UniCredit Bank Austria Purchasing Managers' Index in May:

Austria's industry continues to lose momentum

- UniCredit Bank Austria Purchasing Managers' Index falls to 56.6 points in May

- Ramp-up of production to process order backlogs

- First decrease in new orders in almost two years

- Employment growth maintains high pace for time being

- Supply bottlenecks and cost increases reduce only marginally compared to previous months

- Further deterioration in production expectations over year underlines increasing risk of stagnation in industry

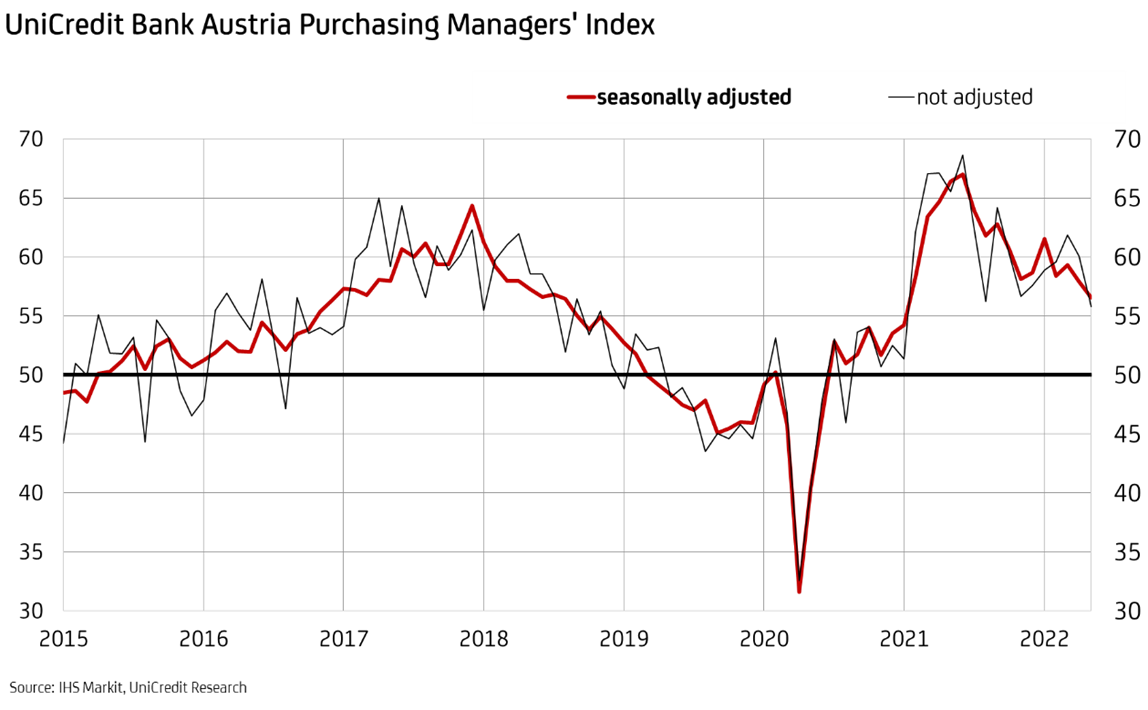

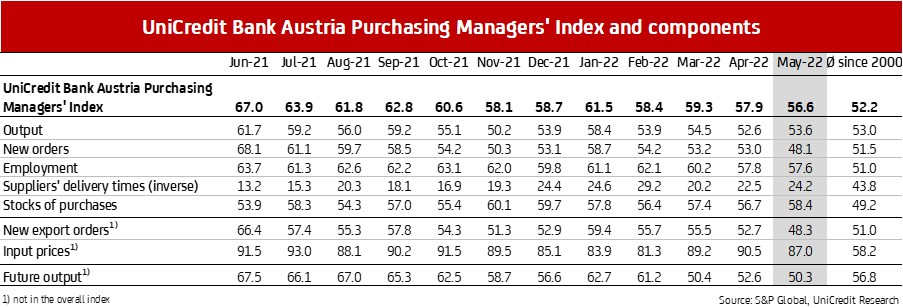

The industrial economy in Austria continues to decline. "UniCredit Bank Austria Purchasing Managers' Index fell in May to its lowest level in 16 months at 56.6 points. This indicates that Austria's industrial economy remains on a growth trajectory, despite the pressures caused by the worsening of supply bottlenecks and the sizeable cost increase resulting from the war in Ukraine and the pandemic measures in China", reports UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Compared to the start of the year, however, the domestic industrial sector lost considerable momentum in line with the international trend. While neighbouring Germany saw a stabilisation in its pace of growth, the growth rate in most European countries slowed in May. The preliminary Purchasing Managers' Index for the eurozone fell by more than 1 point to 54.4 — its lowest level in 20 months".

