UniCredit Bank Austria Business Indicator:

Incremental economic recovery

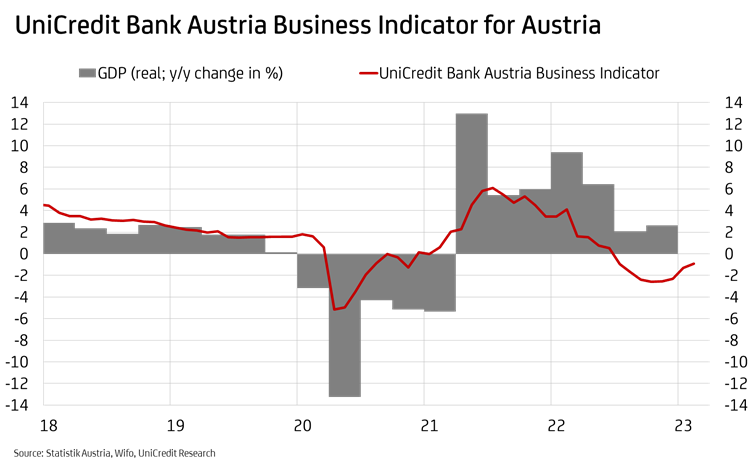

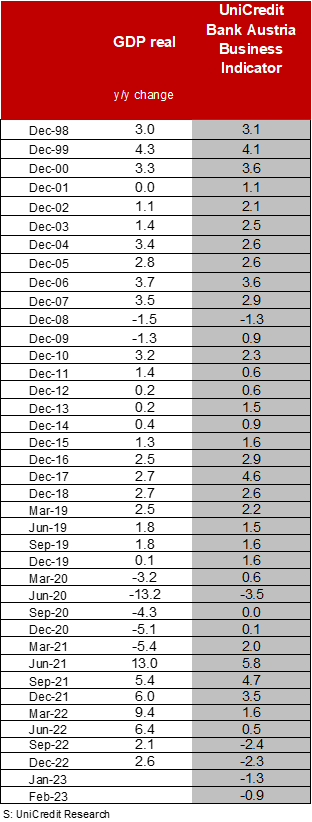

- UniCredit Bank Austria's business indicator rose further to minus 0.9 points in February

- The pace of economic improvement in Austria slowed down, and sentiment in the construction sector even slumped further

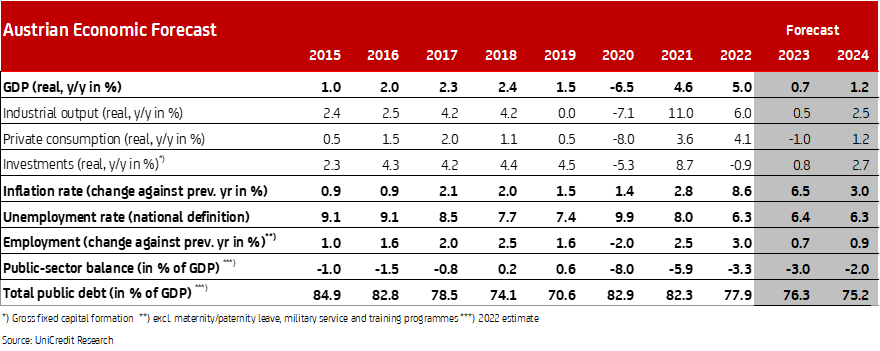

- Slight increase in the growth forecast for 2023 from 0.3% to 0.7% following only mild recession over winter months. GDP growth of 1.2% still expected for 2024

- Economic downturn now affecting labour market but only slight increase in unemployment rate to 6.4% expected for 2023 and drop back to 6.3% forecast for 2024

- Inflation peaked at start of 2023 but will fall only slowly due to high wage dynamics, strong fiscal measures and robust demand in some areas

- Further tightening of monetary policy: Deposit and refinancing rates set to peak at 4% and 4.5% respectively in mid-2023

The Austrian economy is slowly but steadily recovering from its low in sentiment. "Following the strong improvement at the start of the year, the UniCredit Bank Austria Business Indicator rose only slightly in February. The brightening of the economy is losing pace. With a value of minus 0.9 points, the indicator is well below its long-term average and continues to signal at least a slight decline in Austria's economic development", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

"The headwind for the Austrian economy eased only slightly in February. However, while the industrial and services sectors are a little more optimistic heading into spring, the construction economy has weakened once again. The deterioration in the order situation is placing a burden on business expectations, in structural engineering in particular", says Bruckbauer.

