UniCredit Bank Austria Business Indicator:

Economic slowdown expected after strong start to year

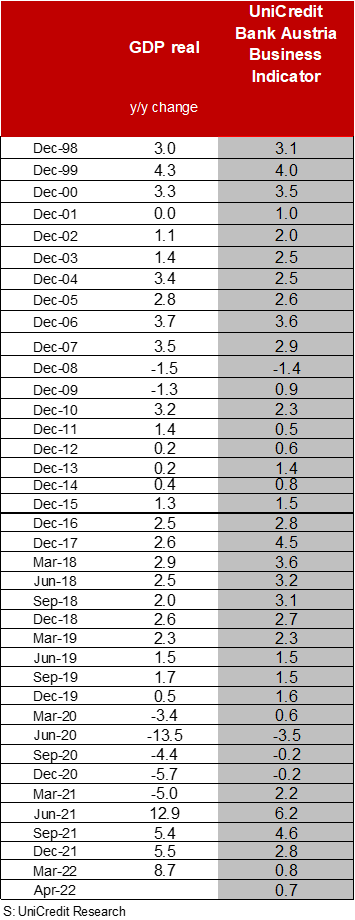

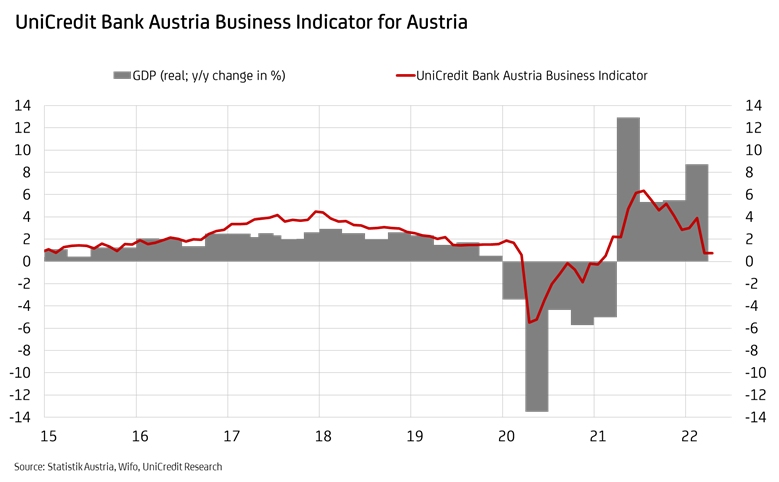

- UniCredit Bank Austria Business Indicator falls to lowest level in a year in April at 0.7 points

- Sanctions against Russia and high energy prices set to put brakes on economy in Austria in coming months

- Slowdown evident in industrial and construction sectors but services economy set to benefit from removal of pandemic measures, despite burden of inflation

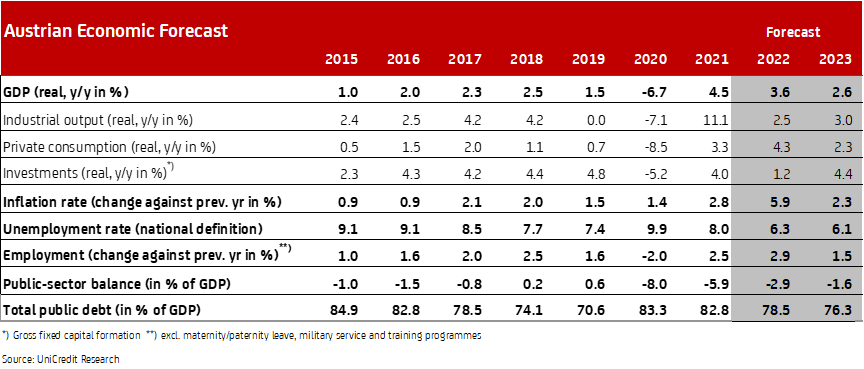

- Strong growth at start of year drives GDP increase of 3.6% for 2022. Lower economic growth of 2.6% expected for 2023

- Reduction of unemployment rate to average of 6.3% in 2022 and 6.1% in 2023 despite burdens of Ukraine war

- Inflation expected to fall to annual average of 2.3% in 2023 from 5.9% in 2022

- Early ECB interest rate hike on horizon in wake of rise in inflation expectations

The ongoing supply problems and price increases continue to weigh on economic sentiment in Austria. "As a result of the war in Ukraine, the Austrian economy is now seeing clear signs of a slowdown. The UniCredit Bank Austria Business Indicator fell to 0.7 points in April", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Following the abrupt slump in the previous month, economic sentiment deteriorated only slightly in April, but the change was seen at all levels. The outlook deteriorated in the industrial and construction sectors as well as in the services sector."

