UniCredit Bank Austria Business Indicator:

Austrian economy changes down a gear with rapid rate of recovery

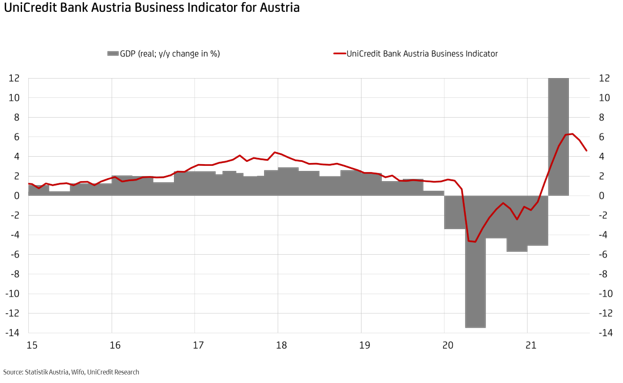

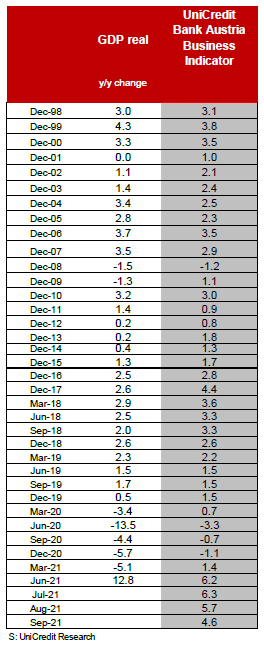

- UniCredit Bank Austria Business Indicator falls to 4.6 points in September, but still outstrips the long-term average significantly

- Catch-up effects coming to an end and increasing burdens from production bottlenecks slow the rate of recovery

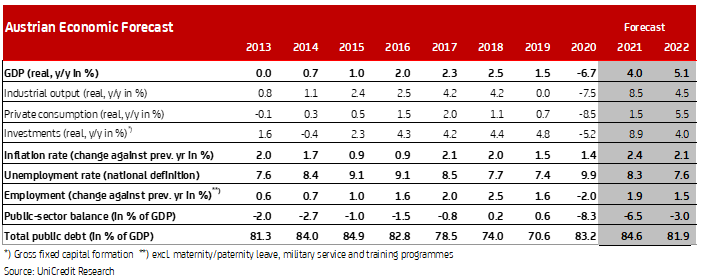

- Growth forecasts for 2021 and 2022 remain high, with GDP rising by 4.0% and 5.1% respectively

- After rapid drop in the unemployment rate in September to seasonally adjusted 7.7%, we could see winter blip in the trend

- Inflation risks rise: fall in oil prices should reverse this trend in 2022

After the positive sentiment during the summer months, optimism in the domestic economy has decreased noticeably since. "With the start of autumn, economic sentiment in Austria has begun to cool off. The UniCredit Bank Austria Business Indicator fell to 4.6 points in September. Yet this indicator is clearly above the long-term average, indicating that the Austrian economy is continuing to recover at a very rapid rate", says Stefan Bruckbauer, Chief Economist of UniCredit Bank Austria. Compared to the surplus trend in the spring after the end of lockdown, the upward trend is still expected to lose momentum as the strong catch-up effects begin to fall away.

The slowdown in business activity has become noticeable in all economic sectors aside from construction. With its full order books and the easing of problems in the supply chain, the construction industry is again experiencing a somewhat stronger tailwind. "Whereas the construction industry was able to change up a gear at the beginning of the autumn, the upturn in manufacturing is now slowing as international support falls away and the bottlenecks in the procurement of some raw materials fail to ease. Add to that vanishing optimism in many service sectors—the hospitality industry in particular – due to new measures to combat the increased number of infections,” says Bruckbauer.

