UniCredit Bank Austria Business Indicator:

Ukraine war and inflation concerns subdue economic sentiment in Austria

- UniCredit Bank Austria Business Indicator falls to 1.3 points in March, lowest level in a year

- Easing of pandemic measures led Austrian economy back to growth in first quarter, defying deterioration in sentiment at end of quarter

- Russian sanctions and high energy prices will slow pace of recovery, especially in second and third quarters of 2022, but economic growth of 3.6 percent still possible in 2022

- 2023 GDP increase of 2.6 percent expected

- Reduction of unemployment rate to average of 6.7 percent in 2022 and 6.5 percent in 2023 despite burdens of Ukraine war

- Accelerating inflation until at least mid-2022; stabilisation of energy prices will slow inflation in second half of year

- Inflation expected to fall to annual average of 2.3 percent in 2023 after 5.9 percent in 2022

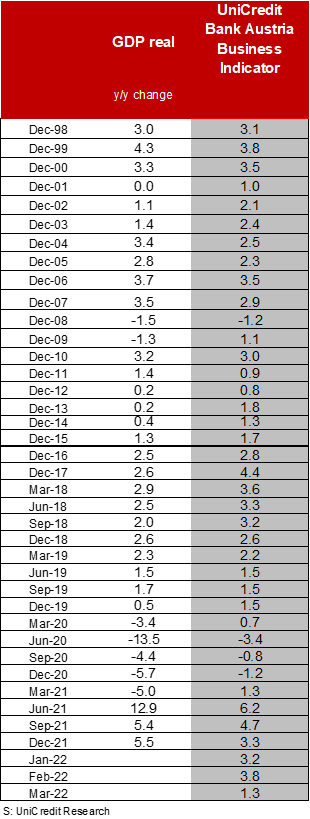

The ongoing war in Ukraine has begun to weigh on economic sentiment in Austria. "The UniCredit Bank Austria Business Indicator fell to 1.3 points in March. After an improvement in the previous month, this is the lowest level in a year", commented UniCredit Bank Austria's Chief Economist Stefan Bruckbauer, adding, "The 2.5-point decline from February is the largest monthly drop in the UniCredit Bank Austria Business Indicator since the first pandemic-related lockdown in April 2020. The decline was driven by the deterioration in the export environment and the slump in consumer confidence, which were far from offset by the somewhat stronger tailwinds for domestic industry and construction".

The global industry confidence index, which is calculated based on the percentage of Austrian foreign trade, has reached its lowest value in a year. In contrast to the incipient deterioration in the export environment, sentiment in the domestic industrial sector improved slightly in March. Despite problems caused by suppliers' delivery delays and rising costs for input materials and raw materials, the upwards trend in orders and existing order backlogs still promise very good business prospects, at least in the immediate future. Optimism also increased in the construction industry in March as a result of full order books and significant new business. "The most significant driver of the deterioration in the overall UniCredit Bank Austria Business Indicator score was the sudden slump in domestic consumer confidence. The uncertainty caused by the Ukraine war and increased costs of living reduced the desire to buy goods and services in the coming months. In spite of the on-going easing of pandemic measures and continuing improvement in the labour market, the momentum for the service sector has waned", said Bruckbauer.

