UniCredit Bank Austria Business Indicator:

Economic slowdown continues

- UniCredit Bank Austria Business Indicator falls to minus 2.4 points in May

- Economic sentiment worsens across all sectors of economy

- Stagnation persists, but prospects for recovery from the second half of the year remain intact

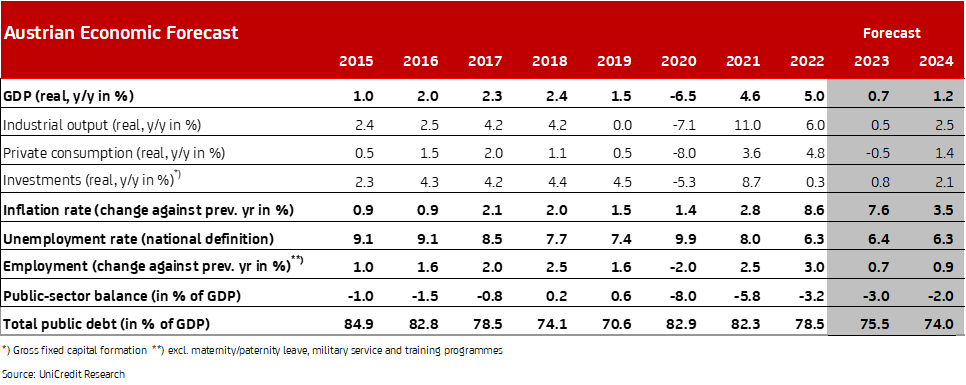

- Austrian economy still expected to grow by 0.7% in 2023 and 1.2% in 2024

- Limited response on the labour market: unemployment rate expected to rise to an average of 6.4% in 2023

- Slow fall in inflation: inflation expected to fall to 7.6% in 2023 and 3.5% in 2024

- Interest rate peak of 4.25% expected for refinancing rate in summer, but ECB keeps door open for further measures

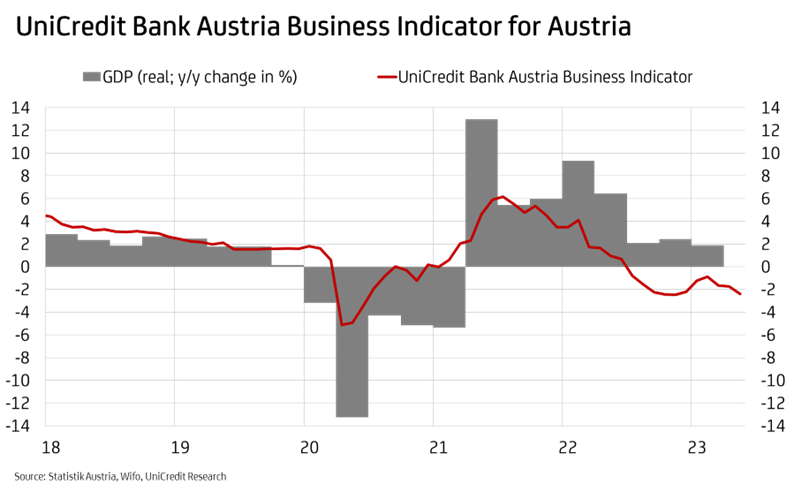

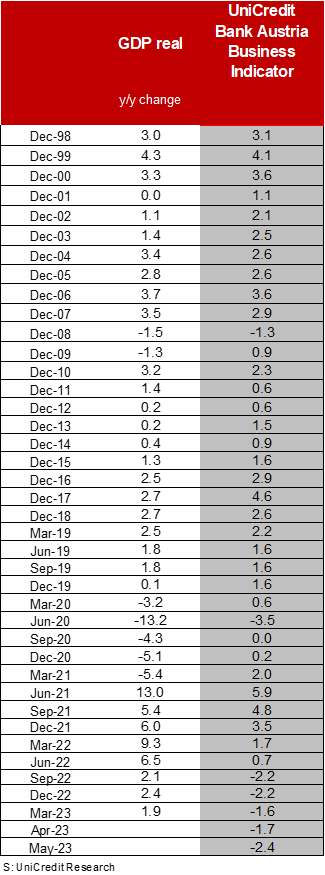

Economic sentiment in Austria has worsened as spring progresses. "The UniCredit Bank Austria Business Indicator fell to minus 2.4 points in May. Falling for the third time in a row, the indicator has dropped to a level comparable to that of autumn last year", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "With this further deterioration, our economic indicator for the second quarter shows that economic development continues to be weak in Austria. The stagnation that has persisted since the second half of 2022 will therefore continue into the summer."

