UniCredit Bank Austria Purchasing Managers' Index in February:

Industrial sector boom continues but optimism waning somewhat

- UniCredit Bank Austria Purchasing Managers' Index decreases to 58.4 points in February

- Decline in new business slows output growth

- However: Job creation picks up pace again

- Supply bottlenecks easing: Price increases and extended delivery times at best levels in a year

- Production expectations in Austrian industrial sector above average but optimism down on start of year

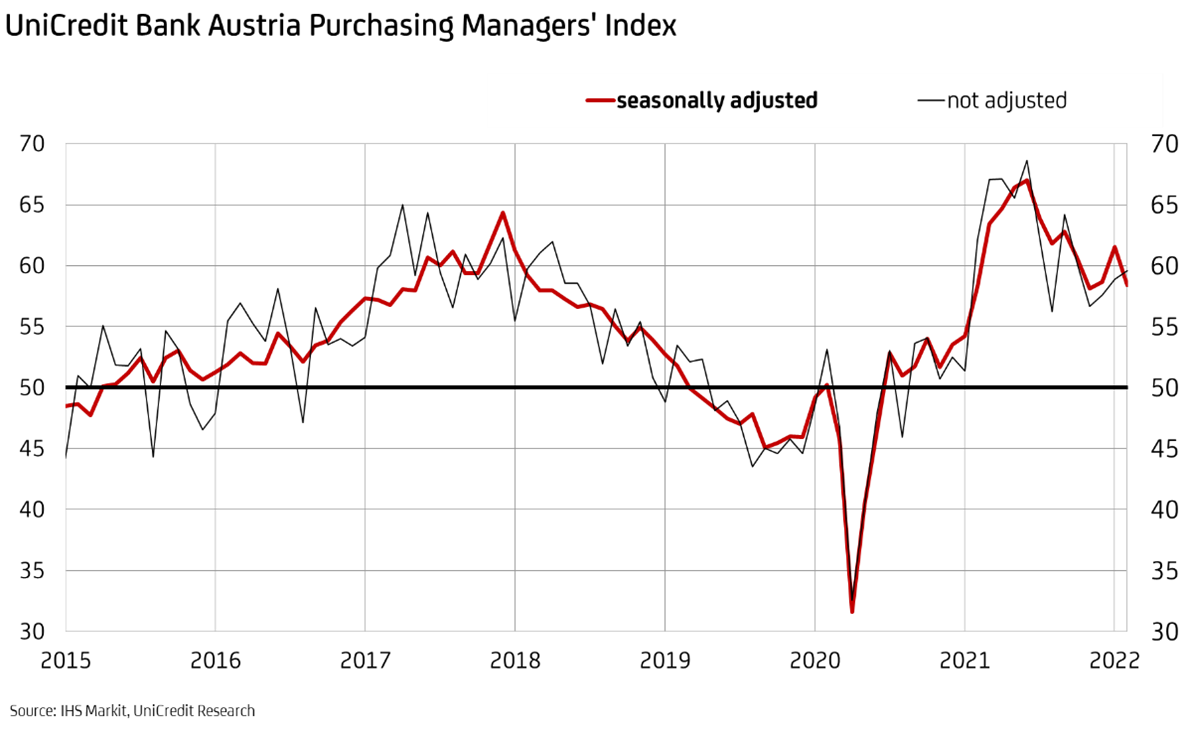

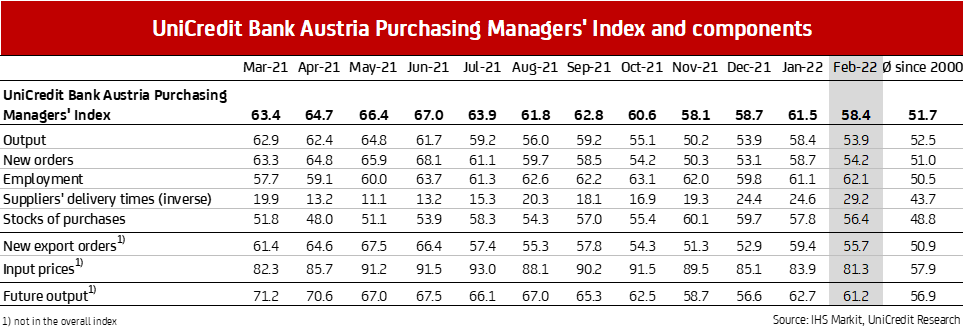

The upturn in the Austrian industrial sector continues, but following strong positive signs at the start of the year the pace has slowed again in February. "The UniCredit Bank Austria Purchasing Managers' Index decreased to 58.4 points in February. The indicator thus remains clearly within the growth range for the domestic manufacturing industry but has dropped more than three points since January. Four of the five sub-components saw a negative impact on the calculated figure; only job creation accelerated in February", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

The current decline in the UniCredit Bank Austria Purchasing Managers' Index is consistent with trends in the international environment for Austria's export-oriented industry. "The preliminary Purchasing Managers' Index also fell in the eurozone in February, though the decline of 0.3 points to 58.4 points was significantly more muted than in Austria. The sharp decline in the Purchasing Managers' Index in Germany—the most important trading partner for the Austrian industrial sector—to 58.5 points was offset by factors such as an improvement in the industrial economy in France", says Bruckbauer.

