UniCredit Bank Austria Business Indicator:

Austria's economy remains optimistic but burden of pandemic restrictions and supply bottlenecks continues into start of 2022

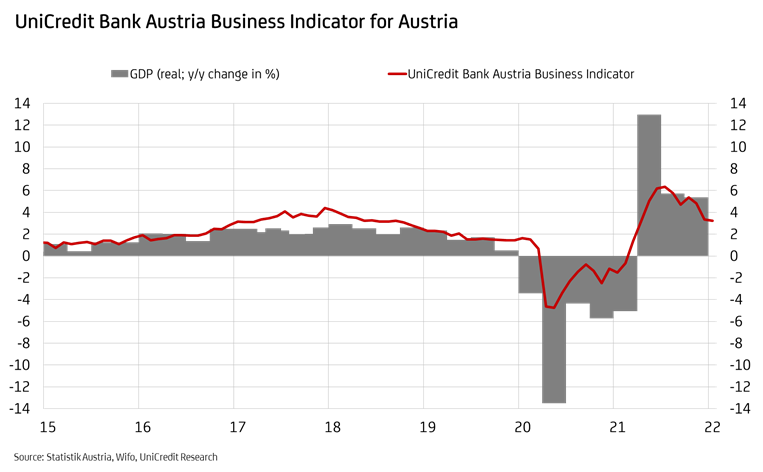

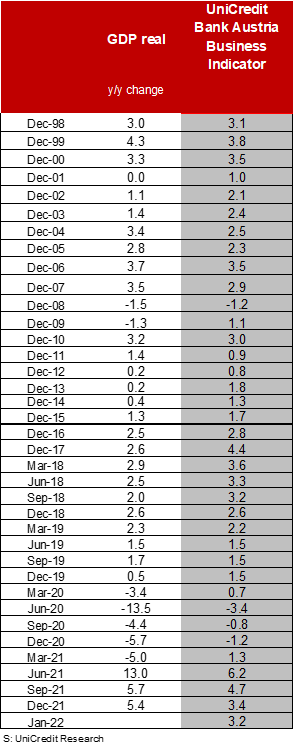

- UniCredit Bank Austria Business Indicator falls further in January 2022, to 3.2 points, but pace of decline slowing sharply

- Easing of pandemic measures supports services sector but lack of progress with supply bottlenecks and cost increases dents confidence in construction and industrial sectors

- Austria's economy returns to growth track in Q1 2022 following decline during lockdown

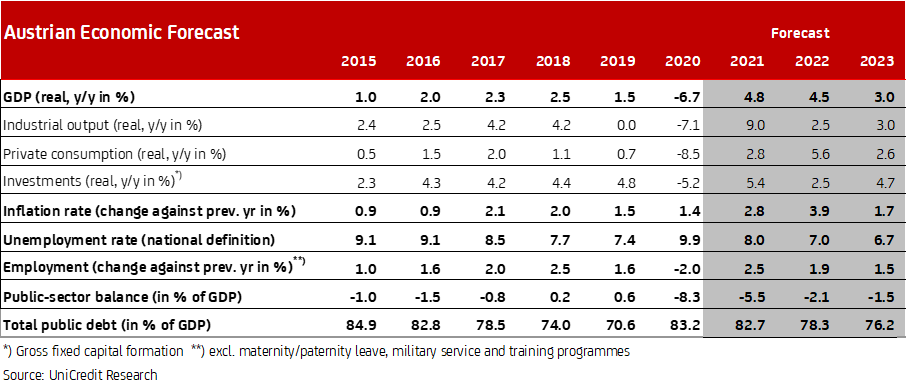

- Strong GDP growth expected in 2022 (4.5%) and 2023 (3%) after growth of almost 5% in 2021

- Continued improvement on labour market despite spread of Omicron: Unemployment rate expected to fall to 7% in 2022 and an average of 6.7% for 2023

- Inflation forecast for 2022 increased to 3.9% but rate set to dip below 2% in 2023, at 1.7%

- Increased inflation and labour market recovery likely to prompt ECB to end net securities purchases in September and introduce first interest rate hike in over ten years in 2022

The Austrian economy was showing signs of cautious optimism as 2022 began. "Economic sentiment in Austria was somewhat more strained at the start of the year than in the previous month due to the problems caused by supply bottlenecks, and following the November lockdown and the continued measures to combat the pandemic. The UniCredit Bank Austria Business Indicator fell slightly to 3.2 points in January but was still well above the long-term average", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Following divergences during the lockdown, the start of the year saw more uniform economic growth across the individual sectors of the economy once again. While the continued global supply problems somewhat marred confidence in the production sectors, the easing of pandemic measures has brightened sentiment in many service sectors that were hit hard by the lockdown."

The mood in the Austrian economy was slightly more uniform once again at the start of the year, although this was due in part to opposing trends in the individual economic sectors. The easing of pandemic measures boosted confidence among many service providers in January, particularly in the retail and hospitality sectors. The optimists have even regained their upper hand in the services sector, due in large part to the fact that consumer sentiment has been buoyed by the surprisingly positive developments on the labour market.

