UniCredit Bank Austria Business Indicator:

Austria's economy heading for mild recession

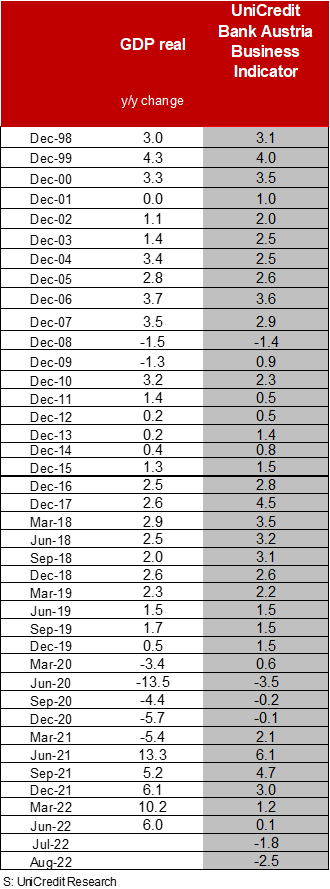

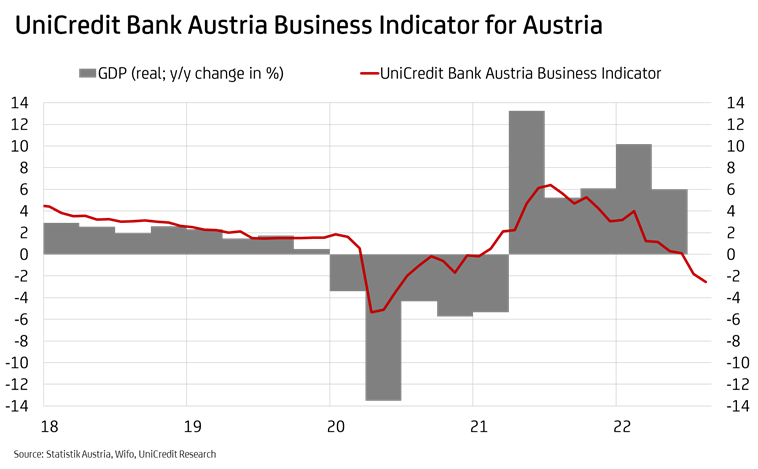

- UniCredit Bank Austria Business Indicator drops to minus 2.5 points, its lowest level since mid-2020

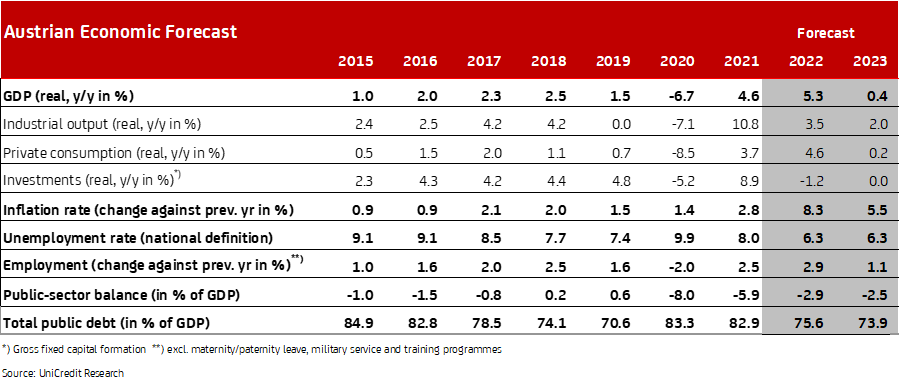

- Despite marked economic slowdown in the coming months, strong growth in H1 will lead to increase in GDP forecast for 2022 from 4.4 to 5.3 percent

- Burden of high energy prices set to trigger mild recession in Austria over winter months: growth forecast for 2023 down to 0.4 percent

- Improvement trend in labour market come to an end: unemployment rate of 6.3 percent expected for 2022 and 2023

- Inflation forecast increased to average of 8.3 percent in 2022 and 5.5 percent in 2023

- More rapid ECB rate hikes set to bring refinancing rate up to 2.5 percent and deposit rate up to 2.0 percent by March 2023

The cooling of the economic climate in Austria continued into the beginning of Autumn. While the supply chain issues are only easing slowly, the impact of high energy prices as a result of the war in Ukraine is placing an increasingly heavy burden on the Austrian economy. "The UniCredit Bank Austria Business Indicator fell to minus 2.5 points in September, remaining in negative territory for the second month in a row. This renewed fall lowers the indicator to its lowest level since spring 2020, when the Austrian economy slid into recession as a result of the outbreak of the COVID-19 pandemic", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "In the meantime, the slowdown of the economy is making itself felt in all economic sectors. Following the decline in sentiment in construction and domestic industrial sectors since the start of the war in Ukraine, the end of the summer saw optimism in the service sector significantly dampened for the first time."

Services sector joins downturn in production sectors

The decline in the UniCredit Bank Austria Business Indicator in August was primarily driven by the deterioration in sentiment in the services sector. Business in most service sectors has gone very well in recent months. Demand benefited from catch-up effects after the pandemic measures were lifted completely, as well as from the high liquidity of customers following limited consumption during the pandemic.

