UniCredit Bank Austria industry overview

Predominantly gloomy industry climate in October 2022 signals further economic slowdown

- In the industrial sector, the shortage of materials has become less acute in the fourth quarter; at the same time, labour shortages and demand issues have become more pronounced

- With the exception of the electronics and mechanical engineering industries, production expectations in October became more pessimistic in all major industrial sectors

- The construction industry continues to operate at a high level and the rise in construction costs has slowed somewhat

- 2022 has been a difficult financial year for the automotive trade and many retail sectors

- Bleak industry climate in most service sectors

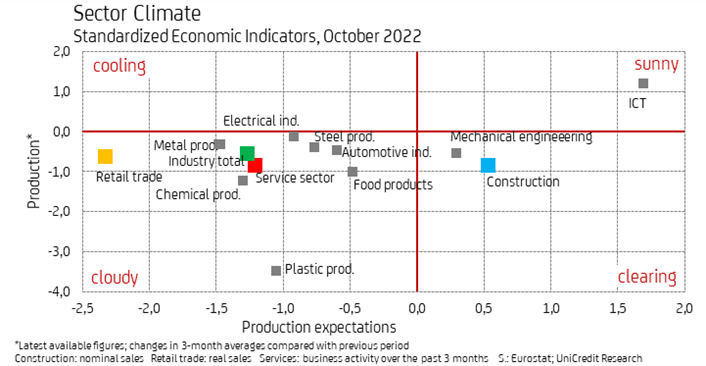

Austria’s economy lost significant growth momentum in the third quarter of 2022 compared to the first half of the year. The latest industry climate indicators from October show that further growth losses can be expected through to the end of the year. On sector average, production and business expectations for the next few months have slipped into negative territory in the industrial sector as well as in trade and services, and the industry climate has deteriorated across the sectors.

(To determine the industry climate indicator, the development of production and sales up to September 2022 is compared with the economic survey results from October 2022.)

UniCredit Bank Austria’s latest industry overview in October shows that the majority of production and business expectations for the coming months remained optimistic only in the construction industry, the electronics and mechanical engineering industries and in some service segments in the liberal professions sector. “Overall, the latest economic survey results suggest that economic output in Austria will decline slightly in the final months of 2022. However, as the industry and construction sectors are still reporting above-average capacity utilisation and a predominantly positive assessment of their order situation, the downturn should not be severe and should only be short-lived,” says UniCredit Bank Austria economist Günter Wolf.

Industrial activity slipping into negative territory

In the industrial sector, the shortage of materials has become less acute: Some 28 percent of companies are expecting significant production constraints in the fourth quarter of 2022 due to bottlenecks and problems procuring primary products and raw materials, compared to 41 percent in the second quarter. At the same time, however, labour shortages and demand issues have become more pronounced. Major problems with the procurement of primary materials continue to burden the automotive industry, where 65 percent of the companies have cited the lack of materials as the main obstacle to production in the fourth quarter, while in the electronics industry the figure is 60 percent and in mechanical engineering 48 percent. While the majority of automotive manufacturers have been negative about the industry’s economic situation since September, companies in the electronics and mechanical engineering industries reported well-filled order books as late as October. In addition, capacity utilisation in both sectors is well above pre-crisis levels at around 90 per cent in each case and production expectations for the coming months remain in the growth range. In all other major industrial sectors, production expectations became more pessimistic overall in October, signalling a further slowdown in industrial activity.

The slowdown in (European) investment activity as a result of economic uncertainties and high energy prices will definitely continue to slow demand for new machinery in the remainder of 2022. However, Austria’s machinery manufacturers will be able to compensate for at least part of the expected decline in European demand in markets outside Europe, including China and the USA, where slightly higher economic growth rates or lower growth losses are likely in 2022 and 2023 compared to the EU.

In the electrical industry, the electronics segment recorded strong production growth of 28 percent up to September 2022. The increase shows the high demand for information and communication technology, which will benefit the segment for years to come. The segment will continue to grow in the coming months, as shown by the positive assessments of orders and the predominantly optimistic production expectations for the coming months presented in October.