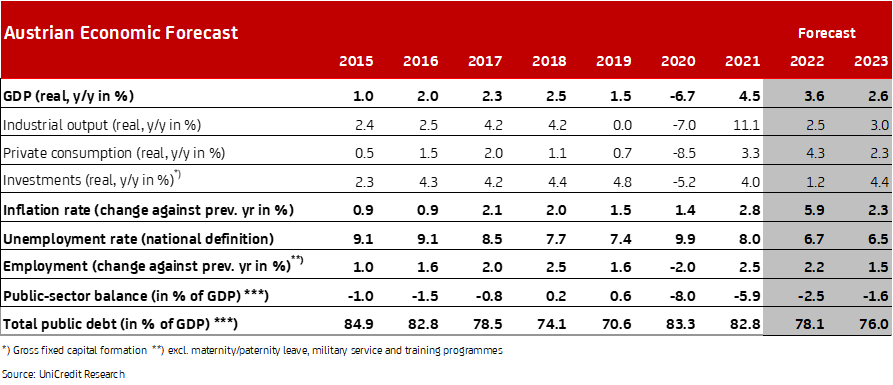

"After the downturn caused by the pandemic at the end of 2021, the Austrian economy resumed growth in the first quarter of 2022 despite the burdens caused by Russia sanctions. We expect GDP to increase by almost one percentage point compared to the previous quarter", said UniCredit Bank Austria economist Walter Pudschedl. The retail and hospitality sectors have benefited greatly from the easing of pandemic measures in recent weeks and have provided a growth comeback for the services sector. Furthermore, the construction industry and, in particular, the manufacturing industry have strongly expanded their production since the beginning of the year, which is also reflected in the positive employment data. In the coming months, however, the negative consequences of the Ukraine war will be felt more strongly by the Austrian economy. Presuming no disruption of energy supplies from Russia, the recovery will continue, but will be less dynamic than expected just a few weeks ago, especially in the second and third quarters. "After the 4.5-percent increase in GDP in the previous year, we are forecasting economic growth of 3.6 percent for 2022 under the current overall conditions. Higher inflation, due largely to the rise in energy prices, will slow consumption and investment growth in the course of the year. For 2023, we expect growth to slow down to 2.6 percent", said Pudschedl.

Significant improvement in labour market in first quarter

With the Austrian economy resuming growth in the first few months of 2022, the situation in the labour market has continued to improve. As of the end of March, employed numbers were already 2 percent higher than before the onset of the coronavirus pandemic and the number of job-seekers was 9 percent, or more than 25,000 people, below the pre-crisis level. "The seasonally adjusted unemployment rate fell to 6.4 percent at the end of March. This means that the unemployment rate is currently not only 0.7 percentage points lower than before the outbreak of the pandemic but is also as low as it was before the financial crisis began in 2008", said Pudschedl, adding, "However, having a high number of people on short-time work, around 170,000, is still a big disappointment. The number of hours worked per employee in Austria is approximately 8 percent below the pre-crisis level.” While the decline in hours worked is limited to 2 percent in industry and 4 percent in construction, it is particularly strong in the service sectors. In other services, the hours worked per employee have decreased twice as much as the average and in the trade sector, including accommodation and catering, the decrease is in double digits. This is likely due mainly to the accommodation and catering sector, which accounts for more than 40 percent of the total number of people registered for short-time work.

Given the large number of job vacancies of more than 100,000, the improving trend of the beginning of the year is expected to continue somewhat. However, the economic slowdown triggered by the Ukraine war will affect labour market developments in the coming months, so the trend of improvement will at least slow down. Economists at UniCredit Bank Austria expect the unemployment rate to fall to 6.7 percent on average in 2022 and to 6.5 percent in 2023.

Inflation to rise to over 7 percent in coming months

The war in Ukraine has led to a further acceleration in commodity prices, fuelling inflation even more. In March, inflation rose to an expected 6.8 percent year-over-year, bringing average inflation in the first quarter to almost 6 percent. Inflation in Austria is expected to continue to accelerate, at least until the middle of the year, driven by energy prices and increasingly by food prices. Values above the 7 percent mark are to be expected. Only in the second half of the year should the stabilisation of energy prices be able to contribute to a slowdown in inflation, despite growing price pressures from passed-on energy costs. By the end of 2022, inflation is still expected to be above 4 percent year-over-year. "We assume an average increase in consumer prices of 5.9 percent in 2022 and, despite the onset of various second-round effects, a noticeable decline in inflation to 2.3 percent in 2023", Bruckbauer concluded.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at