UniCredit Bank Austria Purchasing Managers' Index in March:

Demand in Austria's industry is getting weaker and post-pandemic recovery looks to have ended

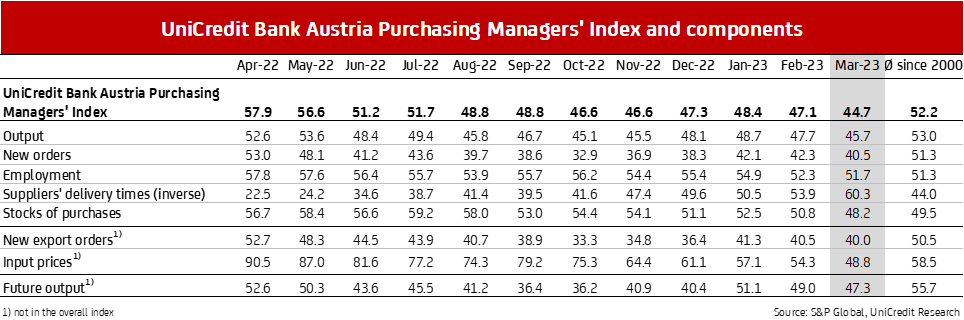

- UniCredit Bank Austria Purchasing Managers' Index falls to 44.7 points in March, reaching its lowest level since May 2020

- Austrian companies are reducing production as a result of receiving fewer new orders from Austria and abroad

- The restored supply logistics chain and fall in demand are leading to a record acceleration in delivery times and the first decline in input prices in 30 months

- Job creation in the domestic industry continues in March, but at the lowest rate in over two years

- Further decline in production in sight in the coming months and medium-term production expectations likewise falling again in March

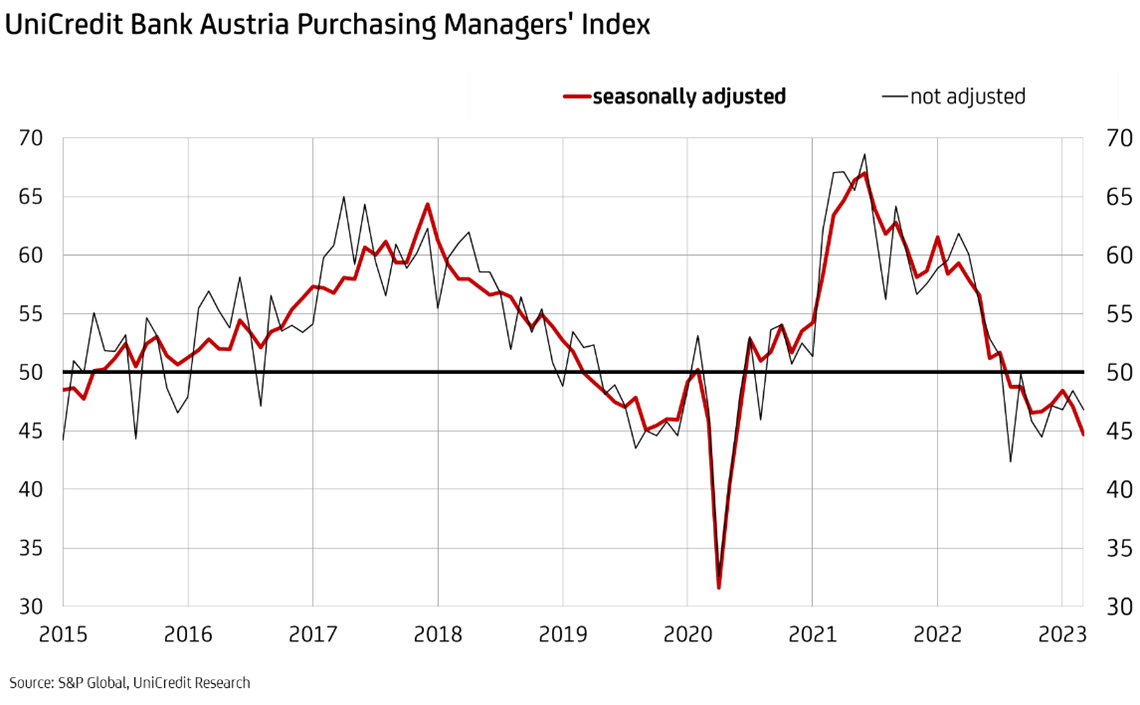

The industrial economy in Austria continued to weaken at the start of spring. "The UniCredit Bank Austria Purchasing Managers' Index decreased to 44.7 points in March. This puts it below the growth threshold of 50 points for the eighth month in a row. Moreover, March saw the lowest level since May 2020, when domestic companies were still subject to coronavirus restrictions. The period of weakness in Austrian industry since the second half of 2022 was not only prolonged in March, but actually worsened slightly", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

