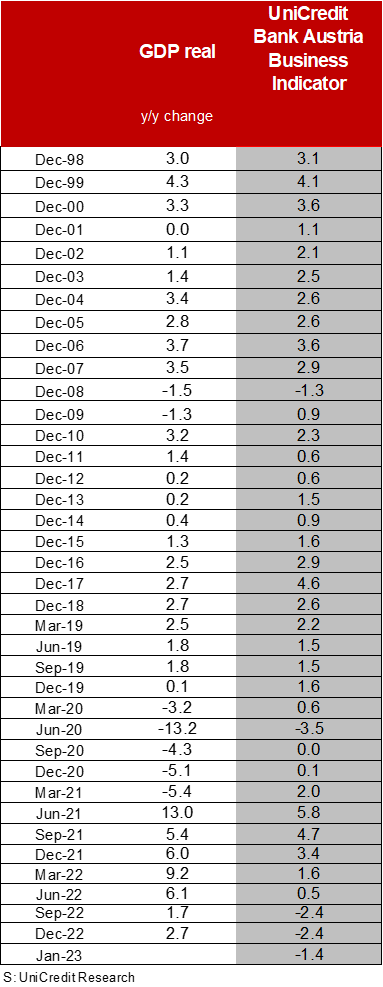

UniCredit Bank Austria Business Indicator:

Economic sentiment is noticeably improving

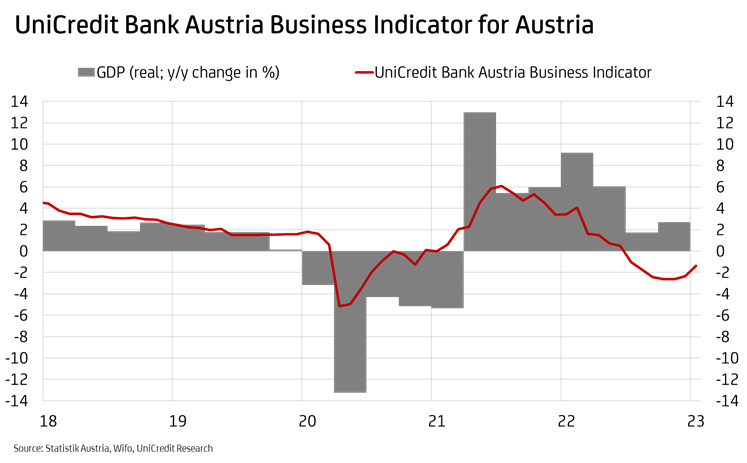

- The UniCredit Bank Austria Business Indicator rose to minus 1.4 points in January

- Sentiment improved in all sectors of the economy, except construction

- Mild recession around the turn of the year in Austria: After a negative final quarter of 2022, GDP is expected to decline only slightly at the beginning of 2023

- Moderate recovery from spring, but only stagnation expected in 2023 as a whole and low economic growth of 1.2 percent in 2024

- Inflation peaked, but inflation will decline only slowly

- Tightening of monetary policy by raising interest rates until mid-2023 and starting of quantitative tightening from March

"The poor sentiment seems to have been overcome by the end of the year. Economic sentiment in Austria has noticeably improved with the start of the new year," says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The UniCredit Bank Austria Business Indicator has risen by a whole point compared to the end of the year. However, despite the strongest monthly improvement in one and a half years, the figure of minus 1.4 points is still clearly below the long-term average and indicates that the economic development in Austria is currently at least still slightly declining."

Service providers feel a little tailwind

The significant improvement in the UniCredit Bank Austria Business Indicator is due to positive development on a broad scale. "At the beginning of the year, the mood in all areas of the Austrian economy brightened, except for construction. Business expectations rose significantly, particularly in the services sector, supported by the tailwind of improved consumer sentiment," says Bruckbauer. Sentiment in the services sector improved for the third month in a row and almost reached the long-term average at the start of the year.

A good start to the winter season and satisfactory bookings have given the tourism industry a boost, and business in the retail sector is also performing better than many business owners had feared in view of the challenging conditions. While the currently declining order trend in the construction industry, especially in residential construction, is negatively affecting the mood, the economic forecast for the domestic industrial sector has not worsened further for the first time in six months.

