UniCredit Bank Austria Purchasing Managers' Index in October:

Lower demand and supply bottlenecks slowing recovery in industrial sector

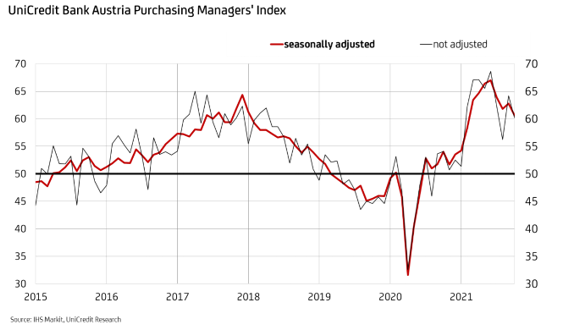

- UniCredit Bank Austria PMI fell slightly in October to 60.6 points, lowest value in 9 months

- Lower order growth from Austria and abroad slowing expansion of domestic production

- Supply problems have further amplified: Delivery times are increasing faster than previous month and prices are rising more sharply

- Accelerating job creation putting strain on productivity

- Expectation index for next 12 months drops to 62.5 points, lowest in a year — recovery nevertheless continues, albeit more slowly

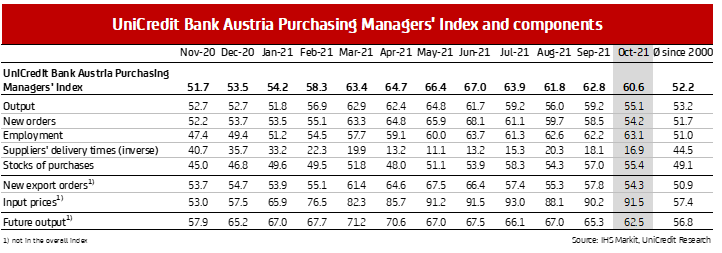

The recovery of the domestic industrial sector has now been underway for one and a half years. However, the peak has clearly passed. "The UniCredit Bank Austria Purchasing Managers' Index decreased to 60.6 points in October. This represents a significant calming of growth in the industrial sector compared with the summer, but remains above average", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. The industrial economy in Austria saw a drop in momentum, mainly due to external influences. "In the US and the eurozone, the Purchasing Managers' Index fell in October due to tighter supply bottlenecks. This puts a strain on demand for Austria's highly export-oriented industry", states Bruckbauer, adding: "Due to the slowing of new business and ongoing supply bottlenecks, domestic industrial businesses have reduced their momentum of production growth in October. As a result, orders on hand rose slightly and delivery times saw a significant increase. The rising prices of primary and raw materials accelerated. At the same time, however, job creation picked up a little."

Supply problems outweigh reduced new business in slowing industrial growth

The greatest impact on the decline in the UniCredit Bank Austria PMI in October was the slowdown in new business. "In October, the index for new orders fell considerably to 54.2 points, the lowest level since the beginning of the year. Likewise, slowing demand from Austria and abroad have also has an impact. That being said, the main cause of the slump in production growth can be seen in the intensified issues in the global supply chains", states UniCredit Bank Austria Economist Walter Pudschedl.

While the production output index also dropped to the lowest level since the beginning of the year at 55.1 points, which is just above the long-term average, the lead times in the Austrian industrial sector rose sharply again. "The sharp increase in delivery times in October, coupled with a considerable growth in orders on hand, clearly indicates that the development of production output in domestic businesses is currently being driven not so much by demand trends, but rather by the intensification of supply and transport problems", says to Pudschedl.

The increase in the price of primary and raw materials accelerates once more

As a result of the current supply problems, the growth of purchasing volumes for the domestic industrial sector decreased. This triggered a slowdown in the inventory accumulation of primary and raw materials. However, for the first time since recovery began in mid-2020, stocks in the delivery warehouses have generally increased on average, reflecting the somewhat lower demand. That said, after 15 consecutive months of declining inventory levels, this trend reversal is to be classified primarily as a targeted measure of operational inventory management.

The bottlenecks for numerous goods have resulted in the rise in purchasing prices driving up again in October. The purchasing price index climbed to 91.5 points. "Due to the supply-side bottlenecks in production and transport, the purchase price increase for primary and raw materials in the domestic industrial sector accelerated sharply after July 2021 to the second-highest rate in the history of the survey. As a result, sales prices have increased to a level never before seen since data collection began almost twenty years ago", explains Pudschedl, adding: "In October, the domestic businesses were better able to pass on the cost increase to customers than in the previous months, but the earnings situation continued to deteriorate on average."

Increased rate of employment growth

Despite the declining level of new business, the domestic businesses increased their workforce in October more than in the previous month so as to reduce the orders on hand. The employment index has risen to 63.1 points, the second highest value seen in the current recovery period.

"Despite the healthy creation of new jobs over the past months, employment levels in goods production in Austria is still a little more than half a percentage point below the pre-crisis level in 2019. By contrast, industrial production is now more than three percentage points higher in real terms, which has led to noticeable productivity gains on average", according to Pudschedl.

However, the development of the employment index relative to the production index indicates that a trend reversal has already taken place and that productivity has tended to decrease since June this year. While in the surprisingly strong start phase of the recovery led to personnel requirements that could not be met quickly enough, additional workers are now being recruited at full speed, although some businesses in the current survey have already reported that they have not hired any new staff at the moment due to material shortages.

Optimism has declined

The fall in the UniCredit Bank Austria Purchasing Managers' Index to 60.6 points in October signals that the Austrian industrial sector has started the fourth quarter of 2021 with the weakest growth momentum since February. Due to supply chain and transport problems, production growth is as weak as most recently seen during the winter lockdown at the turn of the year 2020/21.

Although industrial production is still growing at an above-average rate, the risks for the coming months seem to be on the increase. As a result of the ongoing pandemic, disruptions in the global supply chains are to be expected, which will continue to weigh on domestic industry production for even longer, causing the high price dynamics to be sustained.

"The optimism of domestic businesses saw a noticeable easing at the start of the fourth quarter. The expected index for production in the next 12 months has dropped to 62.5 points, the lowest in the current year. Following strong growth in the spring and summer of 2021, industrial dynamics are expected to weaken noticeably by the end of the year. However, we continue to expect industrial production to increase by 8.5 percent on average in 2021", concludes Bruckbauer.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0) 5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at