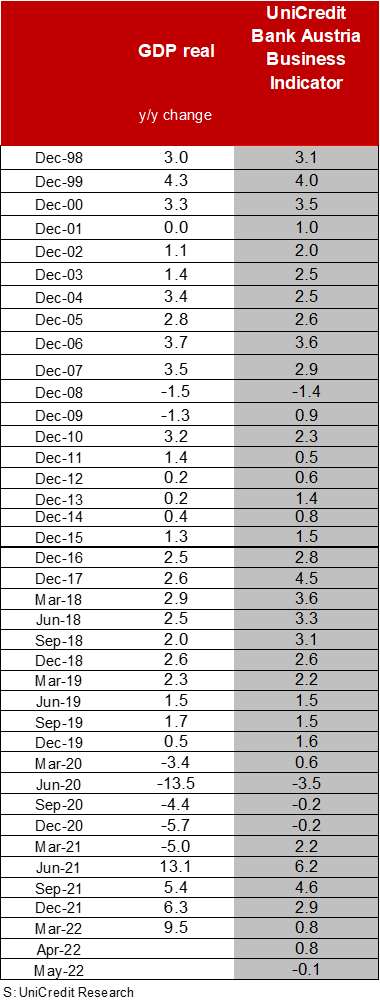

UniCredit Bank Austria Business Indicator:

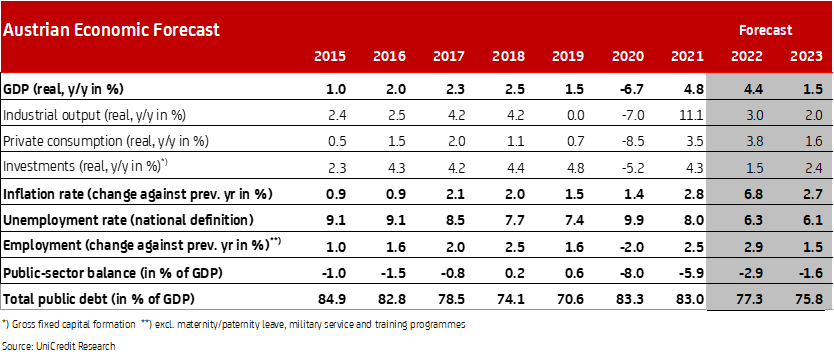

Very strong start to the year lifts growth forecast for Austria to 4.4%, while economic downturn begins

- UniCredit Bank Austria Business Indicator fell to minus 0.1 points in May, into negative territory for the first time since end of 2020/start of 2021

- Tangible economic slowdown expected over coming months due to high energy prices and ongoing supply problems

- Services sector will just about maintain Austrian economic growth thanks to easing pandemic measures

- Strong start to 2022 results in GDP forecast increase to 4.4% despite bleak outlook. 2023 growth forecast reduced to 1.5%

- Unemployment rate still expected to average 6.3% in 2022 and 6.1% in 2023

- Inflation forecast raised to 6.8% on average in 2022 and 2.7% in 2023

- Rising economic risk caused by potential excessive tightening of ECB monetary policy

The deterioration in economic sentiment since the beginning of spring continues to accelerate. "The worsening supply chain problems caused by the war in Ukraine, quarantine measures in parts of China and the sharp energy price increases have already begun to slow economic recovery in Austria. The UniCredit Bank Austria Business Indicator fell to minus 0.1 points in May, falling into negative territory for the first time in 15 months", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Economic sentiment has cooled in all sectors of the economy, but particularly in the industrial and construction sectors."

Following the very dynamic start to the year, the slowdown in the global industrial economy beginning in the autumn of the previous year has now hit domestic industry, after some delay. Although high order backlogs are allowing Austrian businesses to continue expanding production, momentum has already slowed with the decline in new business, particularly from abroad, the worsening supply problems and sharp rise in the cost of primary materials.

Declining order intake also augurs an imminent slowdown in business development in the construction industry. Given the high capacity utilisation and the high possibility of cost increases being pushed through to consumer prices, sentiment is still above average, though showing a strongly downward trend. "Benefiting from the easing of pandemic measures, sentiment in the services sector has so far declined only slightly. However, consumer confidence having now fallen sharply and weighed down by high inflation is expected to grow more slowly over the coming months, both in services as well as the industrial and construction sectors", says Bruckbauer.

Sharp fall in economic growth since start of year

The current UniCredit Bank Austria Business Indicator shows that the Austrian economy will not be able to sustain the high growth rate seen at the beginning of the year. "The continuing supply problems and the high cost dynamics are likely to even interrupt the strong upswing in the industrial and construction sectors in the coming months. It will therefore be up to the services sector to maintain Austrian economic growth", says UniCredit Bank Austria Economist Walter Pudschedl.

While the easing of pandemic measures and the use of assets saved during the lockdowns will give a lot of impetus to the trade and the hospitality industry, consumption will be increasingly burdened by the sharp rise in inflation. The level of support for the economy coming from the services sector will fall short of previous expectations. "After the sharp increase in GDP at the beginning of the year, the Austrian economy will struggle to escape stagnation over the rest of 2022 due to the consequences of the war in Ukraine. However, the particularly strong start to the year has led us to increase our growth forecast for the Austrian economy from 3.6% to 4.4% on average for 2022, despite the deterioration in the outlook for the future", says Pudschedl. For 2023, however, the economists at UniCredit Bank Austria have reduced their expected increase in GDP by more than one percentage point to 1.5%. The high price increases will continue to cause a noticeable slowdown in the economy over the coming year, as a result of both investment and consumption.

Labour market improvement coming to an end

The slowdown in the economy is making its first impact on the Austrian labour market. The improvement trend of recent months has now slowed considerably. Seasonally adjusted employment barely increased in May while the number of job seekers declined only very slightly. Having seen large declines over recent months, the seasonally adjusted unemployment rate of 6.2% remained unchanged between April and May. "In view of the very favourable development so far, we continue to expect the unemployment rate to decline to 6.3% on average in 2022 and 6.1% for 2023, despite the increasing burden on the labour market caused by the war in Ukraine", says Pudschedl. This means that the unemployment rate in Austria will reach its lowest level since 2008, before the start of the financial crisis.

Higher inflation, stronger ECB response?

Since the beginning of 2021, inflation in Austria has been on the rise due to rising energy prices and price pressure is expected to continue even longer, as the oil market remains undersupplied, meaning the oil price will remain high throughout the summer at up to USD 130 per barrel. Higher supply leading to lower oil price is not expected until the second half of the year, which is set to be reflected in a decline in inflation. "As a result of the delayed decline in the price of oil, inflation in Austria will only have fallen to around 6% year-on-year by the end of 2022. At a forecast 6.8%, inflation will therefore be around one percentage point higher on average for the year than we had previously expected", says Bruckbauer. The inflation forecast for 2023 has been raised to an average of 2.7%.

In view of higher inflation forecasts, including outside Austria, the ECB is likely to make greater interventions with interest rate hikes. After an initial rate hike of 25 basis points in July, the ECB’s baseline scenario is moving towards a larger hike of 50 basis points in September and a continuation of a gradual increase, possibly until interest rates reach an unspecified level that is acceptable in respect of monetary policy. "We expect a moderate tightening of European monetary policy, which puts key interest rates in the positive range. However, current money market expectations that interest rates will be raised by almost 250 basis points by the end of 2023 seem exaggerated", said Bruckbauer, adding: "As the economy slows down and the ECB counters inflation expectations with higher interest rates, we see a growing risk of an excessive tightening of monetary policy that could lead to a significant slowdown in economic activity."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at