UniCredit Bank Austria Purchasing Managers' Index in July:

Industrial production in Austria declines in July

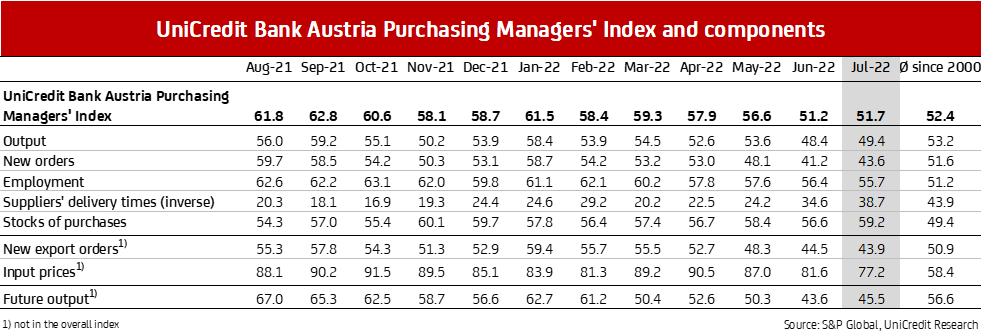

- UniCredit Bank Austria Purchasing Managers' Index in July up slightly on previous month at 51.7 points

- Businesses scale back production again due to sharp decline in new business

- Declining demand prompts further easing of supply bottlenecks and price hikes

- Staffing levels up again, but at slowest rate in 18 months

- Sustained medium-term economic pessimism in Austrian industrial sector increases likelihood of recession

The situation in the Austrian industrial sector remained challenging at the start of the third quarter. "Although the UniCredit Bank Austria Purchasing Managers' Index rose slightly in July to 51.7 points, it was once again well below the long-term average", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

While the overall indicator has further exceeded the neutrality threshold of 50 points, the individual elements suggest that the economic upturn experienced in the domestic industrial sector over approximately the last two years has already come to an end. "Production output among domestic businesses dropped off in July following a further deterioration of the order situation. Employment growth, which generally follows production growth with a delay, slowed. Weaker demand saw price hikes tail off slightly and supply issues also eased somewhat", says Bruckbauer, summarising the key findings from the monthly survey.

Production restrictions due to fewer incoming orders from Austria and abroad

Following a two-year expansion phase, the production output of Austrian industrial businesses fell at the start of the third quarter, for the second consecutive month. The decline was at least less pronounced than in the previous month, with the production index rising by one point to 49.4 points. The production of intermediate and consumer goods in particular was down on the previous month. "Supply chain problems, a lack of staff and high energy prices contributed to a reduction in production among domestic businesses. The key factor in July, though, was the negative trend for incoming orders, with a third consecutive monthly decline. While the decline in domestic orders slowed compared with the previous month, the deterioration of the international environment triggered the strongest decline in new export orders for two years", says UniCredit Bank Austria Economist Walter Pudschedl. In July, twice as many companies reported a decline in demand as an increase, with the intermediate goods sector particularly badly affected. This situation is reflected in the first decline in purchasing volume since the end of 2020. Furthermore, rising prices and liquidity concerns led to a reduction in the volumes purchased by businesses.

Decreasing demand eases supply issues...

The limited number of incoming orders meant that industrial businesses closed off more outstanding orders, resulting in orders on hand being reduced for the second consecutive month. This, combined with the decline in new business, brought about a slight improvement in the supply chain issues. The increase in suppliers´ delivery times was significantly slower in July than in the previous months. The corresponding index rose to a 20-month high of 38.7 points.

…and price hikes

While purchasing prices rose sharply once more in July, the decline in demand kept the pace of the increase significantly slower than in the previous month. The purchasing price index fell to 77.2 points, its lowest rate in 18 months. "While only around one in ten businesses benefited from reduced prices for intermediate goods, in July almost six in ten industrial businesses (consumer goods manufacturers chief among them) reported an increase in the purchasing prices for energy and other raw materials, particularly among consumer goods manufacturers. By contrast, only four in ten businesses increased their sales prices. Generally speaking, domestic industrial businesses have therefore not passed on the full impact of the cost increase to their customers, meaning that the earnings situation is likely to have deteriorated as a result of price trends", says Pudschedl.

Job creation losing pace

Despite the decline in demand and the reduction in production output, Austrian businesses continued to expand their personnel capacity at the start of the third quarter in order to cover the growth in demand experienced during the two-year recovery phase. The employment index stood at 55.7 points in July, its lowest level in 18 months, indicating a continued slowdown in job creation since the start of the year.

The reduced pace of employment growth has been triggered both by the economic slowdown and by a lack of supply on the labour market. "At the start of the third quarter, there were more than 15,000 vacancies in the domestic manufacturing sector. There were around 18,500 job seekers, meaning that there were on average 1.3 job seekers in Austria for every vacancy. The labour shortage was particularly problematic in Salzburg, Upper Austria and Tyrol, where the ratio of applicants to jobs is below 1. With an unemployment rate of 3%, the domestic industrial sector is currently experiencing virtually full employment", says Pudschedl.

Decline in production likely to continue

Despite the slight increase in the UniCredit Bank Austria Purchasing Managers' Index in July compared with the previous month, the latest survey at the start of the third quarter points to a sustained slowdown in the industrial economy. The further deterioration of the external environment is a contributory factor here. In July, the eurozone purchasing managers' index for the manufacturing industry and for its main markets Germany and France fell below the growth threshold of 50 points. This is reflected in the fall in incoming orders in Austria, especially from abroad, which triggered a decline in production. The index ratio between new orders and the stocks of finished goods indicates that the sales warehouses are sufficiently filled to be able to fulfil the reduced quantity of new business without increasing production. Production is therefore likely to drop off still further in the coming months.

"We must not let the slight increase in the latest UniCredit Bank Austria Purchasing Managers' Index to 51.7 points and the fact that the neutrality threshold of 50 points has been exceeded obscure the fact that domestic industrial businesses are facing a very challenging environment that is likely to cause a further slowdown in the economy in the coming months. The production expectations index rose slightly in July, but the low figure of 45.5 points shows that domestic companies are anticipating a sustained decline in production for the year as a whole", concludes Bruckbauer, adding: "The first signs of a recession for Austria's industrial businesses are now apparent."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at