UniCredit Bank Austria Business Indicator:

Austrian economy defies the economic odds

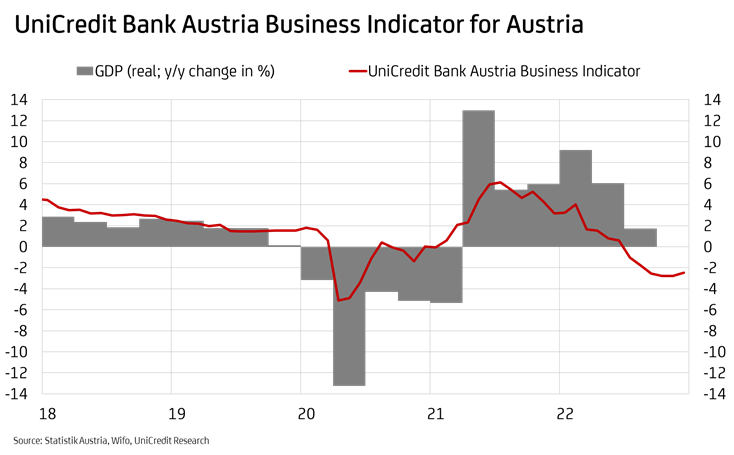

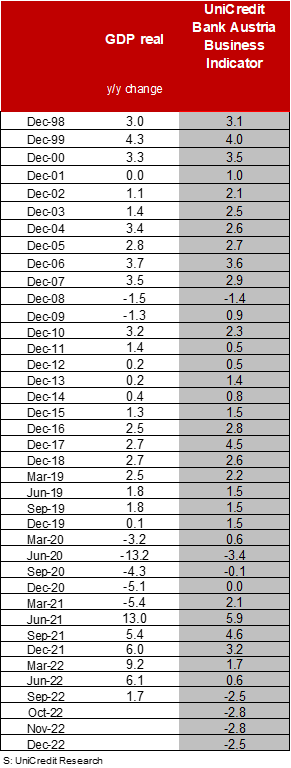

- UniCredit Bank Austria Business Indicator increased to minus 2.5 points in December

- Mood in services sector improved at end of 2022; downturn in industrial sector continued

- Risk of recession has receded, but difficult global environment and new financing conditions mean recovery will only be moderate and from spring onwards

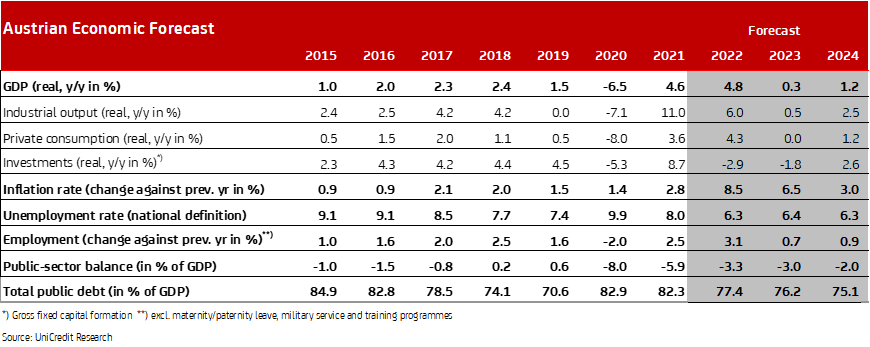

- Stagnation expected in 2023; hard-won recovery expected in 2024 with economic growth of 1.2%

- Labour market continues to buck trend of economic slowdown: Unemployment rate expected to rise only slightly in 2023 to 6.4% before falling to 6.3% in 2024

- Energy price fall dampening inflation but rates set to fall only slowly in 2023/24 due to second-round effects and wage dynamics

- Further tightening of monetary policy expected until mid-2023; trend set to change throughout 2024

"The economic mood in Austria remains tense, but the situation started to improve around the end of 2022", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The UniCredit Bank Austria Business Indicator rose to minus 2.5 points in December, reflecting in particular the noticeably improved sentiment in the services sector."

