UniCredit Bank Austria Purchasing Managers' Index in August:

Downturn in Austrian industrial sector gathers pace

- UniCredit Bank Austria Purchasing Managers' Index drops to lowest level in more than two years in August, at 48.8 points

- Sizeable decline in production following sharper slump in new business

- Pace of job creation slows significantly in August

- Weakening demand helps ease supply problems and lessen price hikes

- Economic outlook clouding rapidly: Number of industrial businesses anticipating production losses matches that during COVID-19 crisis of spring 2020

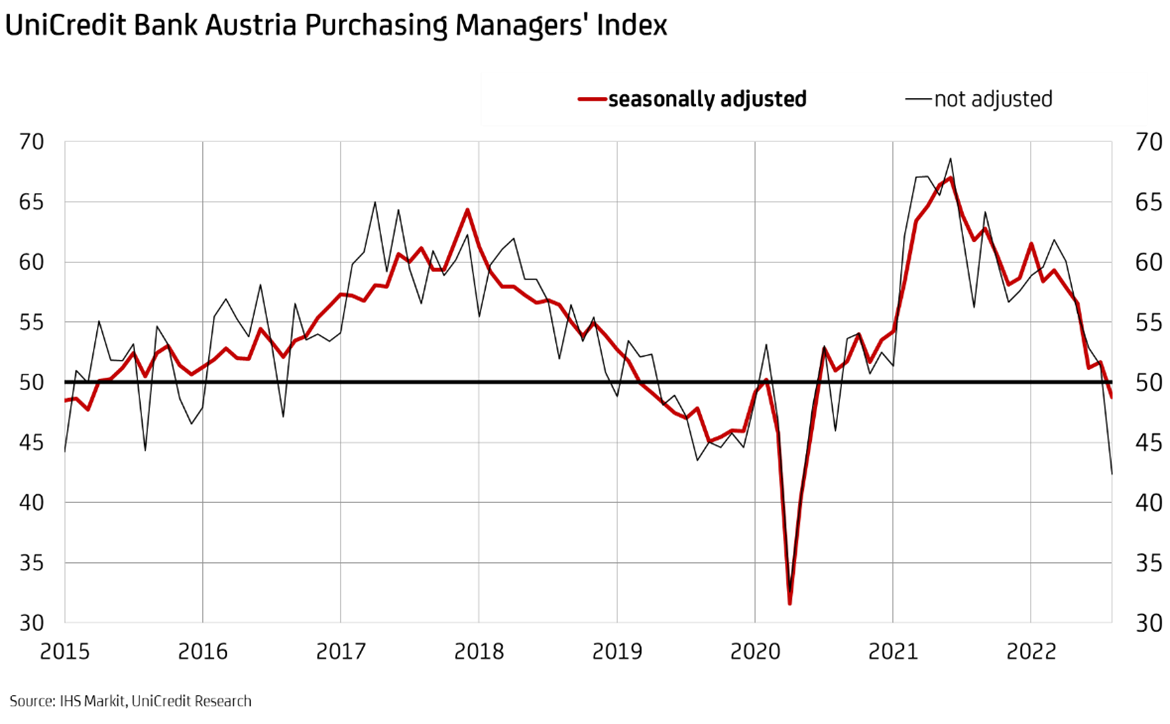

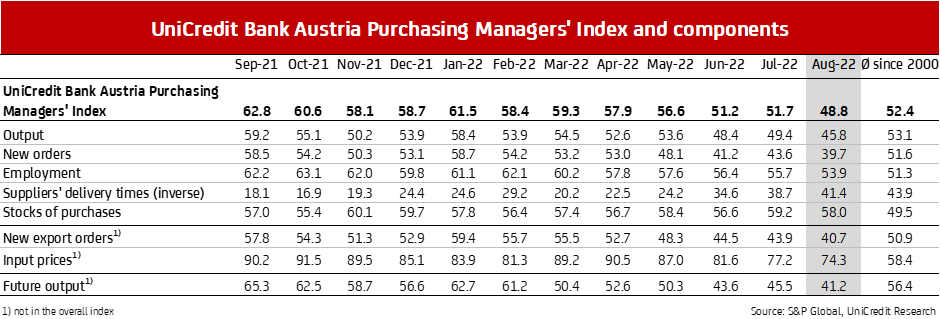

The slowdown in the industrial economy worsened once more at the midpoint of the third quarter. "The UniCredit Bank Austria Purchasing Managers' Index saw a month-on-month drop of almost three points in August, falling to 48.8 points. This took the indicator below the growth threshold of 50 points for the first time in 25 months", explains UniCredit Bank Austria Chief Economist Stefan Bruckbauer. Following a roughly two-year rebound period that began once the peak of the spring 2020 COVID-19 crisis had passed, the Austrian industrial sector has been on a pathway to recession since this summer. "Domestic businesses had far fewer new orders on their books in August than in the previous month, resulting in a significant drop in production. While employment is still increasing, the pace of job creation has slowed noticeably. One positive point to note is that the situation with both the supply chain issues and the price hikes has improved — though admittedly this is due largely to lower demand, which in turn is likely to lead to a decline in the industrial sector over the coming months", says Bruckbauer, summarising the key results from the August survey.

