UniCredit Bank Austria Business Indicator:

A cooler summer - at least for the economy

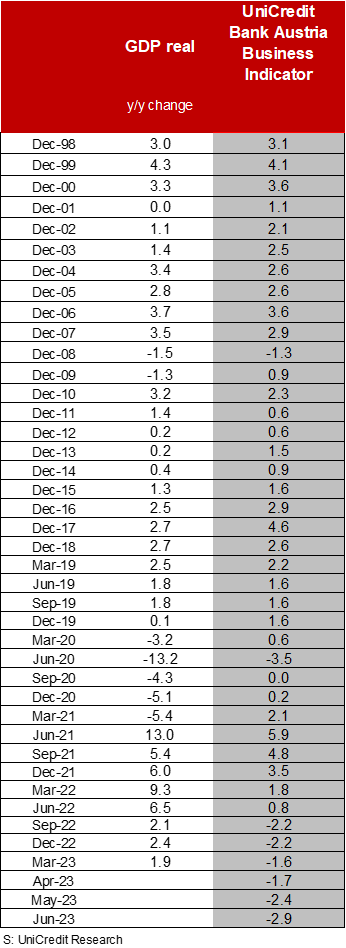

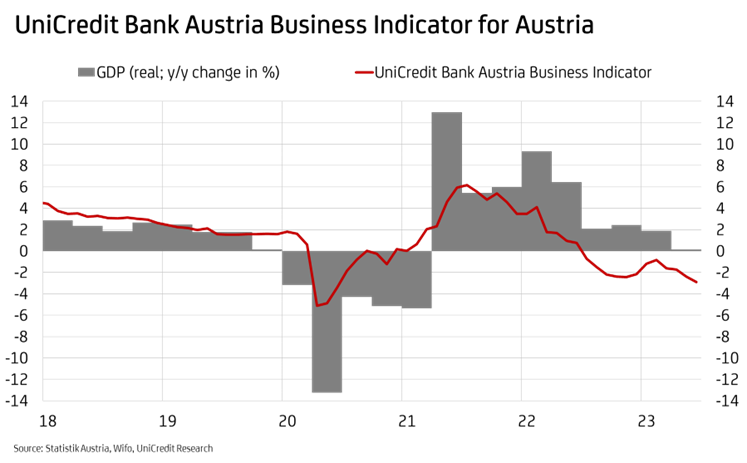

- UniCredit Bank Austria Business Indicator falls to minus 2.9 points in June

- After modest growth at the beginning of the year, Austrian economic output in Q2 is expected to fall slightly short of the previous quarter's level

- Delayed recovery expected in H2, but economic growth is set to remain unchanged at 0.7% in 2023 and 1.2% in 2024

- The weak economy is putting a strain on the labour market, but the 2023 average annual unemployment rate is only increasing slightly to 6.4%, having been at 6.3% in 2022

- Decline in inflation fuelled by low energy prices in H2 with inflation in 2023 expected to average 7.6% and 3.5% in 2024

- The ECB is expected to raise its key interest rates again in the autumn with record anticipated refinancing and deposit rates of 4.5% and 4.00%, respectively

The economic situation in Austria continues to decline. "The UniCredit Bank Austria Business Indicator fell to minus 2.9 points in June. While in recent months the strong service sector stood up to the floundering production sector, the service sector is now increasingly feeling the effects of the recession in industry and construction," says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "With the fourth consecutive decline, the indicator fell on a quarterly average to the low level we saw last autumn, when Austrian economic output had shrunk by 0.1% compared to the previous quarter. After a moderate increase at the beginning of the year, GDP is expected to decline slightly in Q2."

Weakness of production sector rippling out to services

The further decline of the UniCredit Bank Austria Business Indicator towards the middle of the year can be attributed to the noticeable worsening sentiment in the services sector. Nevertheless, the underlying pessimistic mood among consumers did brighten somewhat in view of, among other things, slowed inflation in June. While consumer-related services in the leisure and tourism sector still reaped the rewards of pent-up demand, company-related services in particular increasingly felt the effects of the economic lull in the production sector.

"In addition to the downturn in the services sector, the lack of industrial demand from abroad has also worsened economic sentiment in Austria. The positive trend following the energy crisis easing and supply chain problems being resolved has now given way to disappointment caused by low momentum—including from China after its reopening following its zero-COVID policy—and the increasingly noticeable effect of monetary tightening. Moreover, the slump in construction is putting a strain on the affordability of residential properties following rapidly rising costs and interest rate hikes by the ECB," says UniCredit Bank Austria Economist, Walter Pudschedl.

Recovery in holding pattern

After a weak H1 with a slight downturn in the economy towards the middle of the year, the prospects of improvement in the Austrian economy seem less likely. In view of the current economic and sentiment indicators, rather than the economy recovering in summer 2023, it is expected to cool, but not to slump. "We remain optimistic that improved overall conditions, with falling inflation and the end of monetary tightening, will have a positive impact on economic dynamics later in H2. Thanks to a statistical overhang, we continue to expect economic growth of 0.7% for 2023, although the forecasting risk is clearly indicating downward trends. Conversely, our GDP forecast of 1.2% for 2024 could prove to be too conservative," says Pudschedl.

Weakness in production sector causing reversal in labour market trends

The weak economy of recent months is now noticeably being reflected in the labour market, but for the time being it is only the production sector that is experiencing declining employment levels. The unemployment rate in Q2 only rose moderately, thanks to continued demand for labour in the service sector. In the coming months, the unemployment rate will continue to rise due to the persistently weak economy. Nevertheless, the upward trend will continue to be largely curbed due to the current shortage of the labour market. We continue to expect the average unemployment rate to rise to 6.4% in 2023 and to slightly decline in 2024 to 6.3% thanks to the improved economic outlook," says Pudschedl.

Noticeably falling inflation in H2

The fall in inflation from more than 11% at the beginning of the year to the mid-year rate of 8.0% is set to accelerate in the coming months. The dampening effect of fuels is waning, but is increasingly being replaced by lower wholesale prices for electricity and gas being passed on to consumers, albeit hesitantly. In addition, reduced food and industrial goods prices should also exert downward pressure on inflation. In light of rising wage costs and good demand as a result of imminent real wage growth, prices for services are likely to fall at a much slower rate.

"With the accelerated decline in H2, overall inflation in Austria is likely to fall to around 4% by the end of the year. In 2023 as a whole, the average inflation rate is expected to stand at 7.6%, having been above 9.5% in H1, the highest level since 1975," says Pudschedl. With little help coming from energy price trends and high wage dynamics, the decline in inflation is set to noticeably slow in 2024. The economists at UniCredit Bank Austria expect average inflation of 3.5%.

Will autumn bring record key interest rates?

Core inflation, while expected to peak in mid-2023, will be volatile in the near future and will not clearly slow until the autumn. "As the eurozone has not seen a significant fall in core inflation, it is likely that the ECB will raise interest rates by another 25 basis points at the end of July and probably again in September. We now assume that the deposit and refinancing rate will reach peaks of 4% and 4.5% respectively," says Bruckbauer, adding: "In our opinion, the ECB will not be considering cutting key interest rates until mid-2024 at the earliest."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at