, indicating that expansion in the Austrian industrial sector is far outpacing the long-term average. "The domestic industrial sector helped to accelerate production growth in September despite new business falling for what is now the third consecutive month. While demand from abroad has gained new momentum, the domestic order situation is less favourable and is having a dampening effect", says UniCredit Bank Austria Economist Walter Pudschedl. Despite the decline, the index for new business, at 58.5 points, continues to point to strong growth in order volume among domestic industrial businesses, but at the lowest rate seen in the last six months.

Backlogs of work increase at a much lower level than in the previous month, which is in sync with the slower order growth seen in September and, above all, the accelerated production ramp-up. The index for orders on hand fell by almost four points to 61.0. Despite the increase in orders on hand now slowing among Austrian industrial businesses, delivery times from suppliers have increased again for the first time in three months — suggesting that the problems with global supply chains are unlikely to ease in the short term.

Prices continue to rise

In the wake of declining new business, Austrian industrial businesses increased their purchase volumes of primary materials and raw materials at a lower rate in September than in the previous few months, but inventory levels in primary materials warehouses still rose more strongly on average. By contrast, inventory levels in sales warehouses continued to decline due to strong demand,

and the reduced rate of growth in the purchase volumes of Austrian companies had no dampening effect on price dynamics. "Due to supply-side bottlenecks in production and transport, price increases for primary materials and raw materials purchases in the industrial sector have accelerated once more. Thanks to strong demand, domestic businesses were better placed in September than in the previous few months to pass on the cost increases to customers, but on average earnings still trended slightly downwards", says Pudschedl. The problems with global supply chains are likely to persist for some time yet and to be slow to ease. Prices are therefore set to continue rising steeply over the coming months, albeit at a gradually decreasing pace.

Production growth triggers continued job creation, though at a reduced rate

The recovery could be compromised not only by high material costs but also by a sharp increase in personnel costs. Since the start of this year, the strong recovery of the industrial economy has led to a steady increase in employment and a restriction of supply on the labour market. The number of jobs available in the industrial sector was up again in September too, though the slight decline in the employment index to 62.2 points indicates a modest slowdown in the pace of job creation compared with the previous month.

At a seasonally adjusted figure of 623,000, the number of people employed in the manufacturing sector is now around one percent lower than the pre-crisis level. There are also currently in excess of 12,000 vacancies in the domestic industrial sector, which equates to an increase of more than 50% on the pre-pandemic statistics. Due to the sharp fall in unemployment, the number of open positions per job seeker in the Austrian industrial sector has fallen to below 2.0. In purely mathematical terms, in Upper Austria and in Salzburg there is only one job seeker per vacancy.

"The unemployment rate in domestic industrial sector has fallen to 3.5% at this point in time. The delay in recruitment of new staff due to the surprisingly high rate of recovery, which is reflected in the high number of open positions, suggests that a further decline in unemployment is likely over the coming months. For 2021 as a whole, the unemployment rate is expected to average 3.9% given the higher levels seen at the start of the year; the previous year's figure for 4.9%. So we will be almost back to the pre-crisis figure of 3.7% reported in 2019", says Pudschedl. This means that the unemployment rate in the industrial sector will remain significantly lower than that of the economy overall, which is estimated to average 8.3% for 2021.

Optimism remains high

The rise in the UniCredit Bank Austria Purchasing Managers' Index in September, which bucked the international trend, is expected to be only temporary but does confirm that the ongoing economic recovery in the industrial sector is both sustained and robust despite the problems with global supply chains and the increased spread of new virus variants. Following the rampant upswing in the first half of the year as the pandemic recovery took hold, however, a slight slowdown in the industrial economy is to be expected over the coming months, as indicated by the weakening demand dynamics.

"The recovery of the industrial sector in Austria continues, though the pace of recovery is likely to slow somewhat in the medium term. While the order-stock index ratio indicates with even a slight increase that stocks of finished goods are not sufficient to fulfil incoming orders without further ramping up production output and that a particularly strong recovery therefore seems imminent, the latest survey revealed that the expectation index for production over the next 12 months has fallen", says Bruckbauer, adding in conclusion: "With an index value of 65.3 points, domestic businesses are less positive about the business outlook than in the previous half-year, but they do remain very optimistic overall."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at