UniCredit Bank Austria Business Indicator:

Economic slowdown spreading throughout Austria

- Services sector unable to maintain strong momentum in H2 2022

- Pace of labour market recovery set to slow despite record employment

- Inflation rates to remain well above 7%, with no relief expected until summer 2023

- Economic worries dampen, temporarily at least, the exaggerated interest rate speculations on the financial markets

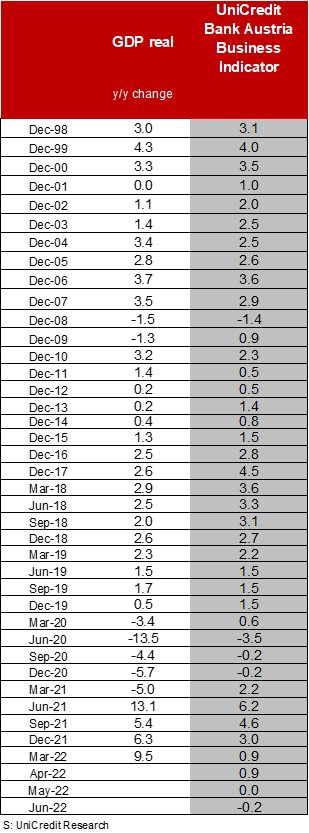

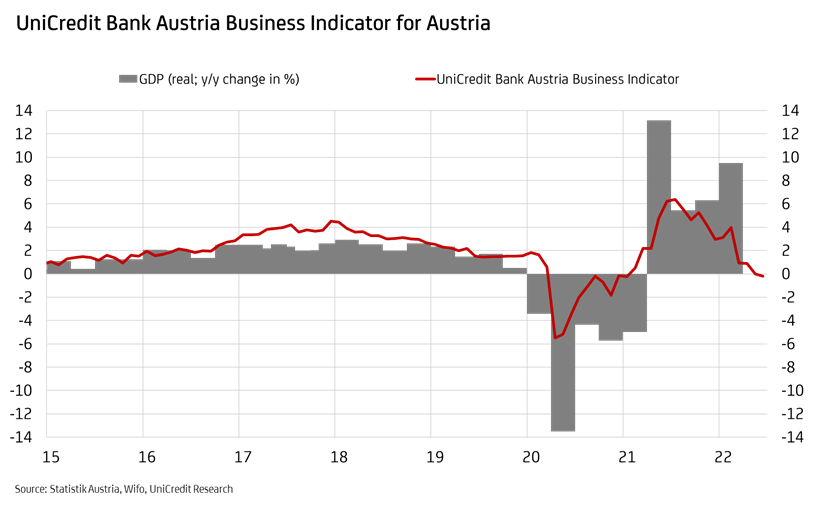

Economic mood in Austria deteriorated slightly once again in June. "At the start of summer, a further slight deterioration in the mood among industrial businesses in important sales markets and the clouding of sentiment in the Austrian services sector led to a further slight decline in the economic climate in Austria. The UniCredit Bank Austria Business Indicator fell to minus 0.2 points in June, the lowest level since January 2021", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The decline in our economic indicator in June was limited by the slight recovery in sentiment in the country's industrial sector following the slump in May, and the stable mood in the construction sector — albeit significantly reduced compared to the beginning of the year."

In virtually all areas of the Austrian economy, the economic climate at the beginning of the summer of 2022 is much weaker than at the start of the year or even a year ago. "The drop in consumer sentiment over the last six months was particularly strong, but demand from abroad, mood among industrial businesses and sentiment in the construction industry were also very gloomy in the summer", says Bruckbauer.

Sentiment has also clouded once again in the services sector, which, following the lockdown, had benefited from the sector beginning to open up again in the first few months of the year. Order intake also continued to fall in the construction industry and activity growth declined, but at the same time the mood in the construction sector remained above-average, not least because price increases were enforceable. However, uncertainty remains very high in the construction sector.

In the services sector, which benefited from the easing of pandemic measures, businesses have reported above-average momentum in recent months, but expectations for the next few months, although still positive, have now cooled significantly. "In the services sector, too, many businesses are still set to impose higher prices, but the reported uncertainty about the future reached a ten-year high", says Bruckbauer.