The decline in the UniCredit Bank Austria Purchasing Managers' Index in February by more than three points represents the worst month-on-month deterioration in almost two years. "The Austrian industrial sector was impeded in particular by falling momentum in new business, which led to a significant slowdown in output growth February. The pace of job creation, by contrast, continued to increase. The limited supply of materials and transportation problems once again drove up costs considerably and led to increased delivery times, but the supply bottlenecks have eased further", says Bruckbauer, summarising the results of the February survey.

Growth in new orders down in February

Although production growth among Austrian industrial businesses was particularly strong in February, the pace of growth slowed noticeably compared to the four-month high seen in January. The production index fell to 53.9 points. "The slowdown in production growth was caused in part by personnel shortages. The lack of personnel capacity due to the pandemic, including challenges such as quarantine regulations, was a burden on the domestic industrial sector. The other factor was that the weaker increase in new business led to a more cautious growth track", says UniCredit Bank Austria Economist Walter Pudschedl. New order growth declined in February for the first time in three months. Thanks to the strong increase in new export orders, the index for new business nevertheless remained well above the long-term average at 54.2 points, though performance was still weaker than in the previous month.

Easing of supply bottlenecks

Due to the existing supply bottlenecks and personnel shortages, orders on hand at Austrian industrial companies increased further in February. The relevant index did fall to 58.6 points, however, which is its second-lowest value in a year. "Supply chains continued to experience significant pressure due to shortages of materials and components, transportation problems and strong demand, but the majority of domestic businesses recorded clear signs of recovery in February. At 42%, the proportion of companies reporting longer delivery times was still high, but at the same time the lowest it has been in a year", says Pudschedl, adding: "As a result, the rise in the prices of raw materials and primary materials has weakened further from the record levels seen in the second half of 2021 and has now fallen to the lowest level in a year."

Cost increases ease for fourth consecutive month

Cost pressure in the Austrian industrial sector remained very high in February, however, as indicated by the corresponding input price index, which at 81.3 points was significantly higher than the long-term average of 57.9. That said, the rise in input prices slowed for the fourth consecutive month. "Over 70% of companies complained in February about rising costs for primary materials, transportation and, above all, energy. Output prices also rose sharply, but at a lower rate. On average, domestic businesses were once again unable to pass on the full increase in costs to customers in February despite strong demand, meaning that earnings are likely to have been trending downwards, albeit at a slightly slower pace", says Pudschedl.

Demand for labour remains strong

Despite the slowdown in output growth, employment in the Austrian industrial sector continued to increase in February. The employment index rose to 62.1 points, signalling faster job creation than even the previous month. "Seasonally adjusted employment in goods production stood at 630,000, which is a new record level. With fewer than 20,000 job seekers in this sector, the current unemployment rate has fallen to a seasonally adjusted 3.2%. This is already half a percentage point below the pre-crisis level", says Pudschedl.

Demand for labour is still strong, given the ongoing recovery. There is currently a record number of almost 14,000 positions vacant. If the number of vacancies could be reduced to the average pre-crisis level seen in 2019, the unemployment rate would be just 2.3% in the domestic manufacturing sector. This figure is theoretical given the shortage of supply in the labour market, but it clearly shows that the employment potential in the industrial sector is significantly higher than in the economy as a whole. Under the same assumptions, the unemployment rate in the economy as a whole would fall to 5.6% from a seasonally adjusted 6.8%, i.e. it would fall 17% compared to a decline in the industrial sector of almost 28%.

Recovery slows somewhat

The measures to contain the pandemic coupled with a slowing of new business put a strain on the pace of recovery in February after the strong start to 2022. "Despite the concerns about the heightened geopolitical tensions in Europe, the domestic industrial sector considers the further business outlook to be above average, especially given the recent signs of both the supply bottlenecks and the cost increases easing. The order-stock ratio decreased only slightly in February, continuing to indicate that further production growth will be needed in the coming months to fulfil incoming orders. The expectations index for the business outlook for the year also fell slightly in February but still continued to far exceed the long-term average at 61.2 points" says Bruckbauer.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at