Range of sector trends persist

The huge range of trends in individual economic sectors that characterise the Austrian economy’s recovery from the pandemic are set to continue over coming months. The construction recovery persists with manufacturing momentum remaining very good, despite a slow-down, as strong demand will ensure continued buoyancy despite bottlenecks in the supply chain. By contrast, the brakes will again be applied to the upturn in the services sector over the winter depending on how the pandemic unfolds, with particularly high risks for service industries with close physical contact.

"Following the strong rebound in the second quarter of this year, with a 3.5% increase in GDP compared to the previous quarter, the rate of growth has already slowed with the end of the summer. We expect a GDP increase of around 2% for the third quarter compared to the previous quarter, with a further slow-down at the end of the year. Despite a lower rate over the winter, the recovery will persist, leading us to expect very high economic growth of 4.0% for 2021 overall", said Walter Pudschedl, Economist at UniCredit Bank Austria. So by around the start of 2022, the Austrian economy will have compensated for the sharp economic downturn it saw during the pandemic.

Consumption becomes driving force in 2022

Despite a slower rate of recovery during the year, economic growth will be higher in the coming year than it was in 2021 due to a statistical surplus. "For 2022, we expect GDP to rise by 5.1% – greater than in the current year and driven by private consumption. However, investment activity will also play a major – albeit slightly smaller – role in the sustained upturn compared to 2021. In addition, foreign trade will be able to contribute positively to economic growth in 2022 after a two-year break", says Pudschedl.

Private consumption should be able to take the positive momentum from the second half of 2021 into the coming year. The strong increase in employment and the marked decrease in unemployment strongly support this. Plus, after two years of decreasing real wages, a slight increase is at least in sight in 2022. Furthermore, the decline in savings ratios to pre-pandemic levels can be expected to provide further impetus.

The tax refund due to kick in from mid-2022 will hardly be capable of having any positive impact in the coming year, however. Although investment activity will no longer drive growth in 2022, it will continue to increase significantly. That is partly because the utilisation of the capacities of Austrian companies is already above average, resulting in expansionary investments. Fiscal stimuli and continued favourable financing conditions will provide support, though.

Monetary policy remains loose despite higher inflation

"The European Central Bank will continue its supportive monetary policy in 2022. The pandemic emergency purchase programme (PEPP) is likely to end in March, but will be replaced. We assume that the normal asset purchase programme (APP) will be augmented as a result and become more flexible in order to obtain favourable financing conditions," Bruckbauer says. The ECB is gradually coming closer to relaxing its emergency measures, but is resisting tightening monetary policy for the time being as the current outbreak of inflation is predominantly viewed as temporary.

"Like the ECB, we also estimate that today’s rise in inflation in Austria to above 3% year-on-year is mostly a temporary phenomenon, although it seems to be more persistent than originally assumed. The supply-side bottlenecks caused by the pandemic are likely to continue well into 2022. For the time being, however, we are sticking to our inflation forecast of 2.4% for 2021 and 2.1% for 2022", says Bruckbauer. In particular, the expected retreat of the price of oil in 2022 is likely to turn the inflation trend around. However, the forecasting risks have clearly shifted upwards.

Improvement to the labour market becoming tougher with risks over the winter in the services sector

The rapid rate of recovery of recent months has improved the situation on the labour market surprisingly quickly. In September, the seasonally adjusted unemployment rate was only 7.7%, just 0.3 percentage points above the 2019 average for the year. In view of the large number of vacancies, a further increase in employment and a corresponding decrease in the unemployment rate can be expected immediately.

"Despite the slowdown in the economic recovery, the unemployment rate in Austria will continue to fall for the time being, although not as rapidly as before. We expect the average unemployment rate to decrease to 8.3% at worst in 2021 and we expect a further decrease to 7.6% for 2022", says Pudschedl. Over the winter, the burden on some service industries of taking measures against higher infection rates could disrupt the downward trend, but this should recommence in the spring with the probable easing of the number of cases.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at