UniCredit Bank Austria analysis of the economies of the federal states for 2022 and outlook for 2023:

From boom to crisis?

- All federal states posted robust to very healthy growth in 2022

- Relaxation of COVID-19 measures boosted tourism strongholds

- Industrial sector helped fuel increase in economic output in almost all regions

- Thriving energy sector and solid construction economy in most federal states

- Business-related services and transport industry key growth pillars for services sector, alongside tourism

- Unemployment rates in all federal states fell sharply, to historic lows in some instances

- Outlook for 2023: Global crises and inflation set to fuel significant economic slowdown in all federal states

- Labour market likely to remain robust in 2023, with regional unemployment rates on par with last year

Following the historic economic slump triggered by the pandemic in 2020, the Austrian economy posted economic growth of 4.6% in 2021 and 5% in 2022. In 2021, the increase was driven in large part by the production sector. In 2022, it was primarily the service sectors that fuelled the strong performance — tourism, transport and retail being the main growth drivers. Despite the inflation situation, they profited considerably from strong demand following the relaxation of COVID-19 measures. The industrial and construction economy was still faring well in the first few months of 2022, but cooled increasingly as the year progressed.

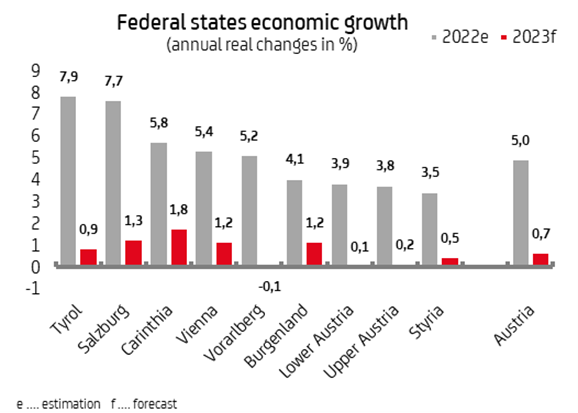

The general economic picture for 2022 was reflected in the economic trends seen in the individual federal states. "The tourism strongholds in the west and the urban economy of Vienna with its emphasis on services outperformed the more industrialised regions. Nevertheless, all federal states generated growth of well over 3%", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

Tyrol led the pack with Styria bringing up the rear

"Tyrol and Salzburg, which rely most heavily on the reinvigorated tourism economy, posted the strongest economic growth last year at 7.9% and 7.7% respectively", says UniCredit Bank Austria Economist Robert Schwarz, adding: "The two industrialised states of Upper Austria and Styria brought up the rear with increases of 3.8% and 3.5% respectively." The Carinthia region (+5.8%) with its exceptionally strong industrial economy, the capital Vienna (+5.4%) with its strong services emphasis and Vorarlberg (+5.2%) with its strong tourism and construction industry achieved above-average growth last year. The increase in economic output was slightly lower in Burgenland (+4.1%) and Lower Austria (+3.9%); the rebound effect, in particular for tourism, was not as sizeable for these regions in 2022.

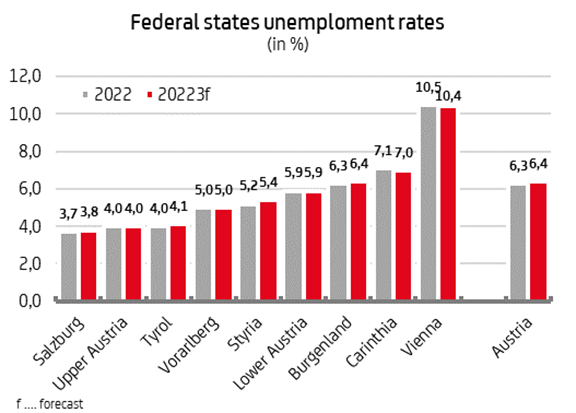

Unemployment rates declined in all federal states in 2022

The unemployment rate fell in all federal states in both 2021 and 2022. "In 2022, some federal states saw the unemployment rate drop to a level not seen for more than 30 years", says Schwarz. Reflecting the economic situation, all federal states saw a sharp decline in unemployment in the accommodation and catering, retail and other economic services sectors. In 2022, for the first time since 2017, Salzburg posted the lowest unemployment rate at 3.7%. The unemployment rate remains highest in the Vienna region, with the average figure for 2022 sitting at 10.5%.

Rising prices drove up trade in goods to record highs

In nominal terms, the total value of goods imports rose by 19.8% on the previous year's figure, to EUR 213.72 billion. Goods exports were also up, by 17.2% to EUR 194.13 billion. The increase in imports is due primarily to the price increases affecting fuels and energy. On the export side, the growth was underpinned in large part by positive trends in machinery and vehicles. "Upper Austria remains by far the strongest state for exports, recording an export volume of more than EUR 51 billion for 2022, which equates to 26.4% of Austria's total goods exports", says Economist Robert Schwarz, adding: "All federal states posted double-digit growth rates for exports." Burgenland exhibited the most momentum, generating an increase of more than 30% — due primarily to mineral fuels exports.

The industrial economy cooled significantly in 2022, with a real-terms value-add of 3.5% (compared with 9.5% in 2021). Strong momentum in key companies led to above-average industrial growth in Carinthia and Styria, but there were no gains at all in Vienna and Lower Austria.

Similar developments were noted in Austria's construction sector. Here too, there was a downturn in the economy in 2022. The real-terms growth in value-add sat at 1.4%, compared with an increase of 2.6% in 2021.

Vorarlberg and Burgenland had the strongest construction economies. According to estimates by UniCredit Bank Austria economists, the construction sectors in Tyrol and Vienna generated a real-terms value loss in 2022.

Services sector surpassed pre-pandemic level

Despite the inflation situation, in 2022 the entire services sector benefited from strong demand following the easing of COVID-19 measures. Real-terms value-add across all areas of the services sector was up by more than 6% in 2022. Having experienced a strong slump in 2020, value-add in the services sector lay above the 2019 pre-pandemic level. The accommodation and catering sector was by far the most important growth pillar, generating a value-add of more than 50%. The transport industry and other economic services were also buoyant in 2022. It was primarily the tourism strongholds in western Tyrol and Salzburg and the capital Vienna, with its strong services emphasis, that benefited from this positive economic environment.

Outlook for 2023: Strong economic downturn expected in all federal states

Following a 5% increase in GDP in 2022, the economists at UniCredit Bank Austria expect the Austrian economy to cool significantly, leading to a 0.7% decline in economic growth. "The Vienna, Salzburg and Tyrol regions will benefit from a robust services economy again this year and are expected to report above-average growth. In the highly industrialised federal states such as Styria and Upper Austria, by contrast, we expect performance to be below average", says Schwarz.

Despite the economic slowdown, the regional labour markets are likely to remain stable this year, with a slight increase in the estimated unemployment rate in Austria to 10.4%, up from 10.3% in 2022. Across all federal states, average unemployment rates for 2023 are set to deviate from last year's rates by a maximum of ± 0.2 percentage points.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Robert Schwarz, Tel. +43 (0) 50505 - 41974;

Email: robert.schwarz@unicreditgroup.at