“Concerns about the sharp rise in inflation and the increasing transfer of the rise in costs to sales prices are now hindering demand in service sectors too. In August, this situation pushed business sentiment below the long-term average for the first time since the lockdown at the start of winter last year. The rising cost of living will further dampen consumer demand in Austria over the coming months", says Bruckbauer. Consumer sentiment, which foreshadows this development with its sharp slump over recent months, has improved somewhat recently, but is only very slightly above the summer's all-time low.

With the order situation remaining strong and supply problems easing, the decline in sentiment in the construction sector in August was initially still relatively small, but the economic climate in the domestic industrial sector was significantly clouded. The deterioration of the export environment is reflected in a decline in new business. In addition, there has only been a slight easing of delivery delays, while the costs of primary materials and, above all, energy, such as gas and electricity, have again risen sharply and are now jeopardising the profitability of production.

Recession expected over winter

After a strong start to the year and the slowdown in growth in the spring, the current negative values of the UniCredit Bank Austria Business Indicator signal that a moderate downwards trend in economic development is likely to occur in the coming months. The strong growth seen in H1 has already largely come to a standstill over the summer as the industrial and construction sectors were no longer able to grow. The services sector did hold up, supported by tourism, but Q3 is unlikely to have seen any more than stagnation. With the services sector no longer acting as a growth driver, the Austrian economy is likely to slide into a recession toward the end of 2022, although this is likely to be mild.

"After the latest data show that economic growth reached 8 percent year-on-year in H1, we have increased our growth forecast for the year as a whole. Despite the less favourable outlook for the coming months, we expect GDP to rise by 5.3 percent in 2022, instead of our previous figure of 4.4 percent", says UniCredit Bank Austria Economist Walter Pudschedl. As a result, following the sharp slump at the beginning of the pandemic, by the end of 2022, Austrian economic output will already be over 3 percent above the pre-crisis level.

The Austrian economy will have a very difficult start to 2023. High energy prices, which will increasingly be reflected in general consumer prices, will mean many households face real income losses, despite government compensation measures. Consumer demand is expected to decline in the first few months of 2023. Corporate investment will also dampen economic growth given the high cost increases as well as the current uncertainties and lack of prospects.

“After the mild recession over the winter, we expect demand to recover slowly and the Austrian economy to return to a path of moderate growth with inflation beginning to ease as 2023 progresses. For 2023 as a whole, we have reduced our GDP forecast from 1.5 to just 0.4 percent", says Pudschedl. The forecast is based on the assumption that there will be no production losses due to a lack of energy supply, but that price trends may lead to production restrictions for profitability reasons at individual companies.

Economic slowdown reflected in the labour market

The improvement trend in the labour market has slowed considerably since the beginning of the year and has been interrupted since the middle of the year. This is due to the tapering off of catch-up effects after the pandemic and the beginning of the economic slowdown due to the burdens caused by ongoing supply disruptions and the war in Ukraine. Since June, the seasonally adjusted unemployment rate has been rising month-on-month for the first time since it peaked during the first Coronavirus lockdown in April 2020 and stood at 6.4 percent in August.

As a result of the worsening economic slowdown, we expect the unemployment rate in Austria to rise in the coming months. This should be manageable, however, as employment is unlikely to be reduced in many sectors given the existing labour shortages. The average unemployment rate is expected to drop to 6.3 percent for 2022, the lowest level since 2007.

Despite the slowdown in growth momentum in the coming year, employment is expected to continue to increase, thus largely offsetting the slight increase in labour supply. "As a result of the deterioration in the economic situation, which in our view will lead to a slight recession at the beginning of the year, we have slightly increased our forecast and now only expect the unemployment rate to stabilise at an average of 6.3 percent in 2023", says Pudschedl.

Upwards trend in inflation set to continue into winter

The high uncertainty surrounding security of supply continues to provide a tailwind for energy prices, especially for gas and electricity prices, and will lead to a continuation of Austria's upward trend in inflation. In addition, higher energy costs are being increasingly reflected in higher sales prices in many industries.

"After an average inflation rate of 7.5 percent in the first eight months and even over 9 percent in July and August, even double-digit inflation figures in Austria can no longer be ruled out in the coming months. We now anticipate average inflation of 8.3 percent for 2022", says Pudschedl. We should not see the rise in inflation slow down until the winter months.

Due to automatic index adjustments, inflation will only slowly fall in 2023, despite the likely dampening effect of the prices of (energy) raw materials. Nevertheless, inflation is likely to return to around 3 percent year-on-year in the last third of 2023, dampened by the noticeable slowdown in the economy. The UniCredit Bank Austria economists have increased the inflation forecast for 2023 to an average of 5.5 percent. Given the volatile influences and the possible government price regulations, however, the inflation forecast is characterised by high uncertainty.

ECB tightening the reins

The European Central Bank is responding to the rise in inflation by accelerating the tightening of monetary policy. In order to ensure that inflation does not become entrenched in expectations and wage agreements, interest rates are raised more sharply, even at the cost of impairing economic momentum with adverse effects on the labour market. After raising the key interest rates by 50 basis points in July, another rate hike of as much as 75 basis points followed in September. "In view of our higher inflation expectations, we now expect the deposit rate to reach its peak of 2 percent in Q1 2023 and the refinancing rate to reach 2.5 percent, instead of our previous figures of 1.25 and 1.75 percent, respectively. We expect two further hikes of 50 basis points by the end of 2022 and only in Q1 2023 do we expect the rate of interest rate hikes to slow to 25 basis points", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Phone: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at