UniCredit Bank Austria Business Indicator:

Winter months herald increasing challenges for economic recovery

- UniCredit Bank Austria Business Indicator increases to 5.2 points in October, interrupting trend of economic slowdown seen since start of autumn

- Recovery over winter months set to encounter increasing challenges from supply bottlenecks in construction and industry; and from high infection rates and catch-up effects tapering off in services sector

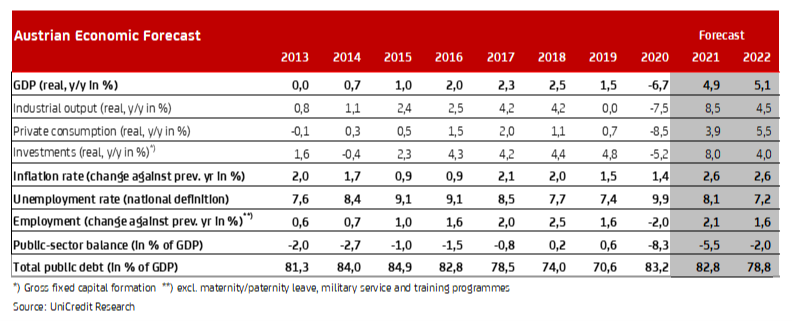

- GDP forecast for 2021 revised upwards to 4.9% following strong recovery in spring and summer. Economic growth of 5.1% still expected for 2022

- Unemployment rate set to fall to as little as 8.1% in 2021 and still further to 7.2% in 2022 despite break in improvement trend over winter months

- Increasing inflation risks: trend reversal thanks to fall in oil price in 2022

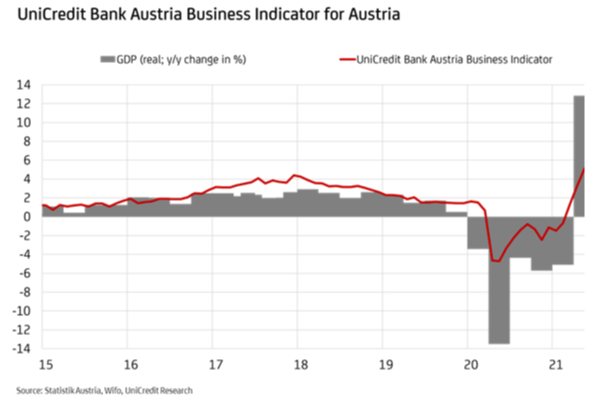

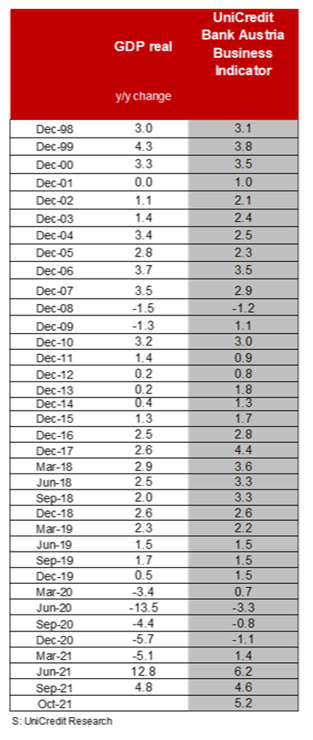

There has been a shift in the worsening mood observed in the Austrian economy over recent months. "The UniCredit Bank Austria Business Indicator increased to 5.2 points in October, marking a slight improvement for the first time in three months. It is our opinion, however, that this increase in the indicator will be only a temporary interruption to the ongoing economic slowdown", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The Austrian economy is expected to continue its recovery over the coming months, but the pace of that recovery will be noticeably slower. The economy will feel the squeeze over the winter months as catch-up effects taper off and we continue to see supply problems as well as measures to combat rising infection rates."

Prior to the announcement in November of stricter measures to contain the pandemic, the mood of domestic consumers had been bolstered even further by the improved situation on the labour market. There was also increased optimism in the services sector thanks to strong demand, which triggered the increase in the UniCredit Bank Austria Business Indicator. By contrast, storm clouds continued to gather over the international framework conditions for the domestic industrial sector, with the mood also dipping in the construction sector in October.

Sector trends align but growth limited

These developments underscore the strong momentum that has been observed in the services sector since the summer and that has contributed significantly to the high economic growth in recent months, while the recovery around the middle of the year was driven primarily by the upturn in industry and construction. Growth in the industrial sector will be impacted over the coming months by the slightly decreasing demand and by supply chain bottlenecks.

In the construction sector, supply problems and a lack of personnel will also affect performance despite order books being full. "We expect to see some alignment of trends in the individual sectors of the economy over the coming months, but this will come at a cost in the form of all areas levelling off to a slower pace of recovery. The recent tightening of measures to contain the pandemic and the introduction of the 2G rule will significantly slow the strong recovery in the services sector over the winter months; the risks are particularly high for the hospitality industry, tourism and personal services", says Bruckbauer.

Although the pace of growth will slow noticeably over the coming months, the recovery of the Austrian economy should continue. "The particularly strong growth has seen domestic economic output return to pre-crisis levels already. We have therefore revised our GDP forecast for 2021 upwards overall, to 4.9%. We still expect economic growth of 5.1% in 2022", says UniCredit Bank Austria Economist Walter Pudschedl.

Improvement trend on labour market likely to temporarily stagnate over winter months

The strong pace of recovery in the Austrian economy over the summer has brought bigger improvements to the situation on the labour market than originally anticipated. By the end of October, the seasonally adjusted unemployment rate had fallen to 7.4%, dipping below the average for 2019 (the last full year before the outbreak of the pandemic) for the first time.

"Given the markedly improved situation on the labour market in recent months, we now expect the average unemployment rate for 2021 to be just 8.1%. The slowdown in the economic recovery and the additional burdens on certain service sectors as a result of the measures taken to combat rising infection rates are likely to interrupt the downwards trend in unemployment over the winter months. As the economy ramps again in line with the expected easing of the situation with infections in the spring, the unemployment rate is likely to fall once more. We actually expect the average unemployment rate for 2022 to be lower than before the pandemic, at 7.2%", says Pudschedl.

Supply bottlenecks currently still driving inflation

Inflation has increased sharply from its low starting point at the beginning of the year. Inflation averaged 2.3% over the first nine months of the year but had already risen above the 3% mark year on year by autumn. "Given the persistent supply-side problems with many raw materials and primarily materials and the continued strong demand, it seems clear that we have not yet reached the high point for inflation. With values of between 3.5% and 4% year on year, inflation in Austria is unlikely to abate until spring. In particular, the expected fall in the price of oil in 2022 is likely to turn the inflation trend around. We currently expect average inflation of 2.6% for both 2021 and 2022, although the forecasting risks have clearly shifted upwards", says Pudschedl.

While inflation risks are increased as a result of higher food prices and the phasing out of the reduction in VAT rates for accommodation, hospitality and culture at the start of the year, and by labour market improvements and higher wage increases on the demand side, the economists at UniCredit Bank Austria do not expect any noticeable increase in inflation from either fiscal or monetary policy. The growth of broad money has decoupled from the increase in the base money. The money multiplier, i.e. the ratio of broad money to base money, has collapsed in recent years. A sustained rise in inflation can only be expected when the utilisation of the ratio rises due to demand. In view of the existing shortfall in economic output in Austria compared to the pre-crisis trend, an inflation risk stemming from the ECB's monetary policy stance is unlikely as things stand, and the current inflation increase likely to be largely temporary.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0) 5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at