UniCredit Bank Austria Industry Overview:

Industry climate in spring 2023 signals weak economic growth

- Materials shortage improves and labour shortage worsens in industrial sector

- Production expectations more optimistic for all major capital goods sectors in March 2023 but greater caution among primary product manufacturers and in construction-related sectors

- Construction industry continues to operate at high level, though expectations worsen in residential and commercial new build sector

- 2023 financial year set to remain difficult for automotive trade and certain retail sectors

- Industry climate cloudy in business-related services sectors but sunny in accommodation and hospitality

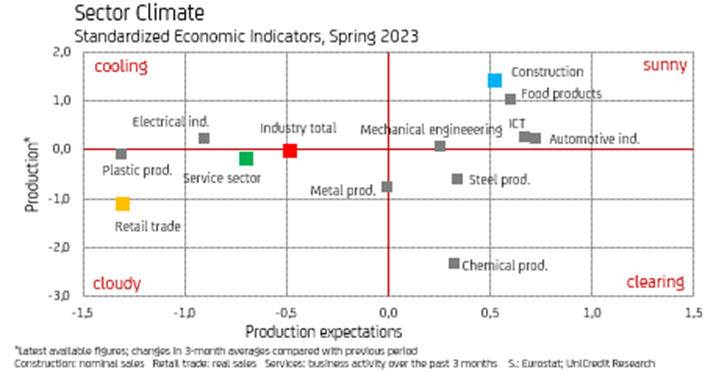

Economic growth in Austria lost momentum in the first quarter of 2023 compared to the previous quarter. The latest industry overview from UniCredit Bank Austria shows that the average expectations in the industrial, retail and services sectors in March signal even further reductions in production output and business activity in the short term. Nevertheless, the industry climate in certain major industrial sectors has already brightened, or, as with construction, remained sunny. "Overall, the latest economic survey results from March 2023 suggest that economic output in Austria will stabilise at a low growth level in the coming months", says UniCredit Bank Austria Economist Günter Wolf.

(The industry climate indicator is determined based on a comparison of production and sales trends up to February 2023 against the results of the economic survey in March 2023).

Industrial activity suffering due to weakness among primary product manufacturers and in construction-related sectors

The shortage of materials in the industrial sector has become less acute. In the first quarter of 2023, only 22% of companies reported significant production constraints due to bottlenecks in the procurement of primary products, compared with 43% in the second quarter of 2022. At the same time, labour shortages in all major capital goods sectors have become slightly more pronounced. Nevertheless, the industry climate remained sunny in spring in the automotive industry, information technology production, mechanical engineering and the food industry. In these industries, the majority of companies reported orders on hand above the long-term average in March and said that they expected further production growth.

The automotive and mechanical engineering industries gained considerable momentum in the first two months of 2023, following below-average production growth of 0.5% and 5% respectively in 2022. The two industries will not be able to sustain the average February gains of 16% in the coming months, but they will continue to grow. While mechanical engineering can partly make up for the slowdown in the (European) investment economy over 2023 in non-European markets, the optimism of companies in the automotive industry is explained primarily by increasing production output and the improved supply situation on the European automotive markets.

Austria's food industry can expect stable sector growth in 2023 thanks to anticipated stronger demand from food retailers and the catering industry, which were very optimistic in March about how their business would perform looking ahead. Furthermore, food producers are benefiting from very high price increases. The average increase in wholesale food prices of 20% in the first quarter of 2023 shows that companies have, for the most part, passed on the sharp price rises affecting raw materials and energy.

Of all the major industrial sectors, in March only companies in the electrical engineering and plastics processing industries became more pessimistic in their production expectations for the coming months. With the exception of construction supply elements, both of these sectors should regain momentum over the course of 2023. Other primary product manufacturers, such as those in the chemicals, metal goods, wood and paper industries, were also responsible for the cloudy industry climate in spring 2023. One the one hand, the decline in production in these sectors, which averaged 10% in the first two months of 2023, is offsetting the high growth over the same period of the previous year; on the other, the losses are due in part to declining orders from the construction industry.

