UniCredit Bank Austria Purchasing Managers' Index in April:

Upswing in Austrian industrial sector continues — but at reduced pace due to supply problems and increased costs

- UniCredit Bank Austria Purchasing Managers' Index falls to 57.9 points in April

- Slowdown in new orders leads to decline in output growth

- Employment growth losing pace

- Sharp acceleration in cost increases triggers record rise in output prices in April

- Worsening supply problems include a significant increase in suplier´s delivery times

- Solid growth, but output expectations for the year indicate risk of industry stagnation

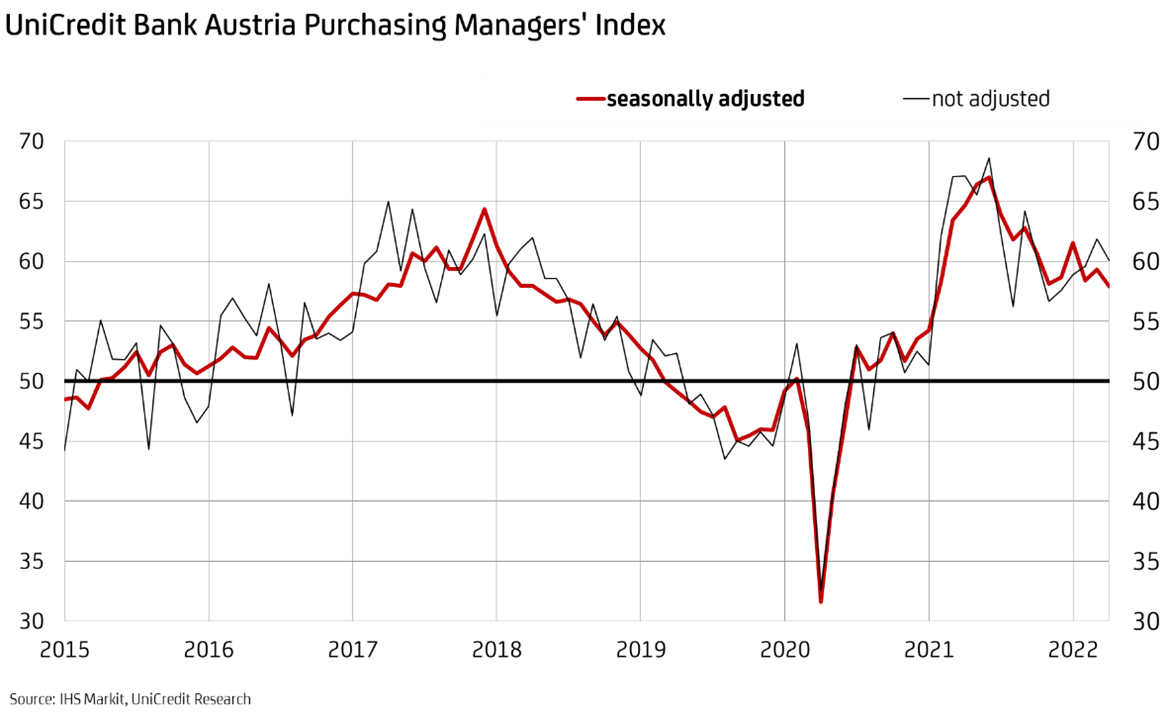

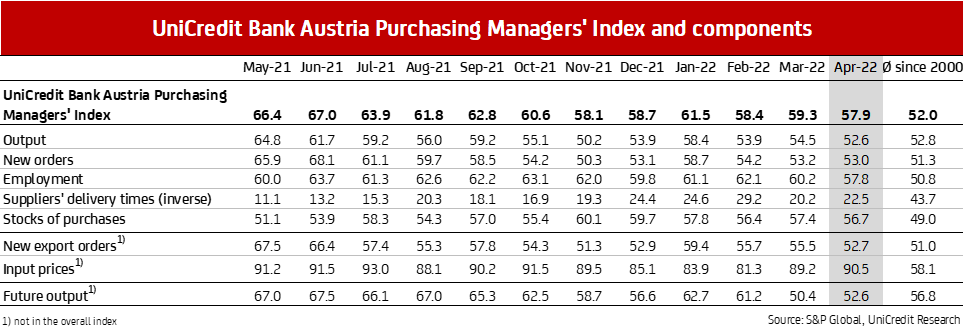

The uncertainty caused by the war in Ukraine and the consequences of the sanctions imposed on Russia are beginning to weigh on Austria's industrial economy. "Following the strong start to 2022 with an average value of almost 60 points in the first quarter, the UniCredit Bank Austria Purchasing Managers' Index fell to 57.9 points in April. With the decline of almost 1.5 points compared with the previous month, the indicator is at a 14-month low", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Despite the decline as a result of the war in Ukraine, the Austrian industrial sector remains on a growth trajectory at the start of the second quarter. Although the pace of recovery slowed in April, as in most European countries, the Austrian industrial sector was able to hold up slightly better, as the Purchasing Managers' Indices in both the eurozone and Germany were lower, at 55.3 and 54.1 points respectively."

