UniCredit Bank Austria Purchasing Managers' Index in May

Accelerated economic downturn leading to recession in Austrian industrial sector

- UniCredit Bank Austria Purchasing Managers' Index falls to 39.7 points in May, reaching its lowest level since April 2020

- Domestic businesses reducing their production output due to sharp decline in new orders

- Employment levels in industrial sector down for the first time in nearly two and a half years

- Low demand causes input and output prices to fall significantly in May

- Lower stocks of purchases, higher inventories in warehouses due to lack of demand

- Prospects steadily worsening: Production expectations index for next 12 months falls to 44.0 points in May, its lowest value since the year began

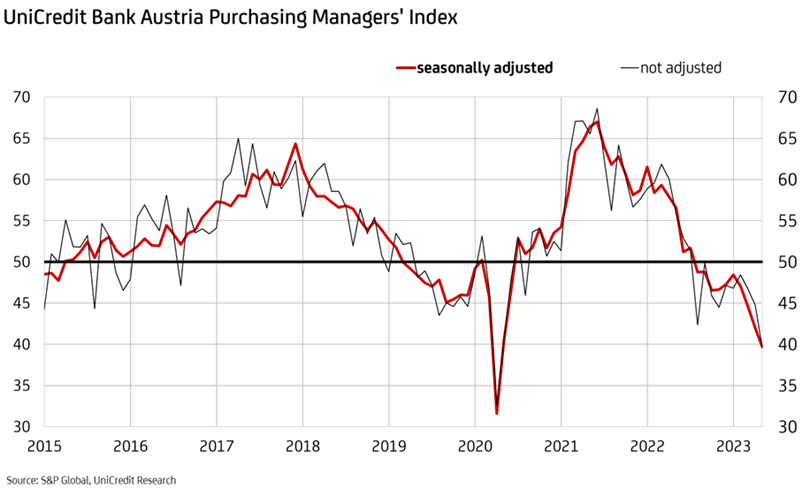

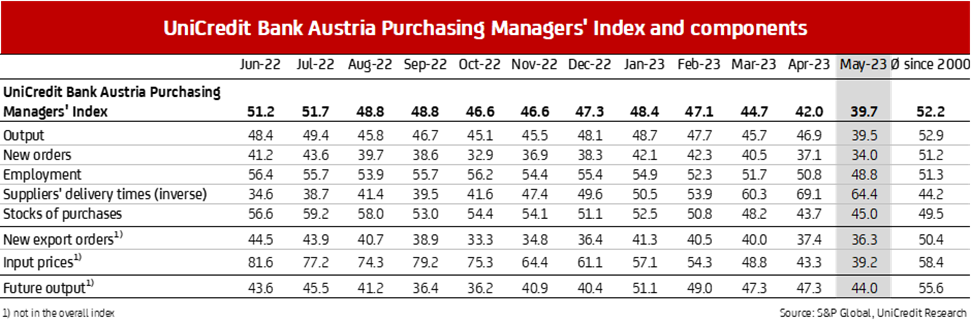

The downturn in the domestic industrial sector is still ongoing. "The UniCredit Bank Austria Purchasing Managers' Index fell to 39.7 points in May, its lowest level since the first lockdown of the coronavirus pandemic in April 2020. Aside from a slight upswing at the start of the year, the gap between the index and the 50-point growth threshold has been widening steadily for the last ten months", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Austria's domestic industrial economy is now in recession, which currently seems to be intensifying."

The industrial sector in Austria is facing a noticeable slowdown in demand. "As a result of the accelerating decline in new business, domestic companies reduced their production capacities significantly in May and, for the first time in two and a half years, slimmed down their workforce too. The lower demand for primary materials caused purchase prices to fall further, and this price drop was partly passed on to customers. The big slump in demand means there aren't generally any supply problems in the industrial sector anymore, and delivery times have got quicker again", says Bruckbauer, summarising the key results of the latest survey.

New business weakening further

May saw the domestic industrial sector reduce its production output at a faster pace than in the previous month. The production index fell to 39.5 points, meaning it has been below the growth threshold of 50 points for a whole year now. "The number of incoming orders from both Austria and abroad was significantly lower than in the previous month, which is why demand for 'Made in Austria' continued to decline in May. In both cases, this was the strongest decline of the current year", says UniCredit Bank Austria Economist Walter Pudschedl. New business continues to be held back not only by the economic downturn, by also by factors such as high prices and customers having high inventory levels.

