UniCredit Bank Austria industry overview

Sunny industry climate from autumn cooling down slightly in winter 2021/22

- Industry, construction and business-related services are ensuring that economic output in Austria in 2021 will exceed the 2019 level by at least 2 percent

- Industry will continue to grow in early 2022: However, a shortage of input materials and high production costs are slowing the pace of industrial activity

- High order backlog in the construction industry in the 4th quarter of 2021 guarantees capacity utilisation until 2022, while production growth has cooled down slightly in autumn due to a lack of input materials

- 2021 remains a difficult financial year for the automotive trade and many retail sectors; the outlook for 2022 is more positive for both sectors

- Business-related sectors are ensuring a sustained, sunny service climate

Despite further pandemic-related restrictions, Austria's economy recovered more quickly in 2021 than had been assumed in the spring. The nominal decline in economic output of 4.6 percent in 2020 can be made up for in full. The performance level of 2019 is expected to be exceeded by at least 2 percent in nominal terms.

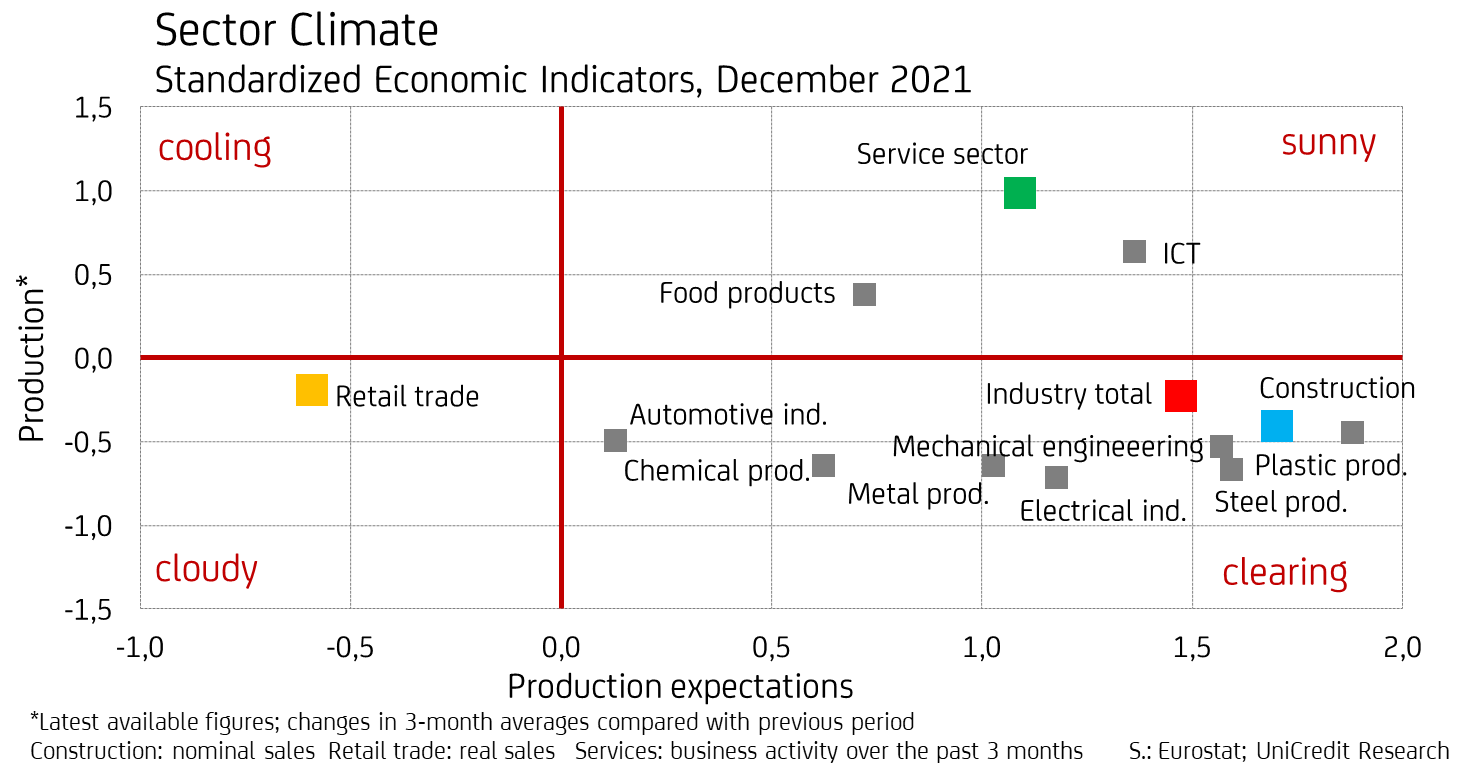

The industry climate in key sectors and branches brightened or remained sunny in November 2021. "The current industry overview from UniCredit Bank Austria shows that the shortage of input materials and rising number of infections have slowed down the process of catching-up since the third quarter. Compared to November 2020, when the third lockdown began, the current climate indicators from November 2021 portray a much more optimistic picture of the economy," says UniCredit Bank Austria economist Günter Wolf. To determine the industry climate indicator, the development of production and sales up to October 2021 are compared with the economic survey results from November 2021.

The slight increase in added value in 2021 compared to 2019 is primarily due to industry, construction and some business-related services. The majority of industrial and construction companies reported an increasing order situation in November. However, material shortage is still being cited as the main obstacle to production in both sectors. The sunny industry climate in the service sector in November was almost exclusively due to business-related sectors. In contrast, tourism-related and personal services are again suffering from a pandemic-related drop in demand. The retail sector is also seeing pessimistic business expectations prevailing in consumer-related divisions. Extensive economic recovery can only be expected here once the lockdown measures have come to an end.

Industrial growth engine slowing down slightly

In the third quarter of 2021, strong growth momentum came from the mechanical engineering and electronics industries, mainly driven by the recovery of the capital goods economy. Demand for information technology will continue to increase in 2022, as will demand for capital goods, stimulated by the investment premium and public spending as part of the climate package in Austria and at the European level. In the larger industrial sectors, metal goods production, plastics processing and the wood industry also reported production increases of well over 10 percent in the third quarter of 2021. In these sectors, companies are benefiting above all from continued high demand for construction at home and abroad.

