UniCredit Bank Austria industry overview

Positive industry climate in spring 2022 despite increased material shortages and growing economic uncertainty

- Increasing material shortages and growing economic uncertainties putting brakes on production growth in industrial sector

- High level of orders on hand in construction industry keeping capacity utilisation high; construction costs and shortage of raw materials reaching record levels

- 2022 financial year remains difficult for automotive trade and many retail sectors

- Growth momentum stemming from services sector

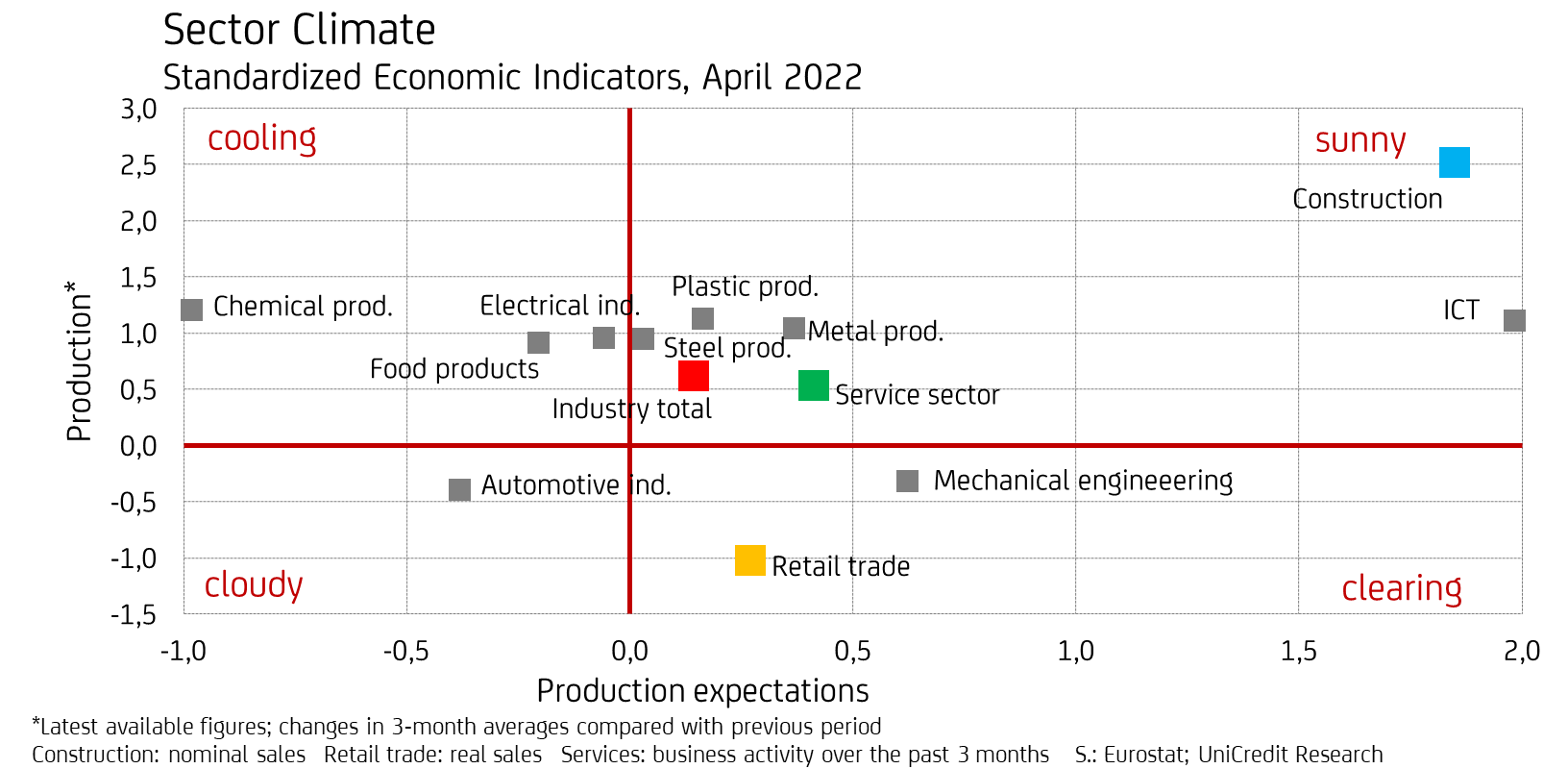

Austria's economy has taken the momentum from the previous year forwards into the current year. The climate in the industrial, construction and services sectors remained positive in April 2022 by comparison against the sector average. The industry climate indicator is determined based on a comparison of production and sales trends up to March 2022 against the results of the economic survey in April 2022.