"The absence of new business led domestic companies to rapidly reduce their orders on hand in May, with delivery times decreasing significantly as a result", says Pudschedl. He adds: "At a global level, shorter delivery times can now be seen in all major industries, even for technological products such as semiconductors. The resolution of supply-side delivery and transportation problems has accelerated as demand has weakened."

Job creation in industrial sector halted

After almost two and a half years, job creation in the Austrian industrial sector has come to a halt. The employment index fell to 48.8 points in May, indicating a decrease in the employment level in the capital goods industry for the first time since December 2020. The majority of businesses are now trimming their workforce due to the worsening order situation and high costs.

With a seasonally adjusted workforce of over 20,000 personnel, the number of job seekers in the Austrian industrial sector has increased somewhat. The unemployment rate also rose slightly to 3.1 percent on a seasonally adjusted basis, as employment stopped increasing. "The unemployment rate in the Austrian capital goods industry is showing a slight upward trend for the first time since the first lockdown of the pandemic ended in spring 2020. With an annual average of 3.3 percent, the unemployment rate in 2023 is expected to be slightly higher than the previous year's 3.1 percent. This means the unemployment rate in the industrial sector will nevertheless be significantly lower than that for the economy as a whole, which is 6.4 percent", says Pudschedl.

The domestic industrial economy continues to face labour shortages, with data suggesting that the average number of applicants for every job opening in the Austrian manufacturing sector is 1.7. The situation is particularly challenging in Salzburg and Upper Austria, where the ratio of applicants to jobs is below one. Given the weakness of the economy, demand for labour in the Austrian industrial sector is expected to decline somewhat in the coming months, which will help to alleviate the labour shortage slightly.

Lower demand causing prices to fall

Due to the lower demand for commodities and primary materials, domestic businesses reduced their purchasing volumes in May. This not only resulted in a further reduction in the number of primary material stocks but also, most notably, led to significantly lower purchase prices. "The shift in supply-demand relations has already prompted purchase prices to fall for the third month in a row. Costs to businesses for primary materials dropped as much as they did during the financial crisis in 2009", says Pudschedl, adding: "In light of weaker demand, the continuing decline in purchase prices was at least partially passed on to customers. Sales prices fell at an increasing pace for the second month in a row."

No immediate prospect of improvement in industrial economy

The recent decline in the UniCredit Bank Austria Purchasing Managers' Index in May indicates that the economic slowdown has accelerated and that the domestic industrial economy is now in recession. The global environment does not immediately appear conducive for Austria's export-orientated industrial sector, as it was not only in Austria that industrial activity deteriorated in May: The Purchasing Managers' Index for the US industrial sector fell back below the growth threshold at 48.5 points, and the preliminary Purchasing Managers' Index for the eurozone manufacturing industry fell even further to 44.6 points, as the decline in Germany's industrial sector accelerated in particular. Compared to Austria, however, the Purchasing Managers' Indices for the manufacturing industry are higher, with the main difference being higher figures for new business. The somewhat more favourable development of demand in the key trading partner countries at least gives hope that the weakening of the Austrian industrial economy will not accelerate further.

However, an end to the recession in the domestic industrial sector is not in sight for the time being. Although the stock-to-sales ratio once again worsened in May, it continues to clearly indicate that, with the present inventory in delivery warehouses, incoming orders can be fulfilled even if production capacities are lower. Production is therefore likely to drop off further in the coming months. This is also indicated by businesses' medium-term production expectations.

"In May, the downtrend in demand, the increased costs—including of wages—and the changed interest rate landscape further reduced businesses' production expectations for the next 12 months. The expectations index fell to 44.0", says Bruckbauer, adding: "Despite positive changes in the environment, such as supply problems being resolved and purchase prices falling, there is no immediate prospect of an upturn in the industrial economy in Austria. With the strengthening of positive signals from abroad, however, the domestic industrial economy could recover in the second half of the year — but we are not seeing any clear signs of this yet."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at