Construction still operating at high level in spring 2023

The construction industry retained momentum in 2022 and has continued to do so in the first few months of 2023. Driven by price, construction output increased by 12% on average in the previous year, with the increase still sitting at 11.4% in February 2023. Thanks to improvements in the supply of materials, the rise in construction costs also started abating midway through 2022, falling to an average of 3.8% in the first quarter of 2023. At the same time, companies have viewed their order situation as getting worse. The fact that capacity utilisation in the sector in the first quarter of 2023 rose again over seven months is explained by the shortage of labour.

The results of the economic survey in March 2023 show that the construction segments are moving at a different pace: In other structural and civil engineering sectors, even more companies than before assessed their order situation as generally satisfactory. In both segments, the demand for construction has recently increased again and has contributed significantly to the persistently sunny climate in the building industry. Conversely, demand for new residential and commercial buildings is declining and the construction sector is slowing down.

In 2023, the demand for new offices and retail buildings is expected to fall due to economic uncertainties. A downturn in new residential construction should likewise be expected (new building permits have been declining for the past two years; permits for single-family dwellings have also been declining since mid-2021). The only areas in which the industry can expect stronger growth momentum in 2023 are building renovation and civil engineering, both of which benefit from subsidies for climate protection measures. After two years of strong growth, the construction industry is expected to record a slight price-adjusted decrease in sales in 2023.

2023 financial year set to remain difficult for automotive trade and certain retail sectors

Sales in the automotive trade (including workshops) fell by 1.4% in nominal terms and 10.8% in real terms in 2022. This is roughly the same as the decline in new car registrations. Despite rising new car sales in the first quarter of 2023, car dealers' business expectations for the next few months were still very pessimistic in March, reflecting not only the declines in used cars but also the continued high level of uncertainty in the market (the number of companies that expect business to decline is 59% higher than the number of optimistic companies, whereas the comparable balance averaged -12% in the ten years before). Stronger sales growth in the automotive trade in 2023 is unlikely, as the poor consumer sentiment suggests. In the first quarter, the number of consumers who wanted to buy a car was still well below the long-term average.

In the retail sector, the high nominal sales growth in 2022 was the result of high price increases in almost all segments. When adjusted for inflation, sales (excluding petrol stations) fell by 0.7%, with above-average losses in areas such as food retail, sales of building materials and online trade. But inflation is not the only factor: The declines are also partly down to the boom in demand returning to an average level.

The drop in sales in the segments and the negative business expectations, which were still present in March, are largely responsible for the gloomy industry climate throughout the retail sector too. Since the beginning of 2023, the number of optimistic retailers has risen again slightly, indicating a slow recovery in the sector economy. "Consumers' willingness to buy should be bolstered by the fact that inflation is now falling and real net income is expected to increase. Furthermore, retailers should benefit from an increasing number of visitors in 2023, especially in the cities", says Wolf.

Industry climate cloudy in business-related services but sunny in accommodation and hospitality

With the exception of tourism-related areas, revenue from services (excluding public and social services) increased by 19% in nominal terms in 2022, thereby offsetting the losses caused by the crisis. That said, the services economy has been losing momentum for months. In the transport sector, the commercial expectations of all key segments have by and large slipped into negative territory. The weaker industrial and export economy, which attests to the decline in HGV mileage on the main road network in the first quarter of 2023, is putting the brakes on forwarding agents and freight transport in particular. In all likelihood, the two sectors will not be able to expect stronger growth in demand until the second half of the year.

The cooling of the industrial economy is being felt by business-related services as well. In March 2023, demand expectations for the coming months in all major sectors, including among freelance professionals, became more pessimistic. Only IT service providers and advertising companies were slightly more confident about developments with their businesses over the next few months. The survey results suggest a slowdown in sales growth in business-related services in the first half of 2023.

By contrast, the expectations of companies in the accommodation and hospitality sector in March 2023 signal slight sales growth. The main obstacle to business in the first quarter was no longer lack of demand, but a shortage of labour. The sector is expected to be able to make up for the considerable sales losses of previous years in 2023.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Günter Wolf, Tel.: +43 (0)5 05 05-41954;

Email: guenter.wolf@unicreditgroup.at