UniCredit Bank Austria Business Indicator:

Austrian economy on brink of recession

- UniCredit Bank Austria Business Indicator falls only slightly in October to minus 3.0 points

- Downturn losing pace: Gradual stabilisation of economic sentiment points to mild and short-lived recession during winter months

- Recovery expected from spring onwards but high inflation and weak global environment set to limit pace of recovery

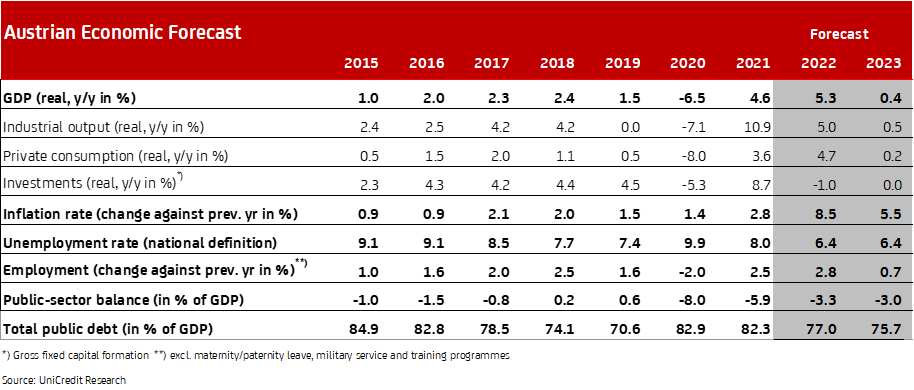

- Economy expected to stagnate in 2023 following GDP increase of 5% in 2022

- Second-round effects and wage dynamics slowing inflation reductions: Inflation set to remain in double digits until spring 2023

- Unemployment expected to increase only slightly over winter months. Unemployment rate likely to average 6.4% in 2022 and 2023

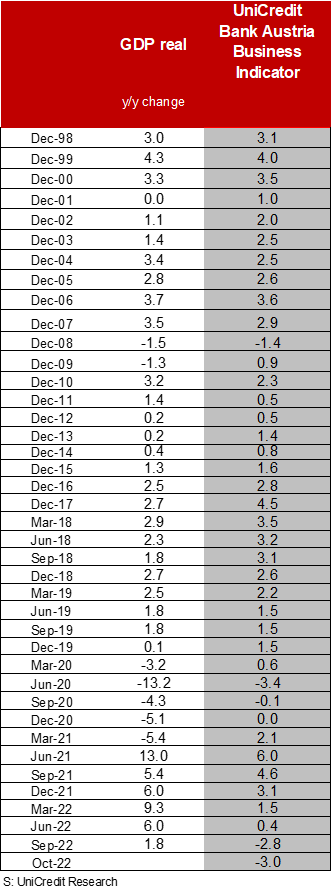

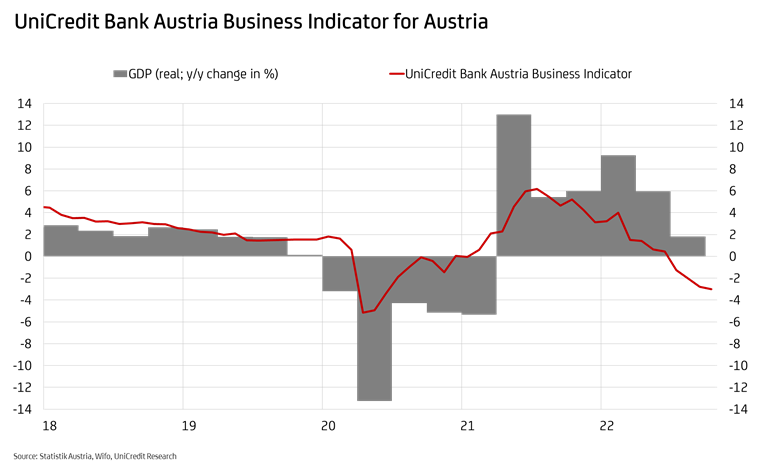

Economic sentiment deteriorated further in Austria at the start of the final quarter of 2022. "The UniCredit Bank Austria Business Indicator fell to minus 3.0 points in October, putting it in the negative range for the fourth consecutive month. Following the disruption of the economic recovery in the third quarter, the new downturn confirms the assumption that the Austrian economy is now right on the brink of recession", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. The economic climate even slowed still further in October. "We continue to expect the Austrian economy to fall into recession. The gradual stabilisation of economic sentiment appears to be confirming our prediction that the recession will be mild and relatively short-lived. The only impact we now expect to see is a slight decline in economic output in Austria over the winter months", says Bruckbauer.