Construction industry weighing on economic sentiment in Austria

The slight rise in the UniCredit Bank Austria Business Indicator in February was driven primarily by the improved sentiment in the services sector. Business expectations increased for the fourth consecutive month, even exceeding the long-term average for the first time since last summer. The tailwind came from the slightly improved consumer sentiment, which has nevertheless been characterised by considerable pessimism since the outbreak of the war in Ukraine.

The renewed improvement in sentiment in the domestic industrial sector also contributed to the rise in the UniCredit Bank Austria Business Indicator, especially once the global export environment began to ease. Improvements with the supply chain problems, falling commodity prices and the opening up of the Chinese economy after the new pandemic outbreak in winter caused a turnaround in global industrial sentiment, an indicator weighted with the Austrian share of trade.

By contrast, the slump in sentiment intensified in a construction sector that is accustomed to success. The price-related reduction in the affordability of residential property, combined with new lending regulations and rising interest rates, have led to significantly fewer orders in structural engineering in particular and dampened the outlook in February.

Better than expected through the winter

After the minimal decline in GDP towards the end of 2022, the mood for the first quarter of 2023 is again signalling a slight decline in Austria's economic development. "The performance of the Austrian economy over the winter months has been somewhat more favourable than we originally expected. We have therefore been able to revise our growth forecast for 2023 upwards slightly, from 0.3% to 0.7%. As the positive trend that is emerging looks set to continue, thanks to gradually declining inflation and the resulting easing of the burdens on domestic demand, we will start to see a recovery of the Austrian economy in the spring", says UniCredit Bank Austria Economist Walter Pudschedl.

Persistent inflation slowing pace of recovery

The pace of recovery will be burdened by persistent inflation in the coming months. In addition, the changed financing conditions following the tightening of monetary policy by the ECB will decelerate the pace of recovery. Financing conditions will remain predominantly challenging in the coming year, hampering corporate investment activities. By contrast, private consumption could provide more support thanks to noticeable real wage growth. "The recovery of the Austrian economy is set to continue into 2024. Economic growth of 1.2% is still expected. In fact, the probability of more favourable development is increasing, supported by better prospects for more tailwind from the global economy due to continued easing or even resolution of supply chain problems. However, the ongoing geopolitical pressures present a considerable risk here", says Pudschedl.

Slight increase in unemployment

The weak economic development of recent months is now having an unfavourable impact on the Austrian labour market. Employment growth has decreased and the number of job seekers is rising while vacancies are falling. "The consequences of the weakening economy over the winter months have become noticeable, but the Austrian labour market is proving to be very resilient. In view of the tight employment market, which is reflected in factors such as the remaining vacancies—numbering almost 120,000—the unemployment rate will increase only slightly in the coming months", says Pudschedl, adding: "After the previous year's figure of 6.3%, we expect the unemployment rate to increase to just 6.4% on average in 2023. We are already anticipating a slight decline in 2024. The stronger economy and the smaller increase in labour reserves compared to previous years, due to the baby boomer generation gradually retiring from the work cycle, should make this possible."

Slow decline in inflation leading to further tightening of monetary policy

The high point for inflation is likely to have been reached at the start of 2023, although inflation in Austria remains in double digits, making it significantly higher than in the eurozone. The high wage dynamics, strong fiscal measures and continuing very strong demand in some areas will also put the brakes on any decline in inflation over the coming months, probably even more so than in the eurozone. At an average of 6.5% in 2023, inflation in Austria will be higher than in the eurozone, where it sits at 5.2%. The UniCredit Bank Austria economists believe that inflation in Austria is also expected to be significantly higher in 2024, averaging 3.0% compared to 2.4%.

"This week, the ECB will almost certainly raise key interest rates by 50 basis points and also announce a further tightening of monetary policy. Based on the latest inflation data, we now expect another 50-basis-point hike in key interest rates in May", concludes Bruckbauer, adding: "We have raised our forecast for the peak interest rate as at mid-2023 for the deposit rate from 3.50% to 4%, and for the refinancing rate to 4.50%, as core inflation is likely to prove more persistent in the short term than we and the ECB had expected."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at