UniCredit Bank Austria Purchasing Managers' Index in January:

Start of new year sees optimism return to Austrian industrial sector

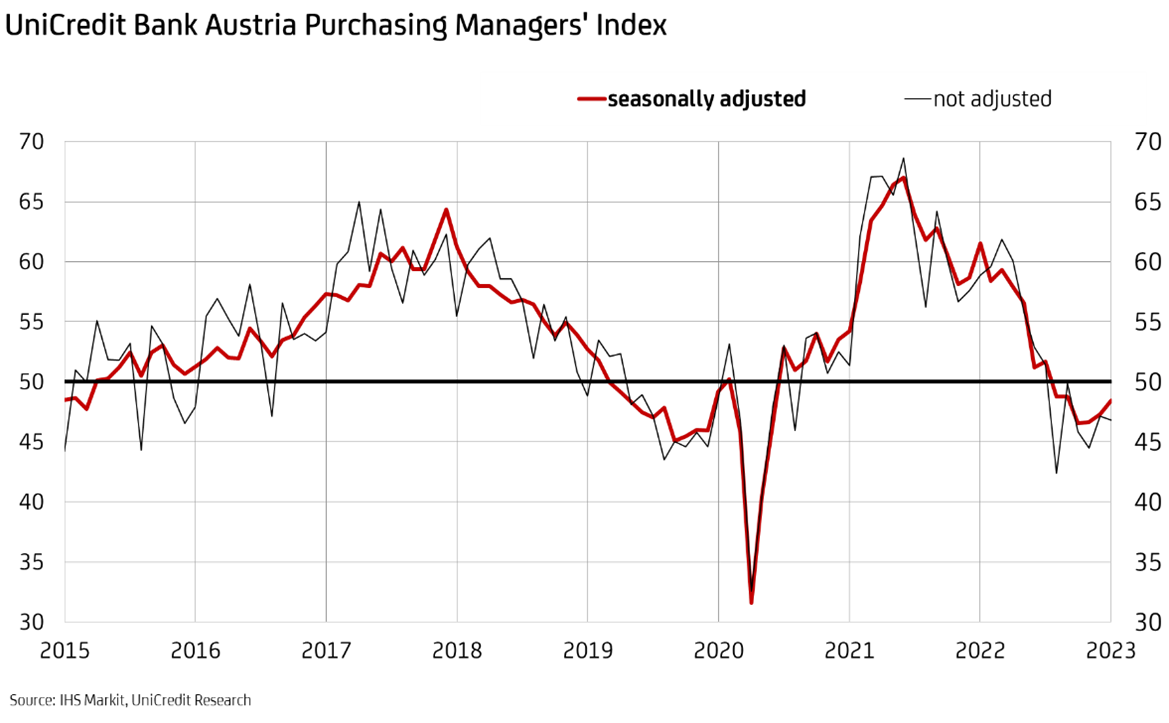

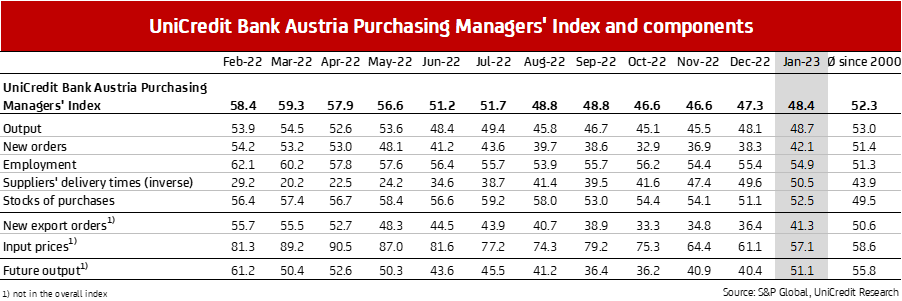

- UniCredit Bank Austria Purchasing Managers' Index rises for third consecutive month in January, to 48.4 points, but remains below growth threshold as in previous six months

- Rate of decline in output and new business continues to improve

- Drop in demand putting brakes on price dynamics in input prices but output prices rising more sharply

- Delivery times in Austrian industrial sector decrease for first time in three years

- Employment growth continues unabated at expense of productivity

- Production expectations for the year now positive for first time in eight months

"The outlook for the Austrian industrial sector improved again at the start of 2023, although we should still expect a weak industrial economy for the immediate months ahead", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "That said, production expectations for the next 12 months rose surprisingly sharply in January. The easing of supply chains and falling commodity prices have brought optimism back to domestic industrial businesses. For the first time in eight months, the majority of those surveyed expect production to increase over the year." The expectation index rose to 51.1 points, which is still significantly below the long-term average.

