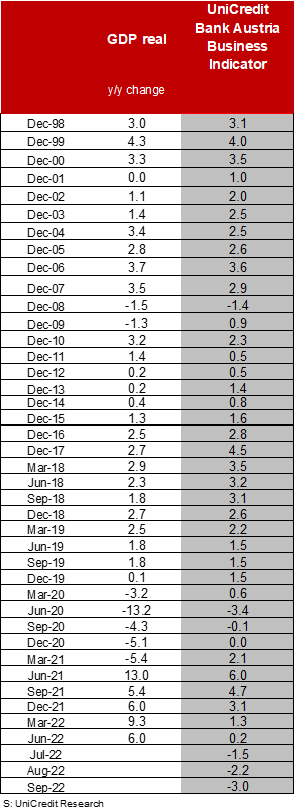

UniCredit Bank Austria Business Indicator:

Swift end to Austria's economic recovery

- UniCredit Bank Austria Business Indicator falls to minus 3.0 points in September, its third consecutive month in negative territory.

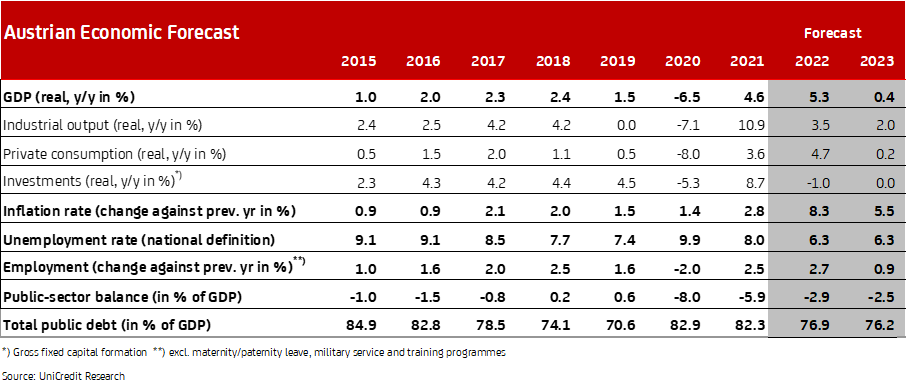

- Following strongest economic growth in 40 years of 5.3% in 2022, Austrian economy set to stagnate in 2023 with only slight GDP increase of 0.4%

- Easing inflation and decreasing supply disruptions expected to lead to moderate recovery in second half of 2023 following mild winter recession

- Inflation falling only slowly: expected to be high again in 2023 at an average of 5.5% following 8.3% annual average for 2022

- Labour market defies economic slowdown with unemployment expected to stabilise at an average 6.3% in 2023

- The ECB to follow up swiftly and even more decisively with refinancing and deposit rates peaking at 2.75% and 2.25% respectively from spring 2023

Following the gradual economic slowdown over recent months, the economic recovery of the past two years is now coming to an abrupt end. "The UniCredit Bank Austria Business Indicator fell to minus 3.0 points in September. The initial declines following high levels in mid-2021 were then followed by a significant slump with the start of the war in Ukraine in February 2022. With the intensifying energy crisis, the Indicator is now in negative territory for the third consecutive month, signalling a disruption in economic growth in Austria", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. In the third quarter of 2022, the UniCredit Bank Austria Business Indicator reached an average value of minus 2.3 points.

"Following the strong growth rates in the first half of the year, the UniCredit Bank Austria Business Indicator is forecasting a significant economic downturn for the third quarter just ended. We expect the Austrian economy to have stagnated over the past three months and see our assessment of an impending mild recession confirmed by current developments. This means that economic development in Austria is expected to decline at least slightly over the winter", says Bruckbauer.