Sustained cooling of the export environment within the Austrian economy is increasingly weighing on sentiment in the domestic industrial sector. Worsening supply problems and rising costs for primary and raw materials, especially energy, are denting confidence despite good capacity utilisation and a strong order situation. High costs are already exerting pressure on new business in the construction industry, with this sector of the economy reporting the strongest impact on sentiment in April. "Following the slump in the previous month, the mood among domestic consumers has improved only marginally. Despite pandemic measures being eased in the retail and hospitality sectors and the continuing improvement on the labour market, momentum in the services sector has dropped off still further", says Bruckbauer.

The Austrian economy made a strong start to 2022 and more than offset the pandemic-related downturn caused by the lockdowns in the fourth quarter with a significant increase in GDP. Economic output is currently more than one-and-one-half percentage points above the pre-pandemic level, buoyed in recent times by strong growth in the industrial and construction sectors. The retail and hospitality sectors as well as many personal services have also benefited from the easing of pandemic measures in recent weeks and have prompted a growth comeback for the services sector.

"The continued decline in the UniCredit Bank Austria Business Indicator shows that the solid growth front is beginning to crumble. Under the current conditions, neither the industrial nor construction sectors will be able to continue the high rate of recovery seen at the start of the year. Gains will scarcely be possible in the coming months as progress is hampered by high costs and the ongoing supply problems, which are likely to prompt a delayed worsening of the situation due to the lockdowns in parts of China", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "The performance of the services sector, which will be buoyed by the easing of pandemic measures, will be decisive in terms of growth momentum in Austria in the coming months. However, it has already become clear in recent months that the rise in inflation is affecting consumer spending."

"In the coming months, the negative consequences of the Ukraine war will be felt more strongly by the Austrian economy, and consumer spending and investments will be strained. Even assuming that there will be no interruption to energy supplies from Russia, hardly any progress with recovery is expected, in particular in the second quarter but also in the third quarter. After a very dynamic start to the year, we continue to expect economic growth of 3.6% for 2022. For 2023, we expect growth to slow to 2.6%", says Pudschedl.

Ukraine war not yet affecting job market

Despite the burgeoning economic slowdown, the improvement in the situation on the labour market is continuing and, for the time being at least, is holding off the effects of the war in Ukraine. In April, the seasonally adjusted unemployment rate fell to 6.2%. The unemployment rate in Austria has not been this low since November 2008. As the number of people registered for short-time working is now only around 50,000 and the number of vacancies is consistently high at around 130,000, favourable developments on the labour market should continue into the coming months. "Due to the very favourable developments to date, we have lowered our forecast for average unemployment in 2022 to 6.3% despite the adverse effects that the war in Ukraine is expected to have on the labour market. We also now expect a lower unemployment rate in 2023, at 6.1%", says Pudschedl. This will take Austria to its lowest unemployment rate in 14 years.

With the number of job seekers declining to just over 250,000, the situation on the Austrian labour market is becoming tougher, and the shortage of skilled workers is becoming an increasingly important factor. The number of unemployed persons per job vacancy dropped to 2.0 in April. In manufacturing, construction, economic services and now also in retail trade, there are now fewer than two job seekers for every vacancy. The problem is particularly serious in the federal states of Upper Austria and Salzburg, where the number of job vacancies is calculated to be lower than the number of job seekers. The situation is also particularly bad in Styria and Vorarlberg. The number of unemployed persons per job opening is highest in Vienna, at more than five.

Inflation still trending upwards with ECB expected to respond imminently

The war in Ukraine has led to an acceleration in raw materials prices, intensifying inflation even more. In April, inflation rose to 7.2% year on year, bringing average inflation in the first third of the year to more than 6%. By the middle of the year, the pressure on energy prices and increasingly on food prices is expected to increase still further, reaching in excess of 7% year on year. "Energy prices will stabilise in the second half of the year, slowing inflation. We expect inflation to decline to around 4% at the end of the year, bring average inflation for 2022 to 5.9%. Inflation is set to fall significantly in 2023, to 2.3% based on our forecasts", says Bruckbauer.

In recent weeks, long-term inflation expectations for the eurozone have risen to over 2% in market surveys, for the first time since the introduction of the euro. "We expect the ECB to respond to increased inflation expectations by hiking interest rates. The rate-tightening cycle could begin shortly after the securities purchase programme is phased out in July. Overall, we expect key interest rates to rise by 100 basis points over the next 12 months, leading to a deposit rate of 0.50% one year from now", says Bruckbauer. The economists at UniCredit Bank Austria thus expect interest rates to rise somewhat rapidly but to the same ultimate level previously expected, as no further normalisation steps are expected for the time being. This is because inflation is expected to drop below 2% in the eurozone in the second half of 2023 and because the labour market situation is not expected to worsen due to the dampening effects of the war in Ukraine, which limits the risk of second-round effects.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at