By contrast, sentiment in the construction and domestic industrial sectors clouded over somewhat at the start of the year despite the full order books. This was prompted by the effects of a sharp rise in costs and by the absence of the much-hoped-for rapid resolution to the supply bottlenecks. However, both the construction industry and the domestic industrial sector remained strongly optimistic at the start of the year. In the industrial sector, this optimism is due in part to the favourable global export environment, despite support from the US and Asia, China in particular, tapering off. "With the individual economic sectors showing opposing trends in sentiment at the start of the year, the particularly positive economic mood across all areas of the Austrian economy is an important common feature. Despite the restrictions imposed by measures to combat the pandemic or as a result of supply bottlenecks, domestic production and service businesses and the vast majority of consumers are far more optimistic in 2022 than they were a year ago", says Bruckbauer.

Following the decline in economic output in the final quarter of 2021, the easing of pandemic measures and the—albeit only slight—improvement with the supply bottlenecks have put the Austrian economy back on a growth track. "The Austrian economy is expected to achieve at least a modest GDP increase in the first quarter of 2022. This means that, unlike last year, it should be possible to avoid a technical recession", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "In addition, the pace of growth is set to accelerate from spring onwards, supported by a strong comeback in the services sector and, later in the year, by an upturn in the construction and industrial sectors, with a gradual easing of global supply problems in the second half of the year in particular."

"After the significant GDP increase of almost 5% in 2021, we also anticipate strong economic growth in 2022 — at 4.5% the figure will not be much lower than last year. Private consumption in particular is set to become a powerful growth driver this year, fuelled by the marked improvement in the situation on the labour market and greater certainty about health policy. However, the continued high rate of inflation could increasingly prove to be a sticking point", says Pudschedl. The economists at UniCredit Bank Austria expect economic growth in Austria to be above average in 2023 too, with a GDP increase of 3% despite the significantly lower catch-up effects.

Improvement trend on labour market only briefly dented by pandemic measures

Following the slight increase in the unemployment rate during the November lockdown, the downwards trend has returned despite the ongoing supply bottlenecks and the restrictions for many sectors due to the measures to combat the pandemic.

"At the end of January 2022, the seasonally adjusted unemployment rate of 6.8% was already well below the pre-crisis level of 7.1% seen in February 2019. The current unemployment rate is below the pre-pandemic level in both the industrial and construction sectors and across the services sector as a whole. Furthermore, the sector-specific fluctuations caused by the varying impact of health policy measures are increasingly tailing off", says Pudschedl. These developments are driven both by state support measures such as reduced working hours and by companies that are adapting their business models to the prevailing framework conditions with increasing success. Only in the accommodation and hospitality sectors and in the provision of other services, including the provision of various personal services in particular, have there once again been noticeable upswings in the unemployment rate this winter, and even these increases have been significantly lower than in previous lockdowns. It is only in these two sectors that the unemployment rate has not yet returned to pre-crisis levels.

"Following a rate of 8.0% in 2021, given the positive developments over the winter we now expect the unemployment rate to fall to just 7.0% in 2022 and even further again to an average of 6.7% in 2023", says Pudschedl, adding: "The unemployment rate in Austria has not been this low since the financial crisis 13 years ago." A rapid end to the pandemic and the supply bottlenecks would bring an even more marked improvement in the labour market within reach, given the current large number of vacancies. Considering the number of vacancies in various sectors, the greatest potential for improvement on the labour market over the coming months is in manufacturing, the provision of other economic services, in the construction, retail, and accommodation and hospitality sectors, and in transportation and storage and the healthcare sector.

Inflation set to remain high and interest rate hikes on the agenda

The rise in inflation continued at the start of 2022 and with an increase of more than 5% year on year reached its highest level since the end of 1984. Energy prices remain the main driver of these developments, but in January price increases were also caused by factors such as the end of the temporary measure to cut the reduced VAT rate in half for hospitality, accommodation, culture and publications. The high point for inflation is likely to have been reached, however, as the first signs are emerging of an easing of supply-side supply problems for many raw materials and primary materials.

As a result, inflation is set to slow from spring onwards as raw materials prices drop, but the strong demand for services will drive it up and the initial effects of the rise in energy prices will also be felt, on the price of food for instance. "Following an average of 2.8% in 2021 we anticipate a significant rise in inflation for 2022, albeit with a declining trend over the course of the year. We have revised our forecast for 2022 upwards to an average of 3.9% given the risk of a sharper rise in the event of an escalation of the Ukraine crisis. Inflation should fall again significantly in 2023, although possible second-round effects could delay this trend", says Pudschedl.

The renewed rise in energy prices will lead to sustained higher inflation, and not only in Austria. This situation, combined with the faster recovery of the labour market, has clearly led to a change in the European Central Bank's monetary policy assessment.

"We expect monetary policy to normalise more rapidly than before. The ECB's net purchases of securities could come to an end as early as September and the first interest rate hike in more than ten years is on the horizon at the end of 2022, for both the repo rate and the deposit rate. The start of 2023 could see a further increase in interest rates, bringing an end to a period of negative interest rates in the eurozone that has lasted for over seven years", says Bruckbauer, adding: "However, inflation should fall below 2% year on year again in 2023, meaning that the ECB is likely to put the brakes on and only continue the cycle of interest rate hikes in 2024." However, with higher wage agreements and/or other second-round effects, the ECB could move to increase interest rates sooner.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at