The latest industry overview from UniCredit Bank Austria shows that business expectations remained in the growth range in all sectors up to April, following strong growth in the first quarter of 2022. In addition, businesses are reporting well-filled order books in both the industrial and construction sectors. Nevertheless, production expectations for the next few months have become more pessimistic in certain larger branches of industry, probably due to economic uncertainties. The shortage of raw materials, which had actually eased somewhat in many production sectors at the start of 2022, has worsened again recently based on the April survey and is dampening sentiment. "In summary, the results of the latest economic survey suggest that momentum in the domestic economy is slowing, but that if the war-related turbulence subsides, the strong growth seen in the first quarter could quickly resume", says UniCredit Bank Austria Economist Günter Wolf.

Industrial growth slowing

The shortage of materials in the industrial sector has worsened following the outbreak of war in Ukraine. Some 48% of industrial businesses are expecting significant production challenges in the second quarter due to bottlenecks and problems procuring primary products and raw materials. This figure was just 38% for the first quarter. The shortage of materials is particularly pronounced in the automotive industry, where 84% of businesses have reported a lack of primary products, and in the mechanical engineering and electrical sectors, where the proportion is around 60%. The shortage of primary materials also outstrips the sector average among industrial construction suppliers. Beyond this, no significant supply chain problems have been reported by the larger branches of industry.

In the second quarter of 2022, industrial production is expected to weaken slightly year on year due to the very high 26% production growth in 2021. However, the results of the company surveys show that the industrial economy has retained momentum so far despite the shortage of materials. In April, capacity utilisation in the sector averaged 89%, which is still above the pre-crisis level. In addition, order books were well filled, measured by the positive order assessment figure of 12 percentage points. By comparison, the order assessment figure in the high-growth year 2018 was fewer than 6 percentage points. Last but not least, production expectations for the coming months have become more cautious on average across the industrial sector, but remain within the growth range. In April, the industrial climate in the electrical engineering, chemicals and food production sectors cooled, and in the automotive industry it had already clouded over.

Since July 2021, production in the automotive industry has been steadily declining compared with the previous year's figures; it has fallen by a further 17% on average in the first quarter of 2022. The production expectations of businesses has also became more pessimistic as at April 2022, with further losses announced. By contrast, the order situation for the sector remained strong with a positive figure of 22 percentage points, which is well above the long-term result of 17 percentage points. The survey results are explained by the high demand for motor vehicles, which is not matched by a corresponding supply of vehicles due to the supply shortages affecting key primary products. The sector is not expected to return to pre-crisis levels in 2022.

By comparison with the larger capital goods manufacturers, the economic survey results for April still paint a picture of stable growth in the electrical sector. In the first quarter of 2022, production output increased by 11.1% year on year, driven primarily by the electronics sector. Up to April, businesses in both the electronics and electrical engineering sectors remained optimistic in their assessment of the order situation on balance. In this respect, the shortage of raw materials, which has been cited as a major obstacle to production for three quarters now, has slowed growth only slightly up to this point. In April, however, the electrical engineering companies became somewhat more cautious in their production expectations for the coming months and reported a cooling in the sector economy. At the same time, confident production expectations have risen again in the electronics sector.

In the first quarter of 2022, the mechanical engineering sector recorded an increase in production of 6.4%. In addition, businesses still reported a very good order situation in April. Although production expectations for the coming months have become somewhat more cautious compared to March, they have remained optimistic on balance. As in the electrical sector, the optimistic results of the company survey for the mechanical engineering sector also indicate at least stable production performance, which is remarkable in view of the considerable supply difficulties affecting raw materials. For the second quarter of 2022, 60% of businesses expect significant production challenges due to material shortages; this is the highest figure so far in the mechanical engineering sector.

