Austrian economy defies pandemic to remain on growth track

- Headwind from higher infection rates, supply bottlenecks and rising inflation fails to rattle global pandemic recovery but global economic growth set to be weaker in 2022 than 2021

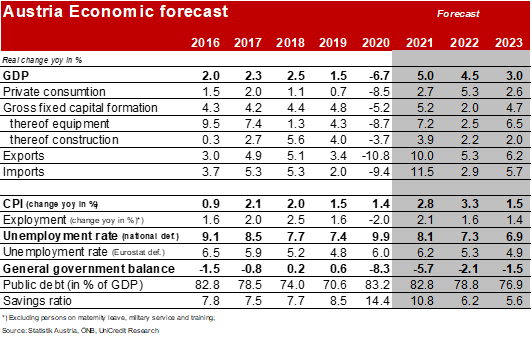

- Continued recovery following lockdown and resolution of supply bottlenecks set to deliver economic growth of 4.5% in Austria in 2022, compared with 5.0% for 2021; GDP growth of 3.0% expected for 2023

- Labour market situation eases: Unemployment rate in Austria set to fall from average of 8.1% for 2021 and improve on pre-crisis levels with 7.3% in 2022 and 6.9% in 2023

- Inflation likely to reach ten-year high of 3.3% in Austria in 2022 but energy prices and resolution of supply bottlenecks set to reverse trend

- Inflation in Austria expected to fall to 1.5% 2023

- Monetary policy shift on horizon: Fed set to raise key interest rates from H2 2022; ECB putting brakes on securities purchases but rate hike not expected until 2024

- Economic risks unusually high due to the pandemic, supply bottlenecks, concerns about Chinese economy and uncertainty driving consumer restraint among private consumers and companies

Against the backdrop of the strong recovery expected over the coming two years, the Austrian economy as a whole is set not only to recover its pandemic-related losses by the end of 2023 but also to deliver economic output of 6% more than the 2019 level and thus close the gap on the growth trend that was apparent before the pandemic hit. Unlike the financial crisis of 2008/2009, the coronavirus crisis will not have a long-term impact on the economy.

"Following an expected 5% increase in GDP for 2021, we anticipate that the upswing out of the pandemic will continue strongly in 2022 with economic growth of 4.5%; momentum is also likely to remain above average in 2023 at 3%", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. Over the coming year growth will be driven largely by private consumers, supported by catch-up effects, positive employment trends and a tail-off in the savings rate. By the end of 2023, however, some of the services sectors that were particularly badly hit, especially the hospitality sector, will be lagging well behind the most successful sectors of the industrial economy, such as metal production and processing, electrical engineering and construction.

Investment activity will increase again as the supply problems are resolved, and there will be strong momentum in 2023 in particular, buoyed by the continuation of favourable financing conditions in the Austrian economy. Following two years of negative growth, the economists at UniCredit Bank Austria expect to see a return to positive export contributions from 2022, driven largely by services exports as the tourism sector ramps up again.

Global recovery continues

"The global recovery of economic activity continues, though persistent and prolonged supply bottlenecks and unexpectedly high inflation will have an impact on the pace of growth next year. By contrast, the recent economic restrictions in most industrialised countries aimed at containing the number of infections will have relatively little impact on how the global economy recovers but will trigger greater volatility and uncertainty", says Bruckbauer, adding: "Following growth of 5.8% in 2021, the global economy is set to show less momentum in 2022, with just 4.2% growth. This will be true both of the US and of the eurozone, which with a GDP increase of 3.9% is set to actually outstrip the 3.5% expected for the US economy."

Developments with the pandemic are expected to see the global economic situation ease significantly from the spring of 2022. "As things stand, it is the supply difficulties that will be the real barrier to growth; the challenges look set to continue at least until the summer of 2022, but after that the 'lag effect' will generate strong momentum for the global economy", says Bruckbauer. In addition, a portion of the additional savings made during the pandemic, which total 14% of disposable income in the US and 11% in the eurozone, will support growth through increased consumption.

It is possible that the decline in labour market participation observed in many countries during the pandemic will be offset by increased investment activity — with the key factor here being digitalisation. Public investment, including the NextGenerationEU development plan, will also be a contributing factor. Financial support is set to reduce again over the coming years, but is expected to remain more robust than before the pandemic.

