UniCredit Bank Austria Purchasing Managers' Index in March:

Strong upswing in Austrian industrial sector continues but Ukraine war clouding outlook significantly.

- UniCredit Bank Austria Purchasing Managers' Index rises to 59.3 points, signalling continuation of strong growth in domestic industrial sector in March

- Output growth outstrips previous month despite slight slowdown in new orders

- Supply problems ramping up considerably once more: Price increases and delivery time delays close to record levels of last autumn

- Employment continues to grow but at slightly lower rate

- Solid growth continues in short term but annual output expectations fell in March to lowest level since spring 2020

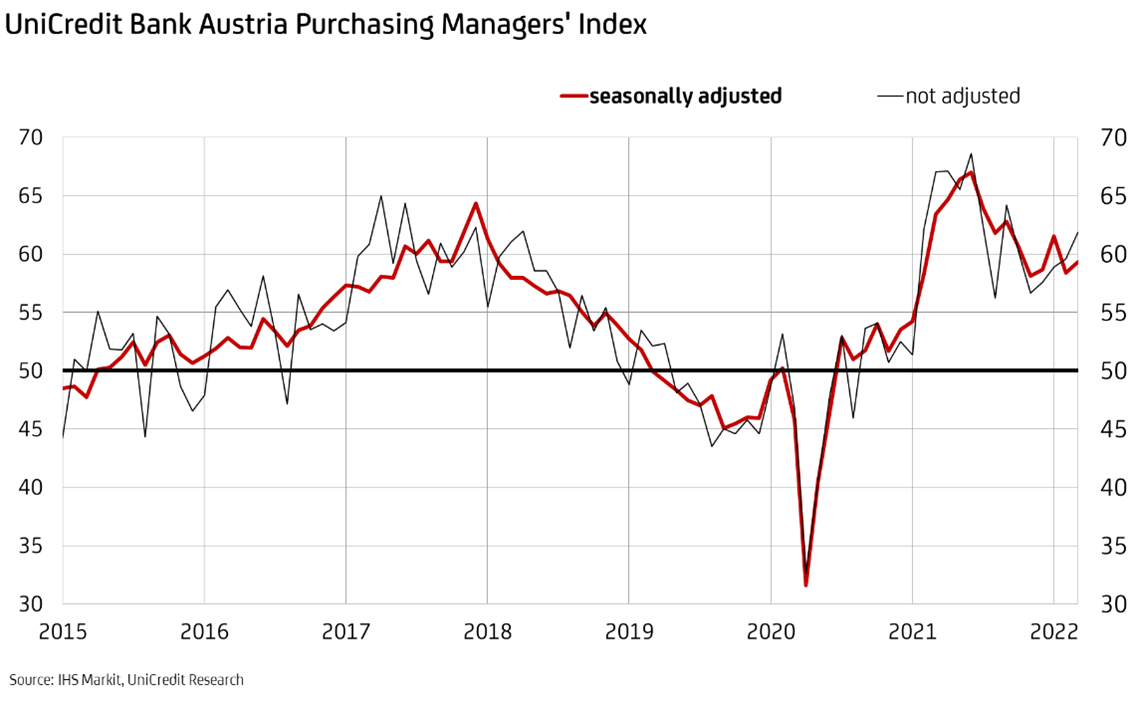

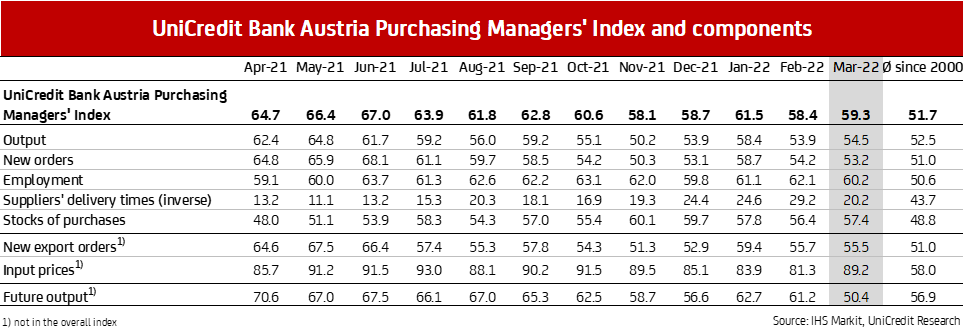

Despite the war in Ukraine and the sanctions imposed on Russia, the industrial economy in Austria has improved slightly. "The UniCredit Bank Austria Purchasing Managers' Index increased to 59.3 points in March. The pace of growth in the domestic industrial sector has even increased slightly on the previous month due to the excellent order situation we are currently seeing", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "However, in view of the dramatic change in the prevailing conditions as a result of the escalation of the Ukraine conflict, output expectations among Austrian industrial businesses have deteriorated abruptly. While a glance in the rear-view mirror still points to a continued industrial-sector upswing in Austria, the landscape ahead for domestic industrial businesses is fraught with the risk of stagnation or even recession."