However, production growth in the third quarter of 2021 cooled down compared to the second quarter in most of the major industrial sectors, with the sector average falling from 27 percent to 9 percent. On the one hand, this was due to the return to an average growth path and on the other hand, supply bottlenecks with input materials. As the company surveys show, the supply of input materials in the mechanical engineering and electrical industries was further exacerbated in the fourth quarter. Here, more than half of companies cited material shortage as a major obstacle to production. The supply of input materials has eased slightly in the construction-related sectors, plastics processing companies and the wood industry.

Nevertheless, capital goods manufacturers and construction-related industries should still register strong growth until the end of the year and the beginning of 2022. This is supported by the predominantly positive assessments of the order situation in November and the above-average optimistic production expectations for the coming months. As an industry average, companies are reporting an order backlog in the fourth quarter of 2021 that guarantees a production capacity utilisation of 5.4 months, a value that was last exceeded in 2008. Capacity utilisation in the high-growth years of 2017 and 2018 averaged 5 months.

The automotive industry will not recover its production shortfall of 16 percent from the previous year until 2022, driven primarily by a wave of new, announced vehicle models. In November 2021, production expectations for the next few months showed renewed caution and were only slightly in the growth range. Compared with the rest of the industry, the sector has been hit hardest by the shortage of materials. In the fourth quarter of 2021, supply difficulties with input materials were cited by all companies as the single relevant obstacle to production.

Of the larger industrial sectors, food and beverages production will not reach pre-crisis levels again until 2022. In both sectors, economic activity lost significant momentum in the third quarter of 2021. While food production was able to at least partially offset its 3.2 percent decline in production in 2020 by September 2021, beverages production recorded another small loss. The industry has been affected much more severely by the lockdown than food production, as indicated by the production losses of 10.3 percent in the previous year. In line with the continued cautious production expectations by companies in both sectors in October and November, stronger production growth is not expected again until the first quarter of 2022 at the earliest.

Construction reporting an above-average order situation in the fourth quarter

The construction industry has long since recovered from its 2.2 percent nominal drop in turnover in 2020. By September 2021, sales in both building construction and civil engineering had increased by an average of 15 percent in nominal terms. The fact that growth in all sectors has cooled down noticeably since the middle of the year can primarily be explained by the sharp rise in material shortages. As recently as the fourth quarter, the highly positive order situation ensured that production capacity was utilised for 7.6 months, well above the ten-year average of 6 months.

