UniCredit Bank Austria Business Indicator:

Ukraine conflict dampens growth outlook and increases inflation expectations

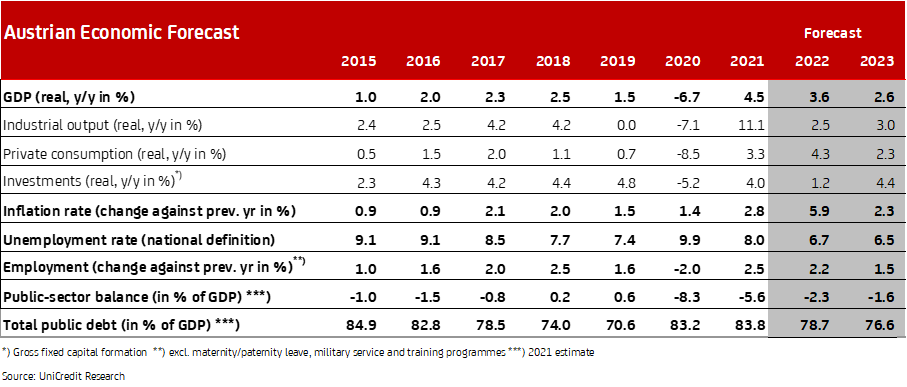

- UniCredit Bank Austria Business Indicator improves to 3.8 points ahead of outbreak of Ukraine crisis in February

- Sanctions on Russia, high energy prices and uncertainty to dampen economic recovery in Austria by a cumulative 1.25 percentage points over next two years

- Economic growth expected to decline to 3.6% in 2022 and 2.6% in 2023, due primarily to negative effects on consumption and investment

- Rise in raw material prices set to fuel inflation to average of 5.9% for 2022

- Second-round effects to keep inflation at 2.3% in 2023 despite dampening effect of energy prices

- Unemployment rate to fall to an average of 6.7% in 2022 and 6.5% in 2023

- ECB set to delay normalisation of monetary policy somewhat due to Ukraine conflict: interest rate hikes not expected before 2023

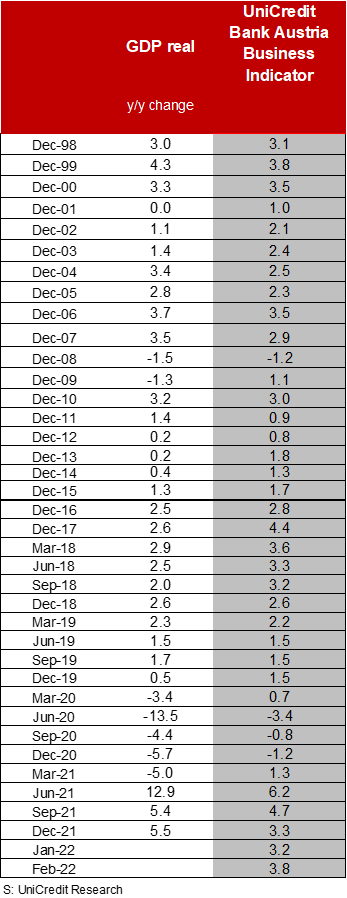

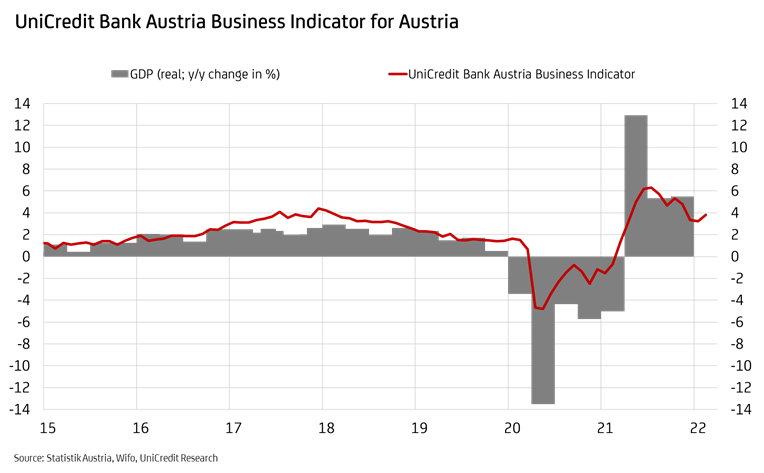

Shortly before war broke out in Ukraine, economic sentiment in Austria had improved following the slump caused by the lockdown at the end of last year. "The UniCredit Bank Austria Business Indicator increased to 3.8 points in February. The relaxation of pandemic measures and a slight easing of supply problems have given the domestic economy more tailwind and increased economic optimism compared to the end of last year", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "However, with the escalation of the Ukraine crisis the framework conditions have changed. The recovery of the Austrian economy will slow noticeably. The sanctions on Russia will certainly have a direct impact on foreign trade, but more importantly the higher energy prices will weaken demand indirectly through lost income and profits."