Construction industry still working at record levels in April

In the first quarter of 2022, construction output rose by an average of 2.7%, and construction sales rose by 11.9% thanks to the high price increases. Capacity utilisation in the construction industry for the second quarter increased to 7.2 months and remains well above the ten-year average of six months. The high capacity utilisation figures are accompanied by a shortage of labour and raw materials, which reached its highest level yet in April. As a result, construction costs and construction prices were driven to new record highs. The rise in the cost of residential construction, which slowed somewhat from September 2021 through to February 2022, reached a historic high of 15.2% in March.

In April, the majority of the structural engineering businesses reported a satisfactory order situation. However, order assessments have fallen from 16 percentage points to 11 percentage points on balance compared with the previous month, with orders on hand even significantly lower than in other construction trades. The sector primarily covers the finishing trades and building installation. Here, order assessments reached a positive figure of 32 percentage points in April. This development is an indication that the demand for new buildings in commercial and residential construction is growing at a slower pace than the demand for finishing and modernisation services in the structural engineering sector.

"The construction economy is expected to remain on a growth trajectory in 2022 but will lose momentum compared with the previous year. Weak demand for office and retail space and budget constraints affecting public building construction are putting the brakes on the structural engineering economy. In addition, excess demand for residential construction has already largely been reduced", says Wolf. New residential construction building permits have been declining for the past two years; permits for single-family dwellings have also be declining since the fourth quarter of 2021. The construction industry can expect further stronger growth momentum in 2022 in the area of structural engineering renovation and potentially in civil engineering. Both sectors benefit from subsidies for climate protection measures.

2022 financial year remains difficult for automotive trade and many retail sectors

Since July 2021, sector sales have stagnated and new vehicle registrations have fallen. At the same time, the business expectations of car dealers (including workshops) became more cautious, and signalled a further decline in sales in the first few months of 2022. In April, business expectations for the coming months was -42 percentage points on balance, and the long-term average was -4 percentage points. The automotive trade is suffering in particular from delivery delays with new cars. With the outbreak of war in Ukraine, consumer confidence, and in particular the number of consumers who want to buy a car in the next 12 months, has also fallen significantly.

Strong growth in retail sales in the first quarter of 2022, averaging 10% in nominal terms year on year, was due primarily to the considerable decline in sales in the previous year and does not at this stage an indication of robust recovery in the retail economy. Rather, the predominantly negative business expectations of the traders in recent months signalled a subdued economic trend. While the outlook for the next few months has been significantly more negative for food retailers in March and April, the sentiment in the non-food retail sector rose slightly above the long-term figure in April. Nevertheless, it is to be expected that in 2022 strong price increases, real-terms wage losses and growing economic uncertainties will make consumers less willing to buy.

Positive industry climate in most services sectors

With a few exceptions, such as travel agencies, advertising and publishing, the turnover of the other economic services sector returned to pre-crisis levels in 2021, and the turnover of providers of information technology and telecommunications services, other freelance services and building cleaning services rose above the levels seen in 2019. In 2022, the sector's climate has also remained largely positive. Only in the publishing sector have pessimistic assessments from businesses once again dominated since March. While the services sector is less affected by the current economic turmoil than the industrial sector, it has also been affected. In April, demand expectations for the coming months in all major sectors have become at least somewhat more cautious compared to the previous month.

In the transport sector, business expectations in April 2022 only became more optimistic in the area of warehousing. In the land transport sector, freight transport is set to have benefited from the lively industrial economy and passenger transport from the renewed increase in tourism at the start of 2022. However, the growing uncertainty as a result of the war in Ukraine is dampening demand expectations and the sector economy, as demonstrated, for example, by the slight decline in HGV mileage in March of 0.4% year on year (on toll roads in Austria).

In the accommodation and hospitality sector, the mood in February and March 2022 improved further against the backdrop of growing tourism demand and the expected catch-up effects. It was not until April that demand expectations become somewhat more cautious. It is likely that demand for domestic and foreign travel will decline over the course of the year, dampened by economic uncertainties and high fuel prices.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Günter Wolf, Tel.: +43 (0)5 05 05-41954;

Email: guenter.wolf@unicreditgroup.at