Global slowdown weighing on sentiment in industrial sector

The development of the UniCredit Bank Austria Business Indicator components suggests widely diverging trends in the various economic sectors. While optimism has actually increased somewhat in the construction sector and the economic slowdown has abated in the services sector thanks to a slightly improved consumer mood, the October result reflects the sustained collapse of sentiment in the industrial sector.

"The sharp deterioration in expectations in the export-focused industrial sector is currently the main driver behind this repeated decline in the UniCredit Bank Austria Business Indicator, which is now at its lowest level in more than two years", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "The international export environment deteriorated significantly in October, dampening the mood in domestic production, as did declining incoming orders, only slow improvements with supply bottlenecks, the shortage of skilled workers, and strong wage demands, coupled with the growing concerns about high energy costs, which are affecting the ability to remain competitive internationally."

Stagnation for 2023 as a whole

Following the abrupt downturn in the economy after the summer period, the major challenges created by the energy crisis will start to have even more of an effect over the coming months. "A decline in GDP by the end of the year is becoming more and more likely. Although the Austrian economy is likely to have already entered recession by then as a result, strong economic growth of around 5% will still be achieved for 2022 as a whole, which is significantly higher than in the eurozone. Economic output will therefore sit around three percentage points higher than the pre-pandemic level", says Pudschedl. The economists at UniCredit Bank Austria expect GDP for the eurozone to rise by around 3% in 2022, putting economic output around 1.5 percentage points above the pre-crisis level.

The framework conditions for the start of 2023 are extremely challenging and make it likely that recession will continue into the first few months of the year. In particular, the unfavourable outlook for the industrial sector as a result of high energy costs will slow the development of the Austrian economy, all the more so given that investor restraint will be considerable against the backdrop of a difficult international environment. It should be possible to contain the loss of purchasing power for domestic consumers through the government support package to offset the effects of inflation, such as value adjustments to social benefits and tax changes such as the abolition of cold progression. Some parts of the services sector could produce a particularly positive surprise as a result. The decline in consumer demand is therefore expected to weigh less heavily on the Austrian economy in the first few months of 2023 than the slump in investment — significantly mitigating the extent of the recession as a result.

"We are optimistic that the recession in Austria will be mild and relatively short-lived. As inflation slowly begins to decline, demand for both consumption and investment will start to recover as we emerge from winter, though the pace of recovery is likely to be very modest given the ongoing headwind from the war in Ukraine. After a poor start to the year and with a GDP increase of 0.4%, the Austrian economy will effectively do little more than stagnate across 2023 as a whole", says Pudschedl.

Inflation expected to remain in double digits for another few months

The easing of prices for energy raw materials is not yet being reflected in the inflation trend in Austria but will provide the framework for inflation to slow after winter, thus supporting economic recovery. The rise in inflation is still directly influenced largely by the development of energy prices, in particular gas and electricity. The extent to which the higher energy costs are impacting food prices is increasing however, as are the second-round effects, and this is continuing to drive up inflation. Sustained strong demand in many sectors, such as accommodation and hospitality, is also driving up inflation — which in turn is being fuelled somewhat by government compensation benefits targeted primarily at lower-income households with a high propensity to consume.

Inflation in Austria will remain in the double-digit range until spring 2023 and is expected to fall only slowly thereafter. Relatively high wage agreements signal increasingly strongly that at least a minor wage-price spiral has been set in motion in Austria, and this will keep inflation high throughout 2023. "Having sat at around 8.5% on average in 2022, inflation will remain high in 2023. The situation is not expected to ease to any noticeable degree until the final third of the year, when the prices of (energy) raw materials, decreasing supply disruptions and lower demand will have a dampening effect. That said, inflation is still expected to rise by up to 4% year on year by the end of 2023", says Bruckbauer.

Economic slowdown hits labour market

With the economic recovery coming to an abrupt end, the situation on the labour market has started to deteriorate somewhat. Having dipped to a low of 6.2% over the summer, the seasonally adjusted unemployment rate has now risen 6.4%. However, any further increase during the winter recession is likely to be manageable given that there is still a high number of vacancies in many sectors. "We expect the Austrian labour market to hold up well against the economic slowdown over the winter period. Given that the labour supply is tight and there is a high number of vacancies, the unemployment rate is set to decline again throughout 2023 following a slight increase during the winter recession — despite the pace of recovery being only moderate. We expect average unemployment of 6.4% in 2023, which is unchanged from 2022", says Pudschedl.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at