UniCredit Bank Austria Purchasing Managers' Index in June:

Weak demand exacerbates recession in Austrian industrial sector

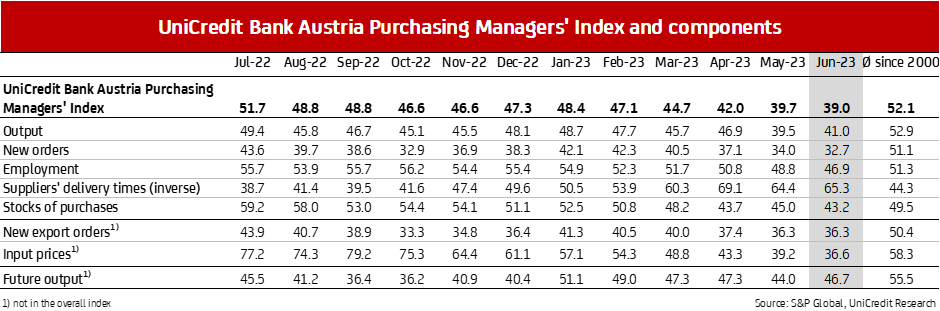

- UniCredit Bank Austria Purchasing Managers' Index falls to 39.0 points in June

- Production cutbacks triggered as new orders from within Austria and abroad decline significantly

- Accelerated decline in employment levels among domestic businesses in June

- Stocks of purchases scaled back but stocks of finished goods increase due to sales problems

- Declining demand prompts further decline in input and output prices

- Production expectations index rises to 46.7 points in June, signalling further decline in production over coming twelve months

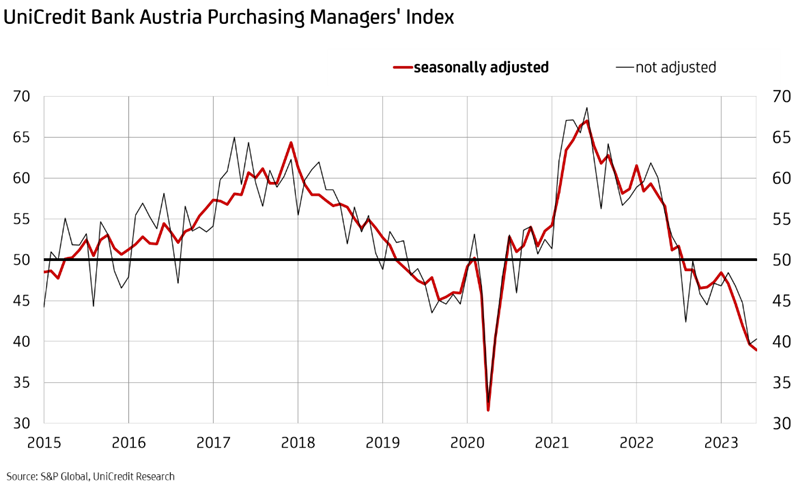

The cloudy outlook in the domestic industrial economy continued as the second quarter drew to a close. "The UniCredit Bank Austria Purchasing Managers' Index fell to 39.0 points, its lowest level since the first pandemic-related lockdown in April 2020", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "For almost a year now, the indicator has trended below the growth threshold of 50 points. The downturn in the industrial economy has actually accelerated since spring of this year, triggering a recession in the Austrian industrial sector that has intensified as we approach the middle of the year. Only at the start of the pandemic and during the financial crisis of 2008/09 has the indicator dipped so low."

The significant decline in demand has become a real problem for the domestic industrial sector. "As a result of the huge slump in new business, domestic businesses have scaled back production and reduced staffing levels. Reduced demand for primary materials caused input prices to fall sharply, but this reduction was not passed on in full to clients. Availability of raw and primary materials continued to improve. Supply chain problems eased again in June, resulting in the second-largest improvement in supplier´s delivery times since the survey was launched in 1998", says Bruckbauer.

Production and staffing adjusted to reflect lower demand

The order situation in the domestic industrial sector deteriorated again at the end of the second quarter. The corresponding indicator has dropped to 32.7 points. Aside from during the COVID-19 lockdown in the spring of 2020 and the financial crisis of 2008/09, this is the lowest the indicator has ever dropped. New domestic orders in particular have been hard to come by, but demand from abroad also continued to decline sharply. More than 40 percent of the companies surveyed reported a decline in new export orders, in particular new orders from Germany.

"Domestic businesses adjusted capacity in June to take account of the worsening order situation. Production output was significantly reduced, although not quite as much as in the previous month. The production index climbed to 41.0 points", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "In addition, employment in the sector fell for the second month in a row, with the rate of job cuts accelerating sharply. The employment index fell to 46.9 points, the lowest figure in almost three years." In the intermediate goods industry in particular, employment rates have been adjusted to keep pace with lower production requirements, primarily by not refilling positions that become vacant.

Weak demand driving purchasing policy and stock trends

Due to declining demand, cautious stock policies and attempts to increase liquidity, Austrian industrial businesses significantly reduced their purchasing activities in June. Although the corresponding index rose slightly from its three-year low in the previous month to 35.7 points in June, it still points to a sharp decline in purchasing volumes compared with the previous month, continuing a trend that has been apparent for a full year now.

"As a result of the sharp reduction in purchasing activities, primary materials inventories decreased significantly in June. In the consumer goods and intermediate goods industries in particular, stock levels were adjusted to account for the lower production requirements. In addition, domestic businesses reported that stock levels would be kept lower for cost reasons, relying on the recovered supply chains", says Pudschedl. While levels of stocks of purchases decreased, weaker demand and the postponement or cancellation of orders by customers led to increasing levels in stocks of finished goods again.

Strong decline in input prices

The slump in demand prompted a fourth consecutive month of decline in input prices in June. The current index is just 36.6 points, reflecting the strongest price drop since the financial crisis of 2008/09. In particular, raw materials such as various metals and woods became cheaper to purchase. Energy and transportation costs also decreased.

"Competition for new orders in an increasingly challenging demand environment prompted domestic businesses to cut their output prices for the third month in a row. However, the appreciable cost relief due to reduced input prices was only partially passed on to clients. This means that price trends have on average improved the earnings situation of domestic businesses", says Pudschedl.

Deepening recession

The recent decline in the UniCredit Bank Austria Purchasing Managers' Index in June due to the significant weakening of demand suggests that the recession in the domestic industrial sector is likely to persist for the time being, particularly as the provisional purchasing managers' indices for the key export destinations of the domestic economy are also indicating a worsening downturn. The purchasing managers' index for the US industrial sector fell to 46.3 points and the index for the industrial sector in the eurozone dropped even lower at 43.6 points, driven by the further decline in Germany.

In addition to the lack of momentum from abroad, the continued deterioration in the index ratio of new orders to stocks of finished goods (to the lowest level since the first COVID-19 lockdown) suggests a sustained downturn in the industrial economy. Over the coming months, it will be possible to fulfil incoming orders with a reduced production output due to increased stocks of finished goods.

"Domestic companies have been anticipating production decline since February of this year. The sharp slump in demand and the rise in financing costs remain increasingly worrying, despite the expectations index rising for the first time in five months in June. At just 46.7 points the index certainly does not signal an end to the recession, but it does raise hopes that the downturn will soon cease to worsen and that the industrial economy will bottom out", concludes Bruckbauer. Following a real-terms increase in industrial production of 6.0 percent in 2022 and an average increase of just over 1 percent in the first four months of this year, the economists at UniCredit Bank Austria expect a slight decline of less than 1 percent for 2023 as a whole given the ongoing downturn.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at