Despite the additional burdens caused by the escalation of the Ukraine crisis, the UniCredit Bank Austria economists believe that the Austrian economy will return to a growth track in Q1 2022 following the pandemic-related decline at the end of 2021. Nonetheless, a much slower pace of recovery than previously expected is likely as a result of the situation. "Overall, we anticipate a negative growth effect of around 1.25 percentage points cumulatively over the next two years due to the Ukraine crisis. For 2022, we expect economic growth of 3.6%, which is 0.9 percentage points lower than the forecast prior to the conflict. In 2023, the GDP increase will be will be about 0.4 percentage points lower than previously expected, at 2.6%", says Bruckbauer.

The Austrian economy will effectively be dealing with dual burdens. The sanctions will certainly have a direct impact on foreign trade, though exports to Russia in 2021 amounted to barely EUR 2billion, which is just 0.5% of GDP. Of much greater significance, however, is the impact on the economy of a price increase or even a possible suspension of the supply of imported goods from Russia — in particular gas, given that Austria has to date purchased around 80% of its gas supply from Russia.

The forecasts from the UniCredit Bank Austria economists suggest that there will be no suspension of gas supply or other resources (e.g. ores, metals, agricultural products), but that significantly higher prices are certainly to be expected. "In concrete terms, the increase in raw materials prices will have a negative impact on trends with household disposable income and corporate profit; this will dampen consumption primarily but also investment activity. The high degree of uncertainty will weigh heavily on economic sentiment in the coming months and exacerbate this effect", says UniCredit Bank Austria Economist Walter Pudschedl.

Inflation increase amplified and prolonged

The largely energy-price-driven rise in inflation caused by the fast pace of recovery and the global supply bottlenecks continued at the start of 2022, with the interim figure for February suggesting inflation of 5.9% year on year. Inflation has thus reached its highest level since the summer of 1984.

"Due to the escalation of the Ukraine crisis, inflation is set to accelerate even further over the coming months as there has been a significant increase in energy prices. Inflation will continue to rise and will climb above the 6% mark year on year, fuelled not only by the oil price, which has risen to over USD 120 per barrel, but also—due to the dependency on Russian gas—by the gas price and, in its wake, the electricity price. We now anticipate average inflation of 5.9% for 2022", says Pudschedl.

While energy price dynamics will be the main driver of accelerating inflation in 2022, second-round effects from factors such as higher food prices are now to be expected, and this will mute the anticipated easing of inflation from autumn of this year. In the short term there is likely to be a strong focus on passing on the higher input costs to consumers, but this is likely to ease over the course of the year as savings are eroded and demand subsequently weakens. In 2023, average annual inflation will remain unusually high at 2.3% despite decreasing upwards pressure from energy prices due to second-round effects such as rent indexation. Second-round effects via wages should remain manageable as increased uncertainty should also have an impact on wage negotiations, and inflation is likely to decrease again in the medium term.

War in Ukraine set to impact labour market

After the slight increase in the unemployment rate during the last lockdown, the downward trend resumed at the start of the year. At 6.8%, at the end of February the seasonally adjusted unemployment rate in Austria actually reached its lowest level in ten years.

"Following the 8.0% seen in 2021, we expect the unemployment rate to fall to 6.7% on average for 2022. Given the high number of vacancies, the positive trend seen at the start of the year is set to continue for the time being. However, the economic slowdown as a result of the military conflict will affect labour market trends, and as such this positive trend will slow at the very least", says Pudschedl. The unemployment rate is expected to decline moderately to an annual average of 6.5% for 2023; this is the lowest level since 2008.

Delayed does not mean lost

In the longer term, the already difficult task of the ECB is likely to be further complicated by the conflicting goals of higher inflation and weaker growth, which will be exacerbated by the effects of the Ukraine war. "We anticipate that following the discontinuation of the PEPP at the end of March, net purchases under the standard APP securities purchase programme will also stop this year. However, we do not expect interest rates to move until 2023. The deposit rate could be raised to zero in two steps by mid-2023. The conflict in Ukraine will delay normalisation of monetary policy in the eurozone by at least one quarter compared with our previous estimates", concludes Bruckbauer.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at