UniCredit Bank Austria Purchasing Managers' Index in February:

Continued weak demand weighing on manufacturing in Austria

- UniCredit Bank Austria Purchasing Managers' Index falls to 47.1 points in February, putting it further below the growth threshold than at the start of the year

- Decline in new orders causing further drop in output compared to previous month

- Easing of supply chain problems and dwindling demand leading to shorter delivery times and sharp slowdown in cost increases

- Employment growth in domestic industry continuing in February, but at a much slower pace

- Production expectations for the next 12 months fall back into negative territory

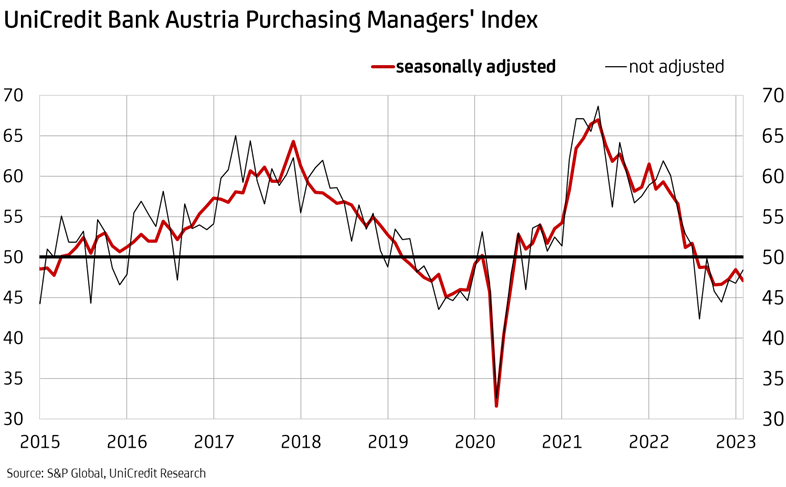

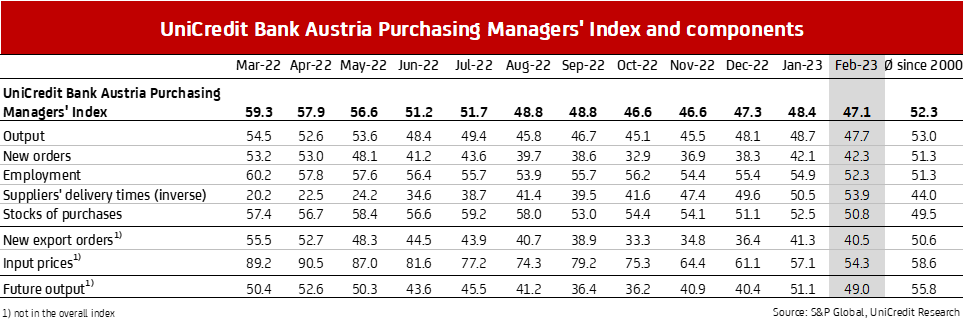

Difficult conditions and weak global demand are continuing to pose major challenges for Austrian industrial companies. "Following a gradual improvement over the past three months, the UniCredit Bank Austria Purchasing Managers' Index fell to 47.1 points in February. The indicator is therefore signalling a renewed and even more significant weakening of manufacturing than at the beginning of the year", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Development in Austria was in line with most European countries. In the eurozone, the preliminary Purchasing Managers' Index fell to 48.5 points, brought down in particular by declines in Germany and France."

Persistently weak demand is behind the decline in the UniCredit Bank Austria Purchasing Managers' Index in February. "Domestic companies significantly reduced their output in February compared to the previous month as new orders declined sharply, and at an even higher rate from abroad. This decline in demand helped to ease supply chains, however, significantly shortening delivery times and putting the brakes on input price pressures. There was a significantly decline in employment growth, though", says Bruckbauer, summarising the key findings from the survey.

Strong decrease of new export orders

February saw domestic businesses reduce their production output for the ninth time in a row, and at a much higher rate than in the previous month. The slight improvement trend observed since autumn has therefore not continued, as significant progress has now been made with processing orders on hand and, most importantly, fewer new orders are being received. "Demand for products "Made in Austria" fell sharply again in February. While the losses in domestic business decreased slightly, the decline in export demand accelerated. However, the total drop in new orders in Austrian industry fell for the fourth month in a row, reaching the lowest level since July 2022", says UniCredit Bank Austria Economist Walter Pudschedl.

Continued easing in supply chains

Supply problems continued to ease in February. "The drop in output due to a decline in new business has reduced the need for primary materials. This has led to greater availability of materials, supported by a decrease in pressure on transport capacity. As a result, the delivery times of suppliers in Austria shortened significantly in February. With an increase to 53.9 points, the index points to the shortest delivery times in Austrian industry since the end of 2019", says Pudschedl.

Further slowdown in cost increases

Thanks to the significant decline in supply pressure, input prices in Austrian industry rose at the lowest rate in over two years. While the prices of many raw materials, such as energy in particular, even fell, factors such as higher wages increased the costs of businesses.

"Input and output prices rose at a much lower rate in February than in the previous month. On average, however, the dynamics of output prices clearly exceeded those of cost increases", says Pudschedl, adding: "This means that, on the one hand, companies' earnings are likely to have improved as a result of the price trends. On the other hand, the evidently strong price enforcement power wielded by businesses is likely to exert even more significant upward pressure on consumer price inflation in the coming months, which could slow the expected decline in inflation", says Pudschedl.

Industrial slowdown gradually reflected in the labour market

In February, Austrian companies in the manufacturing sector increased their employment rate to a new record high of 645,000 people (seasonally adjusted). However, the decline in the employment index to 52.3 points shows that the pace of job creation has slowed noticeably and is now at its lowest rate in two years.

The adjustment of production capacity to weak demand is now having an impact on the labour market, especially since the pent-up demand for labour arising from the recovery phase following the height of the pandemic has now largely been met. Although the number of registered vacancies in the sector remains high at 13,000, this figure is now clearly declining.

"The improvement trend observed in the industry unemployment rate in 2022 has come to a halt. Nevertheless, at 3%, the seasonally adjusted unemployment rate in industry in February was still less than half of that for the economy as a whole. Although the labour market in the industrial sector is likely to feel the economic challenges more strongly than other sectors in the coming months, there will still be a shortage of qualified workers here too", says Pudschedl, adding: "The number of job seekers per vacancy in Austrian industry is only 1.5 on average. The situation is particularly precarious in Salzburg and Upper Austria, with fewer job seekers than registered vacancies."

Industry expectations fall again

Following the noticeable improvement at the beginning of the year, the continuing weak demand, especially from abroad, led once again to a decline in the UniCredit Bank Austria Purchasing Managers' Index in February. The partial indicator for production output has also fallen and, at 47.7 points, signals a decline in output compared to the previous month.

"The ratio of new orders to stocks of finished goods indicates that production is continuing to fall. In view of the adequate stock levels in sales warehouses, the low volume of new orders can be handled even if production capacities are lower in the coming months", says Bruckbauer, concluding: "Domestic companies are also again assessing the medium-term outlook less favourably than in the previous month. The expectation index for production over the next 12 months has dropped to 49.0 points, indicating the possibility of further downward development in domestic industry unless there is a significant revival in demand."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at