UniCredit Bank Austria Purchasing Managers' Index in January:

Strong start to 2022 for Austrian industrial sector as optimism grows

- UniCredit Bank Austria Purchasing Managers' Index rises significantly in January to 61.5 points

- Strong production growth following acceleration of orders from Austria and abroad

- Increase in employment growth rate at start of year

- Industrial sector accumulating stock due to tense supply chain situation

- Slowdown in price increases and improvement in delivery times indicate further moderate easing of supply bottlenecks

- Outlook for new year more optimistic: Marked improvement in immediate outlook for coming months and expectation index for year up to 61.7 points

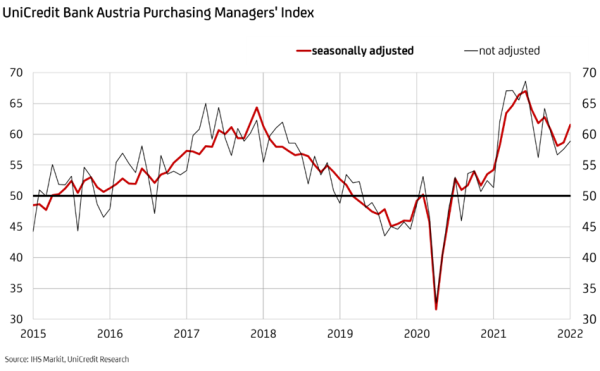

The upwards trend in the industrial economy continued at the start of 2022, despite the spread of the new Omicron variant throughout Austria. "Following the dip caused by the November lockdown, the recovery in the domestic industrial sector picked up considerable pace again in January. The UniCredit Bank Austria Purchasing Managers' Index climbed to 61.5 points, reaching its highest level since September", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Following the slowdown at the start of the winter, the end of the lockdown and the improvement in the international environment provided a strong start to 2022. The preliminary Purchasing Managers' Index for the manufacturing industry in the eurozone rose to 59 points, fuelled mainly by the marked improvement in the German economic situation." The manufacturing industry index in Germany, the most important trading partner country for the Austrian industrial sector, increased to 60.5 points.

The increase in the UniCredit Bank Austria Purchasing Managers' Index by almost three points at the start of the year was the strongest improvement since the spring of 2021. "The acceleration of new business in particular lent increased tailwind to the Austrian industrial sector and led to significant production growth in January, which had the knock-on effect of boosting job creation. The limited supply of materials and transportation problems once again drove up costs considerably and led to increased delivery times, but the supply bottlenecks have eased slightly", says Bruckbauer, summarising the results of the January survey.

New business stimulates production

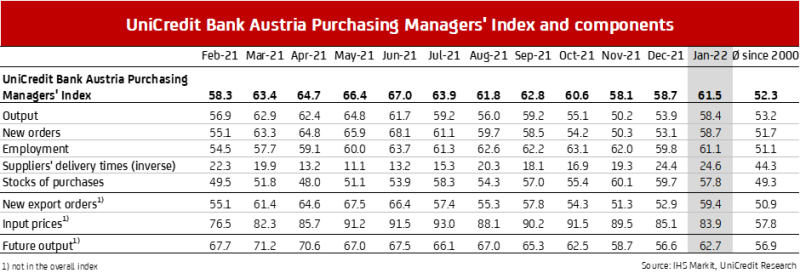

Austrian industrial businesses ramped up production considerably at the start of 2022. The production index rose to 58.4 points in January, its highest value in four months. "The noticeable increase in demand for "Made in Austria" products in January drove significant output growth. In addition to domestic new orders, new business from abroad in particular rose sharply. At 59.4 points, the index for new export orders reached its highest level in six months", says UniCredit Bank Austria Economist Walter Pudschedl.

Despite the strong production growth, orders on hand still increased noticeably, due not only to the acceleration of demand but also in large part by the major challenges in procuring primary materials and raw materials as a result of the supply bottlenecks. Delivery times were also significantly extended in January, but the increase was the lowest seen in a year. The start of 2022 saw a drop in the volume of materials subject to delivery problems, and the data from businesses indicates that shipping delays also showed signs of easing.

Supply problems ease slightly but staffing problems on the up

"Improvements in supply bottlenecks has fuelled significant production growth in many domestic businesses at the start of the year. At the same time, however, staffing problems have worsened and are increasingly hampering production", says Pudschedl, adding: "Employment in the domestic industrial sector has been rising for a year and the pace has increased once again in January. With a seasonally adjusted workforce of 630,000, it is at an all-time high. Supply on the labour market has dropped significantly, with the unemployment rate falling well below the pre-pandemic level. This has led to more and more sectors facing a shortage of skilled workers, hampering their ability to meet incoming orders in good time."

Slight easing of cost increases

Improvements in the order situation combined with the efforts of many domestic businesses to build up safety stocks have driven up purchasing volumes significantly. Stocks of primary products and raw materials grew very sharply once again, albeit at a slower pace than in the previous two months. The high demand for primary products and raw materials, some of which are affected by supply problems, again drove up costs sharply. At 83.9 points, the index for purchasing prices was also well above the long-term average in January, but fell for the third consecutive month to its lowest level since the spring of 2021.

At the start of the year, the cost increases were particularly noticeable with energy, but also with many raw materials, electronic components and transportation resources. In step with the input costs trend, the average output prices of Austrian businesses rose less in January than in previous months but nevertheless saw a sharp increase. "The upswing in the cost of primary materials and raw materials remained very high at the start of the year, albeit lower than over the last ten months. Output prices also rose sharply, though the pace of growth has been decelerating for three months. What this amounts to is that, in January, domestic businesses were once again not in a position to pass on the full cost increase to customers, meaning that, on average, earnings are likely to have gone down — and actually at a slightly increased pace", says Pudschedl.

Recovery gains momentum again

Although the domestic industrial sector was significantly less hard hit by the lockdown at the start of the winter months than many other sectors, the situation still put the brakes on its economic upturn. The recovery picked up again at the start of the year, supported by increased tailwind from abroad, despite the sharp rise in the infection rate caused by the new Omicron variant in Austria.

The start of 2022 has seen the immediate outlook improve for the Austrian industrial sector, fuelled by signs of a slight easing of the supply problems and cost increases and by the more favourable demand situation. In January, the order-stock ratio reached its best value in four months, indicating that further production growth will be needed over the coming months to fulfil incoming orders.

"The material shortages and transportation problems will remain the major challenge for the domestic industrial sector in 2022, with global supply difficulties not expected to ease significantly in the immediate future. However, the acceleration of job creation in January shows that the first signs of easing have already boosted optimism among domestic businesses. The expectation index for the business outlook for the year ahead was up significantly in January and again exceeded the long-term average at 62.7 points", says Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at