With an average figure of minus 2.7 points for the final quarter of 2022, the indicator did point to economic slowdown as the year drew to a close, but the slump that had been considered likely failed to materialise. "So far this winter, the Austrian economy has proven itself highly resilient in the face of the twin burdens of a global economic slowdown and the consequences of high inflation. Government support packages and the surprisingly sharp drop in energy prices have improved the situation slightly. Although we anticipate a slight decline in economic development as winter progresses, the probability of recession in Austria is now noticeably lower", says Bruckbauer.

Sentiment in services sector on the up

The increase in the UniCredit Bank Austria Business Indicator at the end of 2022, along with the decreased likelihood of recession in the Austrian economy that this signalled, is due primarily to the improved economic mood in the services sector. Christmas trading was largely satisfactory in the retail sector and bookings are strong in the tourism sector, leading to a slight improvement in the rather pessimistic expectations.

"The mood in the services sector improved slightly in step with consumer sentiment at the end of the year. Business expectations also improved in the construction sector. Only in the domestic industrial sector did the mood deteriorate once more. While the eurozone and Eastern Europe were largely showing signs of improvement, developments in China in particular dampened the economic expectations of the domestic industrial sector", says UniCredit Bank Austria Economist Walter Pudschedl. Following sharp declines in the number of incoming orders and concerns about cost trends and competitiveness, the mood in Austria's industrial sector now falls squarely into pessimism.

Pace of recovery remains slow following poor start to year

With inflation slowing, the Austrian economy is likely to start its recovery in the spring. The pace of recovery will be determined largely by the strength of domestic demand. The various government support initiatives, such as abolishing cold progression, introducing an electricity price cap and providing an energy cost subsidy, will relieve the pressure on households and businesses and encourage private consumption and investment.

"Despite the fiscal support packages, we believe that the pace of recovery from spring onwards will be slow given the tense economic environment, as financing conditions will create a burden", says Pudschedl, adding: "We expect the Austrian economy to grow by 1.2% in 2024 following a stagnant 2023."

This forecast means that momentum in the Austrian economy is at least set to outperform that in the eurozone, for which the economists at UniCredit Bank Austria are anticipating a GDP increase of 1.0% in 2024.

Despite the economic slowdown, the situation on the labour market remains largely stable. "Despite the weak economic development, we expect the unemployment rate to rise only slightly to 6.4% this year. In our view, the limited supply of labour means that a noticeable deterioration is unlikely. As such, in 2024 the unemployment rate is expected to improve slightly once again to 6.3% despite the slow pace of recovery", says Pudschedl.

Inflation peak appears to have been passed but figures set to fall only slowly throughout 2023/24

While double-digit values are still to be expected at the start of the year, inflation should slow throughout the rest of the year as energy prices ease. However, relatively high wage agreements, fiscal initiatives to prop up purchasing power, and the second-round effects of increased energy costs mean that inflation is expected to reduce only slowly. The trend is only likely to gather momentum in the second half of the year.

"We expect average inflation for 2023 to drop to 6.5%, compared with 8.6% in the previous year. Only towards the end of 2024 is the inflation rate in Austria likely to drop into the ECB's target range of 2%, and the average for the year will remain well above that at around 3%", says Pudschedl.

Further interest rate hikes in pipeline but trend reversal expected in 2024

Given that the recent slowdown in inflation was due exclusively to energy price developments, while core inflation continues to rise in Austria and throughout the eurozone, the European Central Bank is expected to continue tightening the reins on monetary policy in 2023.

"We now expect key interest rates to rise further than envisaged in previous forecasts. The refinancing rate is now expected to peak at 4% in mid-2023 and the deposit rate at 3.50%", says Bruckbauer, adding: "With further interest rate hikes expected by summer, the key interest rates in Austria are set to have risen more rapidly in the course of one year than at any point since 1945."

"However, a shift in European monetary policy is emerging for 2024, with the ECB changing course to an easing of its policy following the successful reduction of inflation. We expect key interest rates to fall by 75 basis points in the second half of 2024", says Bruckbauer.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at