Production scaled back significantly in August

The month-on-month decline in the August UniCredit Bank Austria Purchasing Managers' Index was driven by the deterioration of all elements. The effects of the drop in production output and new business were felt particularly keenly. Domestic businesses scaled back production once more in August in the wake of a further significant slump in new orders. "This third consecutive drop in production was highly significant for the first time, with capacity utilisation having been kept on an even keel in the preceding months due backlogs of work. The production index fell to 45.8 points, its lowest level since May 2020", says UniCredit Bank Austria Economist Walter Pudschedl.

Against the backdrop of the decline in new business, the volume of orders on hand has recently dropped to a level last seen at the peak of the COVID-19 crisis. "As the decline in the new business index to 39.7 points shows, the fourth consecutive drop in new orders was more serious than the production losses. Furthermore, both domestic and international contract losses worsened in August compared to previous months", says Pudschedl.

Well-stocked warehouses drive further loss of momentum for orders

The current decline in new orders is due not only to increased uncertainty, higher prices and slightly worse financing conditions following the tightening of the ECB's monetary policy, but also to the fact that consumers in the industrial sector already have well-stocked warehouses. In August, stocks of purchases and finished goods increased rapidly, although the volumes of both purchases and unsold finished goods did grow more slowly than in the previous month. In the case of finished goods, this slowdown in stock accumulation was only minimal given that declining demand makes it increasingly difficult for businesses to send the goods to the market, particularly since many customers have cancelled their orders or delayed order acceptance.

Situation with price hikes continues to improve

The high energy prices combined with the increased costs for personnel and transportation prompted further sizeable price hikes in the domestic industrial sector in August. Although the spike in input prices remained disproportionately high, the extent of the increases actually decreased for the fourth consecutive month, matching the level last seen 19 months ago. As with input prices, the increase in output prices remained sizeable but did decrease for the fourth consecutive month.

"The extent of the increases in raw materials prices, transportation costs and output prices continues to vary across the domestic industrial sector. Not all businesses have actually been able to pass on the cost increase to their customers over the past two years. Earnings are therefore likely to have deteriorated on balance as a result of the price trends, though improvements have been noted recently", says Pudschedl.

In addition to the renewed slowdown in cost and output price hikes following the reduction in the price of certain raw materials, such as crude oil, the latest delivery time trends point to a further easing of supply chain problems. Supplier´s delivery times did increase again in August, but at the lowest level since October 2020. The (inverse) index rose to 41.4 points.

Fewer new jobs stop decline in unemployment rate in manufacturing

The slowdown in employment growth in the domestic industrial sector continued in August. The employment index fell for the sixth consecutive month, to 53.9 points. As a result of the fall in demand and the decline in production among businesses, the need for additional personnel to drive the two-year recovery phase has been significantly reduced.

The decline in employment growth has already had an impact on the unemployment rate, with the downwards trend tailing off since the start of summer. In the first half of 2022, the unemployment rate in the manufacturing sector fell to an average of 3.2%; the figure for the same period of the previous year was 4.5%.

"The seasonally adjusted unemployment rate in the domestic industrial sector for August remained unchanged from previous months at 3.1%. A sustained decline in employment growth and/or the stabilisation of workforce levels is almost inevitable over the coming months given the economic slowdown. As such, a slight increase in the unemployment rate cannot be ruled out", says Pudschedl, adding: "We expect an average unemployment rate of 3.2% in the industrial sector for 2022; this is only around half as much as the 6.3% expected for the economy as a whole." The average unemployment rate in the capital goods industry in Austria for 2021 was 4.0%, while the figure for the economy as a whole was 8.0%.

Cloudy outlook

Almost all elements of the monthly survey of domestic production businesses suggest that a sustained downturn in the industrial economy in Austria is likely over the coming months. Production has already been scaled back in response to weaker demand. The current purchasing managers' indices in the key export destinations point to the continued deterioration of export demand. While the preliminary purchasing managers' index for manufacturing in the eurozone fell only slightly to 49.7 points in August, it is below the growth threshold of 50 points by the same margin as the purchasing managers' index for Germany, Austria's key trading partner.

The sharp decline in new orders, which will weigh heavily on the Austrian supplier industry, is particularly striking. The deterioration of the export environment is already leaving its mark in Austria's industrial sector. The order-to-stock index ratio deteriorated in August for the fourth consecutive month, indicating that stocks of finished goods are sufficient to cover the current volume of new orders despite the reduced production output.

"The continuing supply bottlenecks, the high costs of primary materials and raw materials, rising financing costs, the considerable uncertainty surrounding energy supply and the decline of the global economy fuelled further pessimism among Austrian industrial businesses in August. Business prospects for the next 12 months were reported to be at their worst since the peak of the COVID-19 crisis in the spring of 2020. The expectations index fell to just 41.2 points", says Bruckbauer. Production declines are expected by the end of the year by almost twice the number of companies that expect to see increases over the same period.

"Following an increase of almost 8% in industrial production in the first half of 2022, we expect the industrial sector to enter recession over the coming months — though the strong start to the year means that industrial production is still likely to increase by around 3.5% on average for 2022", says Bruckbauer. Growth in manufacturing in 2021 stood at almost 12%.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at