At 4.5 percent in the year to September, production output in the electrical engineering sector rose much more slowly than in the electronics sector. In this case, the shortage of materials is likely to have slowed down production, which also explains the continued good assessment of the order situation and the negative production expectations of the electrical engineering manufacturers in the majority of cases. Stronger growth in demand is not expected in the electrical engineering sector until 2023. The segment will benefit from the public investment programmes launched in Austria and at EU level as part of the Recovery and Resilience Facility, which are primarily related to the accelerated expansion of alternative energy supply options.

Construction industry continues to operate at a high level

In 2022, construction output has grown by an average of 14.7 percent up to September, faster than in the last two decades. Since the third quarter, construction activity has cooled somewhat and capacity utilisation in the sector has fallen slightly, although utilisation in the fourth quarter is still above the ten-year average. In October, positive and negative order assessments in building construction and civil engineering balanced each other out and, on balance, remained clearly positive in other construction activities. As the economic survey results show, demand for residential and commercial construction has been growing at a slower pace than demand for modernisation and extension work for several months now. New building permits for residential construction have been in decline for two years now, down from a very high level.

“In 2022, the construction industry has lost momentum compared to the previous year, but will end the year with a strong nominal increase. The construction industry can also expect to see stronger growth drivers beyond 2022 in the area of building renovations and presumably in civil engineering,” says Wolf. Both sectors benefit from subsidies for climate protection measures.

With the slight slowdown in construction activity since the middle of the year, the rise in construction costs has also slowed somewhat, most recently reaching 7.4 percent in September. As a further consequence, the increase in construction prices in residential construction, which track costs with a slight delay, is also likely to have lost momentum. One indicator of this is the sharp decline in the number of companies in the building construction sector expecting price increases in the short term since the second quarter.

2022 has been a difficult financial year for the automotive trade and many retail sectors

In 2022, sales in the automotive trade (including workshops) have fallen by 4.4 percent in nominal terms and 9.4 percent in real terms up to August. Although first-time car registrations have been on the rise again since August after more than a year of significant declines, the commercial expectations of automotive dealers remained negative on balance as late as October, signalling further declines in sales. The background to this is the unchanged sharp decline in demand for used cars (registrations of used cars fell by an average of 14.7 percent up to September 2022). The car trade, like many other retail sectors, is suffering from dwindling consumer confidence. Since July, the confidence index has been at its lowest level ever, averaging -32 points.

Retail sales (excluding petrol stations) have been losing momentum since May 2022, falling by an average of 4 percent in real terms in the year to August, particularly in non-food categories. At the same time, sales in the food trade have increased considerably in nominal terms due to the high price increases and have remained roughly the same in price-adjusted terms. As retailers’ increasingly negative commercial expectations as of June suggested, the retail sector has experienced an even greater slowdown. High inflation, real wage losses and increased uncertainty are dampening consumers’ propensity to buy. Only in 2023 can we expect a stronger net wage increase due to the income tax reform and lower inflation rates, which should ultimately benefit the retail sector.

Bleak industry climate in most service sectors

In the transport sector, the commercial expectations of all key segments slipped into negative territory in October. Freight forwarders were particularly pessimistic. In land transport, too, economic uncertainties are dampening companies’ demand expectations and slowing down the sector’s economic activity in the second half of 2022, as the slight decline in haulage vehicle mileage in Austria since June already suggested.

After significant growth in the first half of 2022, the willingness of domestic and foreign guests to travel is suffering to an increasing extent from the economic uncertainties and high (fuel) prices. On balance, the demand expectations of companies in both sectors have slipped back into negative territory since August. The accommodation and catering sector is not expected to compensate for the pandemic-related revenue losses until 2023.

Finally, business-related services have not been spared from the economic turmoil. In October, demand expectations improved only for the liberal professions. In all other sectors, a slowdown in revenue growth is to be expected at the very least, and in advertising, revenue losses can still be expected in 2022.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Günter Wolf, Tel.: +43 (0)5 05 05-41954;

Email: guenter.wolf@unicreditgroup.at