The reduced pace of industrial activity in April is reflected in a decline in all components of the UniCredit Bank Austria Purchasing Managers' Index. "In April, less momentum in new orders led to significantly reduced output growth in the domestic businesses compared with the previous month, which also led to a reduction in job creation. Supply bottlenecks have once again intensified, accompanied by a rapid acceleration of price pressure and a further extension of supplier´s delivery times", says Bruckbauer, summarising the results of the April survey.

Decline in new orders from abroad

In April, domestic industrial businesses also recorded an increase in new orders compared with the previous month. However, the pace of incoming orders has decreased slightly, due exclusively to the significantly lower growth in export demand. "Due to the slowdown in new business resulting from fewer new orders from abroad, domestic businesses ramped up their production significantly less in April than in the previous month. The output index fell to 52.6 points, thus dipping below the long-term average for the first time in six months", says UniCredit Bank Austria Economist Walter Pudschedl. Staff shortages and in particular the worsening supply problems and the sharp rise in input costs have put the brakes on growth in the industrial sector, which can fall back on backlogs of work that continues to increase sharply.

Fewer new jobs

April was the sixteenth consecutive month in which new jobs were created in the Austrian industrial sector. The slowdown in the expansion of production has however led to a reduction in employment growth. The employment index fell to 57.8 points, which is its lowest level in a year. "With more than 630,000 jobs, employment in domestic manufacturing reached a new record level in April. The seasonally adjusted unemployment rate has fallen to 3.0%, which is now 0.6 percentage points below the pre-pandemic level", says Pudschedl.

By contrast, the unemployment rate at over 6% was more than twice as high in the economy as a whole. "The labour supply in the industrial sector is becoming increasingly tight. Data suggests that one vacant position in Austria receives just 1.3 applications. The situation is particularly dramatic in Upper Austria and Salzburg, where the number of unemployed people for every vacancy has already dipped below 1", says Pudschedl.

Supply problems on the up again

The war in Ukraine and the lockdown to contain the Covid-19 pandemic in parts of China severely interrupted supply in the industrial sector worldwide, which resulted in an above-average extension of delivery times among domestic businesses in April. In an attempt to steel themselves against longer delivery times, many companies are increasing the volume of material purchased beyond current requirements. Stocks of purchases increased more slowly than in the previous month, but nevertheless very strongly, although this was also due to few production stops caused by a lack of components. As a result, stocks of finished goods also declined in April for the first time since September.

Record rise in output prices following sustained cost increases

In view of the continuing strong demand, the supply and transportation problems caused a further sharp rise in input prices. At 90.5 points, the corresponding index reached its highest level in six months, lying just slightly below the all-time high of the summer of 2021. "Price pressure in the domestic industrial sector increased sharply in April due to the ongoing imbalance between supply and demand for input and raw materials, particularly energy, and transport bottlenecks. The cost increases were reflected in a record rise in output prices. Output prices have never increased so sharply since the survey began more than 20 years ago", says Pudschedl. The faster rise in output prices was felt across all major industrial groups.

Good short-term prospects but major economic concerns in longer term

The current decrease in the UniCredit Bank Austria Purchasing Managers' Index points to a slight deterioration in the industrial economy compared with the previous month. Demand, particularly from abroad, has dampened new business and led to a slowdown in output growth. However, the index ratio between new orders and stocks of finished goods – recently somewhat improved – indicates an immediate continuation of economic upturn among domestic industrial businesses. Existing stock is not sufficient to fulfil existing orders without further ramping up production.

"For the time being, the domestic industrial sector remains on a respectable growth trajectory. However, the pandemic-related measures imposed in parts of China and the war in Ukraine, and their impact on energy prices and supply chains, are leaving their mark. Following the major slump in the previous month, production expectations for the year recovered somewhat in April, but at 52.6 points the expectation index is well below the long-term average, signalling an increased risk of impending stagnation in the domestic industrial sector", concludes Bruckbauer.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at