Despite the first improvement in the export environment since the outbreak of the war in Ukraine, however, the industrial sentiment in Austria remains clearly pessimistic. The decline in new business and worries about competitiveness in the export business in view of cost developments are clouding the picture.

Inflation slowdown supports recovery from spring

After the decline in GDP in the fourth quarter of 2022, the current mood indicates that the economy is still declining at present. If the trend from the beginning of the year continues, the Austrian economy will decline significantly less in the first quarter of 2023 than at the end of the year, and the expected recession over the winter months will be very mild. With the slowdown in inflation in the coming months, the burden on consumption and investment will gradually decrease and the Austrian economy will be able to recover.

The high nominal wage increases will be increasingly reflected in real income growth over the course of the year. This recovery is also supported by further fiscal measures to compensate households and businesses for inflation, such as the electricity price brake and the energy cost subsidy. In addition, fiscal measures such as the partial abolition of cold progression will support purchasing power.

"After a weak start to 2023, the outlook for a recovery from spring is very good, but the pace of growth is expected to remain low. The slow decline in inflation and the changed financing conditions following the tightening of monetary policy by the ECB will weigh on the pace of recovery. For 2023 as a whole, we therefore expect the Austrian economy to remain stagnating, with GDP rising by 0.3 percent," says UniCredit Bank Austria Economist Walter Pudschedl.

Pace to pick up slightly in 2024

"The Austrian economy should continue to recover in 2024, and at a slightly higher pace than in 2023," says Pudschedl, adding: "We are currently assuming economic growth of 1.2 percent, but we see the probability of a more favourable development increasing." The global economy is likely to provide only a little more tailwind for the Austrian economy in 2024 as the geopolitical pressures are expected to remain unchanged. However, supply chain problems should continue to ease, or have even been largely resolved.

Financing conditions will remain challenging in the coming year, which will limit investment dynamics. The development of private consumption will be key for the pace of recovery in 2024. While fiscal policy measures should be on a smaller scale than in previous years, the second consecutive year of significant real wage growth will give more impetus to consumption.

Slow decline in inflation

The cautious pace of recovery in the Austrian economy in 2023/24 is primarily due to the current slow decline in inflation in Austria. After the significant increase in inflation at the beginning of the year, the peak is likely to have been reached, but the sharp decline in energy costs is not yet reflected in the development of consumer prices. Inflation will decline slowly over the coming months.

Relatively high wage agreements and fiscal policies are supporting household purchasing power. The high utilisation in many industries still favours passing on the cost increases to sales prices. In addition, strong second-round effects are to be expected, including through automatic indexation, for example in rents.

"We expect inflation to fall to 6.5 percent on average in 2023. For 2024, inflation is expected to fall to an average of 3 percent, with inflation just above the 'normal level' of 2 percent towards the end of the year," says Pudschedl.

Reversal in monetary policy in the second half of 2024

In view of the ongoing rise in core inflation in Europe, the ECB will follow the recent rate hike in early February with further steps. "After a 50-basis-point hike in key interest rates in March, we expect two more hikes of 25 basis points each. By mid-2023, the peak is likely to be reached with a refinancing rate of 4 percent and a deposit rate of 3.5 percent," says Bruckbauer, adding: "The trend in monetary policy is expected to change in 2024. The ECB will begin to gradually reduce key interest rates to neutral levels and will start to reduce them by an estimated 75 basis points in the second half of 2024."

In view of the monetary easing in sight, long-term market rates in Europe will trend downwards in the medium term. However, the high supply of bonds and the beginning of the ECB's quantitative tightening by reducing its portfolio of securities pose a challenge in this regard. "We expect that the ECB's balance sheet reduction of 15 billion euro per month from March and a possible acceleration from mid-year will have little impact on the development of European bond yields. In order to avoid greater volatility, the ECB will implement the reduction of its securities portfolio very carefully and will adapt it to the respective data situation," concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at