Sentiment deteriorating in all sectors of the economy

All components of the UniCredit Bank Austria Business Indicator are pointing to an accelerated economic slowdown in September. "While supply chain problems are only slowly easing, the high energy prices resulting from the war in Ukraine are putting an ever-greater strain on Austrian businesses and consumers at the beginning of the autumn. The economy in the production sectors has been showing clear signs of fatigue since the spring. The mood in the service sectors, which had benefited greatly from catch-up effects over the summer, is now also noticeably waning", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "The sharp deterioration in sentiment in the services sector is currently the main driver of the decline of the UniCredit Bank Austria Business Indicator to its lowest level in more than two years. This is clearly reflected in the concerns about the sharp rise in costs and the dampening of consumer demand by higher living costs."

Highest GDP growth in 40 years and cautious optimism after mild winter recession

The third quarter of 2022 was already characterised by initial recessionary trends in the Austrian industrial and construction sectors. Growth in services, especially in tourism, was expected to compensate somewhat for this decline. Following the stagnation in the overall economy over recent months, the major challenges posed by the energy crisis are weighing even more heavily on the outlook for the future.

"We expect the Austrian economy to have already slipped into a recession at the beginning of autumn that will last through the winter. Despite the unfavourable outlook, Austria will be able to achieve high economic growth of around 5% in 2022 as a whole due to a very strong first half of the year. This will exceed the strong growth from 2021—the first year of recovery following the pandemic—and will probably even be the highest GDP increase in more than 40 years", says Pudschedl.

The Austrian economy is going into 2023 under very difficult conditions, which make it likely that the recession will continue into the spring. High energy prices, which are increasingly reflected in general consumer prices and which are triggering second-round effects, are leading to real income losses for many households despite government support measures. A decline in consumer demand is therefore expected in the first months of 2023.

The willingness of consumers to invest will also be very subdued at the start of 2023 due to the high degree of uncertainty about the future economic outlook. In industry especially, investment demand is being dampened by the weakening of the international economy and the cancellation or postponement of export orders, especially as the particularly high energy costs in Europe are affecting global competitiveness.

"The slow easing in price dynamics should lead to the beginnings of a recovery in consumption and investment demand after the winter, ending the recession in Austria. We are optimistic that the second half of the year will see a return to growth, however muted. After a poor start, however, GDP increase of 0.4% means Austrian economy will effectively stagnate in 2023 as a whole", says Pudschedl.

Labour market feeling economic slowdown but holding up well

The situation on the Austrian labour market has improved significantly in the wake of the strong economic recovery in the first half of the year. Following an average of 8% in 2021, the seasonally adjusted unemployment rate had fallen to 6.2% by the middle of the year. The slowdown in the economy has led to the start of a turnaround, with the unemployment rate already at 6.4% in September. "We expect the Austrian labour market to be able to withstand the economic slowdown throughout the mild winter recession. Following the decline in average unemployment rate in 2022 to 6.3%, we expect it to stabilise at this level in 2023, as the tight supply on the labour market should support restrained adjustment of personnel capacities to production", says Pudschedl.

Upwards trend in inflation for now, but noticeable easing expected from spring onwards

Energy prices, especially gas and electricity, continue to drive the rise in inflation. Stronger second-round effects on consumer prices are expected over the coming months, which could keep inflation in double digits through the winter. "We now anticipate average inflation of 8.3% for 2022. Inflation will slow after the winter, but will still remain high, at an average of at least 5.5% in 2023. A noticeable easing can be expected only in the final third of the year due to a dampening effect of the prices of (energy) raw materials, decreasing supply disruptions and lower demand", says Bruckbauer.

Is the ECB overreacting?

At around 3% year-on-year, inflation in Austria at the end of 2023 will remain well above the European Central Bank's target. Concerned that high inflation may become entrenched, the ECB has become active in raising interest rates in recent months. The strong labour markets have also provided the necessary scope to aggressively tighten monetary policy into restrictive measures.

"We expect the tightening of monetary policy to peak in the first quarter of 2023 and the ECB to end its rate hikes at 2.75% and 2.25% for refinancing and deposit rates respectively", says Bruckbauer, adding: "With longer-term inflation expectations remaining within reasonable limits, we believe the ECB is taking its monetary tightening too far. As the ECB appears to give priority to inflation control over economic growth, the downside economic risks are exacerbated even further."

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at