Although there has been an improvement with the latest UniCredit Bank Austria Purchasing Managers' Index, the negative effects of events in Ukraine must not be overlooked. "Output growth was stronger in March despite growth in new business dipping month on month. Employment growth also slowed. Most importantly, though, the supply problems worsened again significantly having briefly eased. Delivery time delays and purchasing price increases returned to somewhere near the record levels seen in autumn of last year", says Bruckbauer, summarising the results of the March survey.

New business continues to grow but at slower pace

The order situation among domestic industrial businesses improved further in March, but new business grew more slowly than in the last two months. While the strong growth in export demand continued, the pace of new orders from the domestic market has slowed noticeably. "Despite growth in new orders dipping, domestic businesses ramped up production slightly more in March than in the previous month. The output index climbed to 54.5 points as businesses were able to fall back on backlogs of works", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "However, the pace of output growth was far too slow to satisfy demand. Orders on hand grew for the 21st successive month, albeit at a slower pace. Staff shortages and in particular the return of increasing supply bottlenecks and the sharp rise in raw materials prices put the brakes on growth in the industrial sector."

Supply bottlenecks worsen again

The pressure on supply chains due to material and component shortages, transportation problems and strong demand has now increased again as a result of the escalation of the Ukraine conflict, having previously eased slightly at the start of the year. In March, the majority of domestic businesses reported a clear worsening of the problems. Alongside the direct failure of certain existing supply chains as a result of the war, there has also been a particular impact from the sharp increases in the price of raw materials and primary materials. In March, price dynamics approached the record levels seen in the second half of 2021, with particularly significant effects on energy resources such as oil and gas.

Energy cost spikes accelerate sharply

The slight easing of cost increases seen since the start of the year came to an abrupt end in March. Following the steady drops since October of the previous year, the corresponding index for purchasing prices rose to 89.2 points. "The vast majority of companies complained in March of sharply rising costs for primary materials, transportation and, above all, energy. Output prices also rose sharply, but at a lower rate. Generally speaking, domestic industrial businesses have therefore been unable to pass on the full impact of the sizeable cost increase driven by energy prices to their customers, meaning that the earnings situation is likely to have deteriorated as a result of price trends", says Pudschedl.

In view of the uncertain prevailing conditions and the further increase in demand, domestic businesses have significantly increased their purchasing volumes and replenished their stocks of primary materials in order to combat further supply chain problems and price increases. The corresponding index rose to 57.4 points. Stocks of finished goods, on the other hand, once again remained unchanged.

Momentum slowing on employment market

With output ramping up again and on the strength of orders on hand, the employment level continued to grow in the domestic industrial sector in March. The employment index fell to 60.2 points, however, which despite the slight slowdown compared to the previous month suggests that the pace of job creation continues to significantly outperform the average when viewed in the context of a long-term comparison. "Seasonally adjusted employment in manufacturing stood at 630,000, which is a new record level. With some 20,000 job seekers in this sector, the current unemployment rate has fallen to a seasonally adjusted 3.1%. This is already half a percentage point below the pre-crisis level", says Pudschedl.

There are currently some 15,000 vacancies in manufacturing, indicating that a further reduction in the unemployment rate is likely in the coming months. However, given the war in Ukraine and the economic consequences of the sanctions, the drop in unemployment is likely to at least slow, or perhaps cease altogether if there are further restrictions. The labour market situation in the industrial sector, on the other hand, will continue to outperform the economy as a whole. The UniCredit Bank Austria economists expect the average unemployment rate for the industrial sector in 2022 to fall from the 4.0% seen last year to around 3%, set against a drop from 8.0% to 6.7% for the economy as a whole.

Good short-term prospects but economic concerns in longer term

The increase in the latest UniCredit Bank Austria Purchasing Managers' Index points to a slight improvement in the industrial economy compared with the previous month. Strong demand, particularly from abroad, boosted new business and led to an increased production growth. In the short term, this configuration will allow the domestic industrial economy to continue its recovery, as indicated by the index ratio between new orders and stock held in warehouses. Existing stock will not be sufficient to fulfil pending orders without further ramping up production.

"While there are signs that a continuation of the upswing in the Austrian industrial economy is imminent, businesses face a very uncertain future given the war in Ukraine and its impact on energy prices and supply chains. Output expectations for the year were only just within the positive range in March. The expectations index has fallen to 50.4 points, suggesting at least that stagnation in production is imminent. The Russian invasion of Ukraine has seen business expectations slump sharply to the lowest level since the spring of 2020 when the first wave of the COVID-19 pandemic hit the Austrian industrial sector", concludes Bruckbauer.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at