Production expectations are not the only aspect to have improved — the decline in the Austrian industrial sector slowed down palpably at the start of the year. "Following the first slight uptrend in the previous month, the UniCredit Bank Austria Purchasing Managers' Index rose significantly in January to 48.4 points. This signals a reversal of the trend in the industrial economy after the significant slump in the second half of 2022", says Bruckbauer. However, the increase in the indicator still was not sufficient to exceed the growth threshold of 50 points. This is now the sixth month in a row that the UniCredit Bank Austria Purchasing Managers' Index has been below the point threshold that indicates growth in the industrial sector.

The January survey increasingly points to the challenges in the industrial sector starting to abate. "At the start of the year, domestic industrial businesses were once again confronted with a strong but easing slump in new business. In addition, production output is beginning to stabilise. Supply chain problems have receded significantly and price dynamics in purchasing have once again declined sharply. Furthermore, employment in the domestic industrial sector continued to rise", says Bruckbauer, summarising the key results of the survey.

Demand falling significantly more slowly

Since the beginning of the second half of 2022, domestic industrial businesses have been reducing their output month on month. The pace has now slowed for the third consecutive month, as demonstrated by a further slight rise in the output index in January. At 48.7 points, the output index has now been above the index for new business for nine consecutive months. By reducing the number of orders on hand, domestic industrial businesses have been able to limit the reduction in output in recent months, although new orders have fallen almost as sharply as they did during the first COVID-19 lockdown.

"Although consumer reluctance owing to economic uncertainty and tightened financing conditions caused the fall in demand to continue at the start of the year, the drop in new orders decreased significantly compared to the previous month, with the index rising to 42.1 points. The index of new export orders also showed a renewed upwards trend in January, climbing to 41.3 points — the highest it has been in six months", says UniCredit Bank Austria Economist Walter Pudschedl.

Easing of supply bottlenecks

The supplier delivery time index has now increased to 50.5 points, a development that indicates significant easing of the supply chain problems experienced in recent months. "For the first time in almost three years, delivery times in the Austrian industrial sector have more than simply improved — they have actually got shorter", says Pudschedl, adding: "The lower demand for primary materials, combined with better material availability and less pressure on transport capacity, have made it easier to fulfil deliveries on time."

Increased pricing power boosts profit

The easing of the supply chain coincided with a significant slowdown in cost increases for domestic industrial businesses. The input price index fell to 57.1 points, placing it slightly below the long-term average and signalling the lowest increase since November 2020. "While the increase input prices slowed significantly at the start of the year—prompted by lower energy costs and price reductions for various metals, particularly steel—the increase in output prices accelerated", says Pudschedl, adding: "On average, January saw the dynamics of output prices exceed those of cost increases, meaning that earnings may have generally improved as a result of these price trends."

More jobs in industrial sector once again

Employment in the domestic industrial sector continued to rise in spite of falling demand, albeit at a slightly slower pace than in the previous month. The employment index fell to 54.9 points in January. Employment growth in the domestic industrial sector has been higher than the long-term average for 24 months in a row now, firstly due to companies catching up on filling vacancies—which did not happen fast enough in the recovery phase after the pandemic peaked—and secondly because capacity is about to be expanded. At around 640,000, the number of people working in the manufacturing sector reached a record high at the start of 2023. Around 17% of workers in Austria are employed in manufacturing.

"The fact that employment is continuing to increase in the domestic industrial sector while production output is simultaneously decreasing is having a negative impact on productivity development in the sector. Productivity has fallen on average for around 18 months now, although this decline has generally been less marked in the last three months", says Pudschedl.

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at