Sharp fall in economic growth since start of year

The current UniCredit Bank Austria Business Indicator signals a continued decline in the pace of growth for the Austrian economy compared to the beginning of the year. "Although the further economic recovery in the services sector in H2 2022 will partially offset the slowing dynamic of the industrial and construction sectors, it won't reach the extent expected at the beginning of the year", says UniCredit Bank Austria Economist Walter Pudschedl.

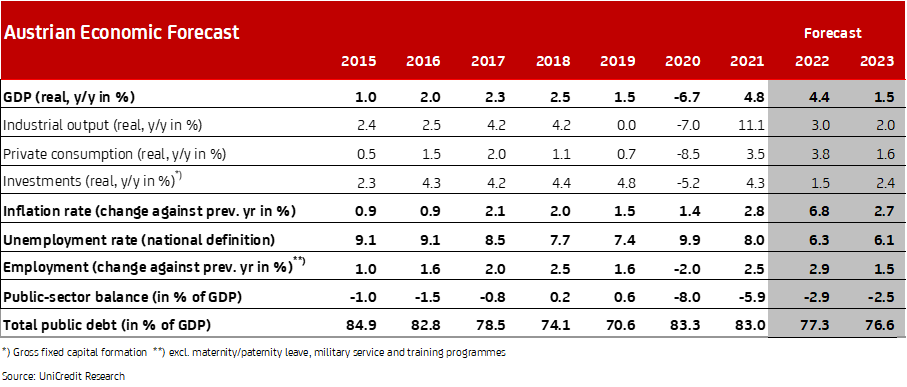

"The slight decline in the UniCredit Bank Austria Business Indicator in June confirms our expectation of a significantly weaker economy as we head into the second half of 2022 and probably also at the beginning of 2023. As a result of the strong start to the year, real economic growth is set to be 4.4% in 2022 and, due to the slowdown in 2023, a meagre 1.5%", says Pudschedl. The high price increases will continue to cause a noticeable slowdown in the economy over the coming year, as a result of both investment and consumption.

Continued improvement on the labour market, but at a reduced pace

The slowdown in the economy is also increasingly making its mark on the Austrian labour market. While the upwards trend of the past months continues, the momentum of the improvement is declining. In June, the unemployment rate reached 5.5%, its lowest level in June since 2008, before even the financial crisis, and with just under 4 million non-self-employed workers in June, this marked the highest level of employment in Austria's history. "With an expected average unemployment rate of 6.3% for 2022, the unemployment rate for this year is likely to be significantly below that of 2021. However, no further noticeable improvement is expected over the second half of this year, and certainly not in 2023", says Pudschedl. For 2023, the economists at UniCredit Bank Austria expect the unemployment rate to only decline slightly, from 6.3% to 6.1% on an annual average.

What is the ECB doing to combat higher inflation and a weaker economy?

In view of the tense and still very volatile price trends for energy, especially gas, the outlook is particularly challenging for the further development of the rate of inflation in Austria. "Taking into account the current market energy prices and businesses' price expectations, it is unlikely that inflation rates will decline in Austria until the autumn", says Bruckbauer, adding, "as things stand, inflation rates are not expected to return to the range of two percent until after the summer of next year." However, these expectations depend heavily on how energy prices continue to develop.

The war in Ukraine, in particular, is leading to energy resource prices constantly exceeding expected developments, which then leads to significantly higher inflation rates than forecast. "Inflation rates, which are significantly above expectations, together with the increased expectations for medium-term inflation, have led to a radical change in central bank policy, including in the eurozone", says Bruckbauer. While a "gradual" approach has been adopted until now, the ECB has impressed the market with much sharper tones over recent months regarding its planned rate hikes, which, throughout June, resulted in the sharpest rise in long-term real interest rates in the history of the eurozone.

"Increasing economic concerns have, at least for the time being, put an end to the sharp rise in real interest rates in the eurozone on the financial markets seen in June. In this environment, we expect the ECB to make interest rate hikes of 25 basis points in July and 50 basis points in September, followed by a further four increases of 25 basis points by March 2023", says Bruckbauer. "The financial market, which a week ago was expecting a money market rate of over 2% in the eurozone for the end of 2023, is now just above our own expectation of 1.4%", adds Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Stefan Bruckbauer, Tel.: +43 (0)5 05 05-41951;

Email: stefan.bruckbauer@unicreditgroup.at