Weak demand in the production sector weighs on sentiment

The decline in the UniCredit Bank Austria Business Indicator can be attributed to a deterioration in all of its sub-components. In particular, sentiment in domestic industry worsened noticeably in May in view of a sharp fall in demand and the necessary adjustments to production and personnel capacities. Furthermore, the export environment did not provide any positive momentum either.

Unfavourable developments in Austria's key European partner countries – particularly Germany and Italy, as well as most Central and Eastern European trading partners – dampened the indicator for global sentiment in the industrial sector, which is weighted by the Austrian share of trade. Likewise in the construction industry, the slump in sentiment persisted due to the low number of contracts in building construction, especially in housing construction. The only time that sentiment in construction has been worse than this May was during the first lockdown in spring 2020.

In view of continuing high inflation and the associated real-terms loss of income, consumer sentiment worsened and the business outlook also dipped slightly in the service sector. "The mood is currently subdued in all economic sectors in Austria. It is well below the long-term average in both the services and industrial sectors. Sentiment in the construction industry is also only slightly above average after the sustained cooling period since the beginning of 2022", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "Economic sentiment in the construction and industrial sectors is increasingly becoming significantly more pessimistic in Austria than in the eurozone, with the particularly strong growth in these two sectors in the previous year likely leading to distorted perceptions that make the situation appear more negative than the reality. By contrast, sentiment among Austrian service providers is slightly above that in the eurozone, despite the current deterioration."

Growth risks for 2023 increasingly trending downwards

There is a delay in the expected recovery of the domestic economy, driven by the resolution of supply chain problems and the fall in commodity prices, which is already partly reflected in a slowdown in inflation. As a result of the changes in financing conditions, willingness to invest is low, especially as demand is weakening in many sectors of the economy, particularly in manufacturing. There is also currently a lack of stimulus from abroad.

While public consumption is slowing falling, private consumption is holding up well for the time being despite high inflation. "With the gradual fall in inflation and improvements in the global export environment, the Austrian economy should be able to start recovering in the second half of the year and overcome the stagnation. We continue to forecast economic growth of 0.7% for 2023. However, current economic data indicates that the risks to our growth forecast are increasingly trending downwards", says Pudschedl. The changes in financing conditions will limit the upturn in both consumption and investment, and the pace of recovery will therefore remain moderate, which should at least allow GDP to rise by 1.2% in 2024.

Labour market now experiencing stagnation

With the delay in the recovery of the Austrian economy, the economic slowdown is having a negative impact on the labour market but remains manageable. "After an average of 6.2% in the first quarter of this year, the seasonally adjusted unemployment rate rose to 6.4% towards the middle of the year. We also expect an average unemployment rate of 6.4% for 2023, slightly above the 6.3% of the previous year. The relatively tight labour supply will continue to limit the negative impacts of the weak economy in the coming months", says Pudschedl. As the recovery begins to take effect, the unemployment rate will stabilise and begin to come back down from the beginning of 2024. It is expected to fall to an average of 6.3% in 2024.

Service prices keeping inflation high for longer

Although inflation is generally trending downwards in Austria, strong second-round effects are making for a rather bumpy descent. Over the first five months of the year, average inflation was just below 10%. Savings from the pandemic period, high levels of fiscal support and now rising wages too are driving demand-side price dynamics – which are already high due to higher prices for raw materials – in certain areas, such as leisure services and tourism.

"While the development of fuel and food prices is expected to dampen inflation noticeably in the coming months, the passing on of higher costs to many service prices on account of the high pricing power of suppliers means that although inflation will fall in Austria, it will do so slowly. Due to strong second-round effects, we expect inflation to reach 7.6% in 2023, after 8.6% the previous year. We are expecting inflation of around 3.5% in 2024", says Pudschedl.

Interest rate peak expected in summer

The ECB has slowed the pace of interest rate hikes given that the effects of previous monetary tightening exercises on the real economy are already being felt; however, it has indicated that the task is not yet over. "Based on the indications from the ECB, and given that core inflation is not yet showing a sustained downward trend, we expect a further hike in key interest rates in the summer, up to a level of 4.25% for the refinancing rate and 3.75% for the deposit rate", said Bruckbauer, adding: "At this level, we believe an end to the cycle of hikes might be prudent to assess the delayed effect of last year's massive tightening exercises, which included not only extensive interest rate hikes but also balance sheet reduction through the sale of securities and the upcoming large TLTRO repayment."

However, the ECB is likely to keep the door open for further tightening after the summer. Depending on the inflation data, the possibility of a further increase in interest rates by 25 basis points in September is becoming greater in order to anchor – from the ECB's perspective – inflation expectations in the face of high core inflation.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at