The most recent change in the UniCredit Bank Austria Purchasing Managers' Index was characterised by a decline in most components. "While in May domestic businesses expanded production somewhat more than in the previous month to process order backlog, new orders decreased for the first time in almost two years. While the rate of job creation stabilised, the renewed tightening of supply bottlenecks had an encumbering effect. Supplier´s delivery times increased and prices continued to rise — albeit at a slightly slower pace than in previous months", explains Bruckbauer.

Decline in new orders

In May—for the first time in almost two years—domestic industrial businesses failed to record a further increase in new orders compared with the previous month. The slump in export demand was the decisive factor influencing the negative developments for order volumes. The index for export orders fell by more than 4 points to just 48.3 points, its lowest level since June 2020 — when Austria's industrial sector was in its first pandemic-related lockdown. "Despite the decline in new business, domestic businesses ramped up production slightly more in May than in the previous month. The production index climbed to 53.6 points, thereby exceeding the long-term average once more", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "Production growth in May should not be interpreted as a reversal of the downwards trend in production growth in recent months, but rather as the fallout of past events, since this was solely attributed to the processing of the large backlogs".

Pent-up demand keeps rate of job creation high

In May, Austria's industrial sector continued to recruit new staff at a consistently high pace. Given the upwards trend in orders in recent months and the increased order backlogs, as well as the ongoing ramp-up of production, there is a great need for staff capacities to be adjusted to production requirements. "The number of employees in goods production reached a new record level at over 630,000. The seasonally adjusted unemployment rate in the industrial sector is only 3.0 percent. The last time figures were this low was in 2008 before the onset of the financial crisis", says Pudschedl.

By contrast, at over 6 percent the unemployment rate is more than twice as high in the economy as a whole. "The labour supply in the industrial sector is becoming increasingly tight. Data suggests that one vacant position in Austria receives just 1.2 applications. The situation is particularly dramatic in the mechanical engineering sector, the electronics and wood industries, other vehicle production and in furniture manufacturing. In these sectors, the ratio of jobs to applicants has already fallen below 1", reports Pudschedl.

Material shortage puts pressure on inventory management

Despite the decline in new business, domestic industrial businesses significantly increased their order volumes of raw and primary materials in May, preparing themselves with increased inventories in the face of material shortages caused by longer delivery delays. Inventories of primary materials increased more rapidly than in the previous month, partly due to a somewhat slower pace of delivery time increases in May. However, halts in production due to a lack of individual components also contributed to fuller inventories for primary materials. Inventories of finished goods nevertheless rose again in May after the decrease in the previous month, which could be a first indicator of more restrained customer demand.

Price increases place strain on demand

The ongoing supply and transportation problems exacerbated by the war in Ukraine caused a further spike in purchasing prices of raw materials and primary materials. The upswing in costs in May was only slightly lower than in the previous month. "In lockstep with input prices, price dynamics in sales also decreased slightly in May. In view of the somewhat weakening demand, businesses were not able to pass on the full impact of the cost increases to customers via higher output prices. The various price trends in May have on average worsened the revenue situation overall in the domestic industrial sector", says Pudschedl.

Economic concerns on the rise

Following the strong start to the year, the current decrease in the UniCredit Bank Austria Purchasing Managers' Index points to a further deterioration in the industrial economy. Particularly weaker demand from abroad led to a decline in the number of new orders for the domestic industrial sector. For the first time in almost two years, the index ratio between new orders and stocks of finished goods fell to a level that calls into doubt a continuation of the upswing for the near future, since existing stocks can be used to fulfil incoming orders without increasing production.

"In the coming months, the high level of order backlogs is likely to cushion the already tangible decline in demand, allowing the domestic industrial sector to remain on a growth trajectory for the time being. That said, supply chain issues and rising raw material prices are increasingly leaving their mark. Given the discussions on an oil and gas embargo production, expectations for the year fell in May to 50.3 points, their lowest level since spring 2020,when the first wave of the Covid-19 pandemic hit the Austrian industrial sector. Following the slight recovery in the previous month, the expectations index once again indicates a significantly increased risk of impending stagnation in the domestic industrial sector", Bruckbauer concludes.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at