However, in recent months, building construction companies have already become somewhat more cautious in their assessment of incoming orders. In this sector, demand for new construction is likely to weaken in commercial construction and, after a delay, also in residential construction. In contrast, the other construction trades continued to show a similar level of confidence in November as in the previous months. At the same time, the order situation in civil engineering has diminished significantly compared with previous months.

The construction industry will lose momentum in 2022. In building construction, commercial construction will continue to lack stronger impetus for demand from the office market and retail trade, while public building construction will increasingly suffer from lower budget spending. Residential construction will also only increase slightly in 2022, as the excess demand has already largely been reduced (new building permits had already fallen in 2020 and most recently in the 2nd quarter of 2021). The construction industry can expect growth momentum in 2022 in the area of residential renovation and presumably also in civil engineering. Both sectors will benefit from the funding of climate protection measures.

The strong growth in construction demand in 2021 and the increasing shortage of building materials have triggered a record increase in construction costs. In the first half of the year, residential construction companies were still able to pass the increased costs onto prices. "In the third quarter of 2021, total construction costs in residential construction rose by 14 percent, significantly faster than the 9.6 percent increase in construction prices. The trend is an indication that the residential construction sector is gradually cooling down and that company profits have come under pressure, at least in the short term," Wolf says.

2021 remains a difficult financial year for the automotive trade and many retail sectors

The 11 percent decline in sales in the automotive trade in 2020 was nominally offset in the first half of 2021. However, new vehicle registrations have been falling since mid-2021, sector sales stagnated in the third quarter and dealers' business expectations have been signalling renewed sales declines since September. The sector cannot expect stronger sales growth in 2022 until the delivery delays for new vehicles are resolved. According to the latest consumer survey from the fourth quarter of 2021, the number of consumers who want to buy a car in the next year has increased again.

In the wholesale sector, the close connection to the dynamic industrial economy will ensure high growth rates in production-related trade through to 2022. By September 2021, the sector's sales had grown nominally by 14 percent, especially in the metals and machinery trade. In comparison, the consumer-related sectors, which were more severely affected by the pandemic, experienced hardly any growth.

In the retail sector, the growth in sales in large-scale food retail, which benefited from the loss of the food services trade, prevented greater losses in the previous year. The non-food sectors, which recorded a nominal 3.6 percent sales loss overall in 2020, were able to offset the decline by September 2021, with the exception of clothing and shoe retailers. Retailers' business expectations slipped back into the red in November, suggesting that sales will fall again in the fourth quarter, at least in the non-food retail sector. Retailers are expected to finish 2021 slightly above 2019 levels, but cannot expect a widespread economic recovery until lockdown measures come to an end.

In the service sector, the industry climate remained sunny in November

In 2020, the decline in sales in the service sector reached a negative record of 15.6 percent. Since April 2021, the industry climate has been sunny again and should remain so until the end of the year due to optimistic business expectations in the business-related services sector. In the transport sector, the proportion of cautious demand expectations only increased slightly in land transport, presumably due to fear of pandemic-related restrictions being reintroduced for passenger transport. By contrast, freight transport and the warehousing/forwarding sector are benefiting from the strong industrial economy.

In other business services, almost all sectors have reported sales growth since the second quarter. As shown by the positive expectations for demand in November, sales growth has not stopped in recent months. However, the survey results show clear differences in the pace of growth: While providers of IT and telecommunications services, lawyers, tax consultants, technical offices, recruitment agencies and advertising should reach pre-crisis levels by 2021, the process of catching-up for personal services will definitely take until 2022.

Tourism-related sectors were able to make up some of their heavy pandemic-related losses in the second and third quarters of 2021. After a 79 percent drop in sales in the first quarter, accommodation and food service businesses recorded an average sales increase of 19 percent in the following two quarters. However, while infection figures have been rising more sharply again since August, the proportion of pessimistic companies in the sector has also been simultaneously growing again, heralding further losses in revenue. Even though Austria's tourism sector can expect a rapid recovery after the end of the pandemic, companies still face an extensive restructuring process due to high revenue losses and changes in travel habits.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Günter Wolf, Tel.: +43 (0) 5 05 05-41954;

Email: guenter.wolf@unicreditgroup.at