By contrast, the unexpectedly high inflation rates, triggered by rising raw materials prices as a result of supply bottlenecks, will be a drag on global growth in the coming months. "Despite inflation being likely to remain high in H1 2022, we do not anticipate any increase in medium-term inflation expectations. Furthermore, we do not expect any significant second-round effects, particularly as the price of oil is set to fall over the next year from the current level of USD 75 per barrel to as little as USD 65 in 2023, which should lead to a noticeable slowing of inflation in the course of 2022", says Bruckbauer, adding: "The current high level of inflation will not prompt the central banks to act prematurely, but sustained economic recovery will allow the gradual introduction of monetary policy shifts."

Monetary policy shifts

In the US, the securities purchase programme is expected to be discontinued earlier than previously announced and the first interest hike will hit as early as 2022, with a rate of up to 1.5% likely by the end of 2023. The ECB is not expected to trigger any interest rate movements before 2024, but the pandemic emergency purchase programme (PEPP) is likely to be phased out in March 2022, to be replaced by a successor programme that offers less in the way of fiscal stimulus. This will also signal a reduction in support for the equity markets, but positive trends appear possible in the industrialised nations, particularly in Europe. Driven by the interest rate differential, the US dollar will appreciate against the euro, reaching up to 1.08 by the end of 2023.

Green light for Austrian economy, but upwards trend tailing off

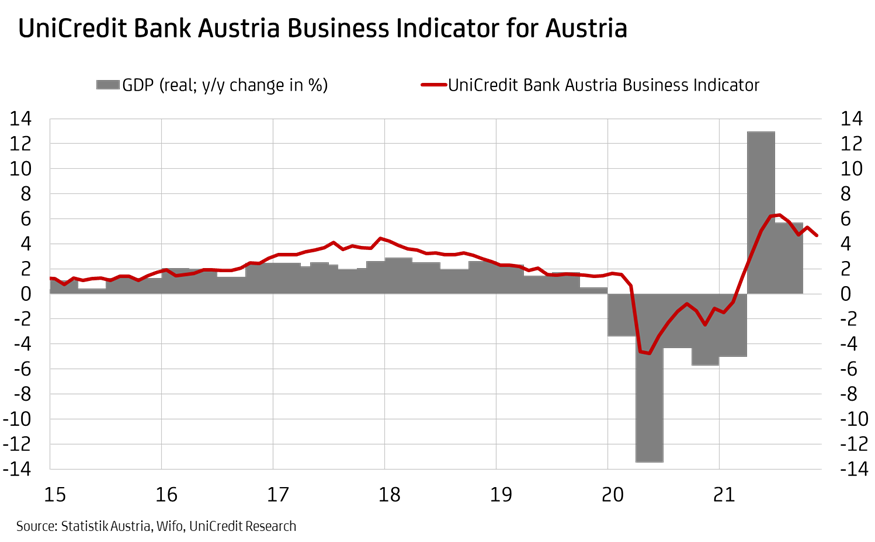

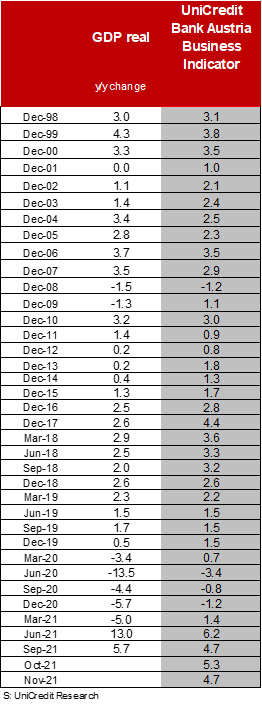

The economic climate in Austria remains positive as we head towards 2022. "The pace of growth in the Austrian economy has slowed in recent weeks, with the latest lockdown creating additional strain from the end of November. The UniCredit Bank Austria Business Indicator for November fell to 4.7 points in November; this is the lowest level seen since April this year, when the pandemic-related restrictions imposed during spring were gradually being phased out", says UniCredit Bank Austria Economist Walter Pudschedl.