The slowdown in the industrial economy at the beginning of spring, which is reflected in the decline in the current UniCredit Bank Austria Purchasing Managers' Index, is due to a continuing decline in demand. "Receiving fewer new orders has led Austrian companies to reduce production compared to the previous month. The amount of purchased primary materials and raw materials was reduced, which contributed to supply chain problems being largely resolved and to input prices falling for the first time in two and a half years. Job creation continued at a much slower pace, but pent-up demand in this regard is expected to be met soon", says Bruckbauer, summarising the key results of the latest survey.

New business declined

At the beginning of spring, Austrian industry reduced its production output—significantly—for the tenth month in a row. The production index fell to 45.7 points in March, its lowest level since November 2022. "While the utilisation of production capacities has still been quite high in recent months due processing orders on hand, the lack of new orders appearing in March led to a very significant fall in production compared to the previous month. Fewer new orders were received, both from inside and outside Austria, with the decline in export demand being comparatively lower", says UniCredit Bank Austria economist Walter Pudschedl. According to the companies surveyed, high market uncertainty, high prices and high customer inventories have slowed demand.

Delivery times accelerated at record speed

In March, domestic companies curbed their purchasing activities significantly. Purchasing volumes declined more sharply than at any time since June 2020, contributing to a sustained easing of supply chain disruptions. "Supplier delivery times have accelerated for the third month in a row and are now as fast as they last were in 2008 and 2009", says Pudschedl, adding: "The marked reduction in delivery times represents a dramatic reversal of the record delays that occurred during the pandemic. This reflects not only that supply logistics chains are working more smoothly again—ports are less overloaded, for example, and container availability has improved—but above all that demand is desperately dwindling in a weakening industrial economy."

The decline in new business and efforts to contain costs led to the first fall in stocks of purchases for nearly two years in March. At the same time, weak demand from customers caused stocks of finished goods to increase for the second month in a row.

Turnaround in purchasing costs

"The resolution of supply problems on the market in March, combined with lower logistical problems and a weakening of energy prices, led to the first decline in purchasing costs for Austrian producers of tangible goods in two and a half years. Although the decline was only moderate, it still represented a reversal of the trend towards record-breaking cost increases in purchasing last year", said Pudschedl. In view of the falling purchasing costs, the rise in output prices subsequently eased further. The output price index fell to 51.6 points, which is the lowest value for approximately two years. Earlier cost increases and rising pressure on wages prompted many companies to raise prices in March.

Pent-up demand for workers is diminishing

During the recovery phase following the height of the pandemic in spring 2020, the increasing demand for labour could not be met quickly enough; consequently, despite production capacities being adapted to meet this falling demand in past months, there was still some catching up to do. Employment in domestic industry consequently continued to increase in March. However, the pace of job creation has decreased somewhat. The employment index fell to 51.7 points in March, its lowest level in just over two years. A higher number of employees in the consumer and capital goods industries was offset by a reduction in the number of jobs for manufacturers of intermediate goods.

Uncertainty over demand dampening expectations in domestic industry

The signs of a slight slowdown in the industrial economy as a result of weak growth in demand, which is indicated by the current decline in the UniCredit Bank Austria Purchasing Managers' Index to 44.7 points at the start of this year, are not limited to Austria; a slowdown in industrial activity can be seen in the eurozone too. The provisional Purchasing Managers' Index for the eurozone fell to 47.1 points in March. However, this was almost exclusively due to the decline in Germany. The index for German industry has fallen for the second month in a row, currently standing at 44.4 points. In the rest of Europe, the USA and China, however, a slight upward trend was observed in March, which should have a delayed impact on industrial development in Austria too.

For the time being, however, no end to the slight recession in domestic industry seems to be in sight. Although the order-to-stock ratio deteriorated slightly in March, it continues to clearly indicate that with the present stocks of finished goods, the fewer new orders can be fulfilled even if production capacities are lower. Production is therefore likely to drop off further in the coming months. This is also indicated by the medium-term production expectations of domestic companies.

"The fact that energy costs are still high, financing conditions have changed following the rise in key interest rates and there is uncertainty on the markets, especially with regard to what will happen to demand in the future, led business expectations for the year in Austria's industry to fall in March. The expectations index fell to 47.3”, says Bruckbauer, adding: "In view of supply disruptions having been resolved and input prices having already declined, the general conditions for domestic industry are slowly improving. However, signals for Austrian industry returning to growth are lacking."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at