The waning economic sentiment is reflected in all aspects of the indicator. While the mood in the industrial sector is still unusually buoyant, propped up by strong international demand and, despite the supply problems, by the construction economy, consumer sentiment has slumped noticeably. "Many parts of the services sector, especially hospitality, are being severely impacted by the latest measures, but the Austrian economy as a whole will not be plunged into recession again this winter", says Pudschedl, adding: "The economic impact is not as great as it was last winter, but we still expect the final quarter of 2021 to close with a slight decline in economic output on the previous quarter of just over 1%. What's more, in contrast to last year the Austrian economy, supported by a rapid recovery in the services sector, will return to a growth track more quickly, with the lockdown only briefly leaving its mark." The recovery is likely to gather momentum again towards the end of 2022 when the resolution of supply problems is set to encourage broad growth impetus from the industrial sector and the construction economy.

No pandemic-induced structural labour market problems; fiscal stimulus even brings benefits

The strong economic recovery set in motion during spring prompted rapid improvements in the labour market. The unemployment rate for 2021 fell to an average of 8.1%, having hit an average of 9.9% in 2020. Unemployment in the construction, industrial and non-market services sectors has even fallen below the levels seen before the outbreak of the pandemic.

The slowdown in the economic recovery as a result of the current supply bottlenecks and the additional burdens on certain service sectors as a result of the measures taken to combat rising infection rates are likely to interrupt the downwards trend in unemployment over the winter months, although the effects are likely to remain manageable. As the economy gathers pace, the unemployment rate will fall again.

"For 2022 and 2023, we expect the unemployment rate to fall to an average of 7.3% and 6.9% respectively; these levels are lower than before the crisis, as a result of fiscal stimulus packages introduced during the pandemic. In addition, the strong economic recovery has headed off pandemic-related structural problems in the labour market, although the record number of vacancies indicates that the skills mismatch that has been an issue for some time now has worsened slightly", says Pudschedl. Adjusting the balance of supply and demand on the labour market will be the central challenge of labour market policy over the coming years.

Inflation to reach ten-year high in 2022

Inflation doubled to an average of 2.8% in 2021, due primarily due to higher energy prices. Given the persistent supply-side problems with many raw materials and primary materials and the continued strong demand, it is likely that the high point for pricing will hit at the start of 2022. "With values currently exceeding 4% year on year, inflation in Austria is expected to slow during the course of 2022. The base effect and the expected fall in the price of oil are likely to turn the inflation trend around. However, due to the high values at the start of the year we now expect average inflation for the year of 3.3% for 2022, the highest value since 2011", says Pudschedl. Inflation is expected to fall further to an average of just 1.5% in 2023, due to major base effects, particularly in the energy sector, and the total resolution to the bottlenecks issue.

High risks but also opportunities driven by pandemic

The economic outlook for the next two years is characterised by unusually high risks. Developments with the pandemic is still the key factor here. "Growth expectations are tied directly to the supply-side logistical problems. While the problems could be resolved sooner than expected, it is also possible that they could considerably worsen and become much more prolonged — especially if a new virus variant proves to be harder to contain and modified vaccines are required. This would put the brakes not only on the recovery but on the expected easing of inflation", says Bruckbauer, adding: "In this scenario, the likelihood of second-round effects would be particularly high, and medium-term inflation expectations would be revised upwards significantly, meaning that the central banks would have to tighten monetary policy on a quicker timetable."

In the view of the UniCredit Bank Austria economists, it is important not to discount the significant risk of a more significant slowdown in the Chinese economy in the wake of the country's struggle with a high level of debt and a bloated real estate sector. "In addition to developments with the pandemic and the potential for negative global influences, there is also uncertainty about how private consumers and companies will respond to a new economic normality. With inflation high, consumers could delay spending the savings they built up during the pandemic and shift their spending focus away from consumer durables and back to consumer-friendly services only slowly. Companies might respond to supply problems by strategically building up larger inventories and attempting to make their supply chains more resilient, which due to the higher costs involved could result in higher inflation over the longer term and thus weaken economic momentum", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel. +43 (0) 50505 – 41957

Email: walter.pudschedl@unicreditgroup.at