UniCredit Bank Austria industry overview:

Industry climate cloudy for summer 2023

- Industrial economy particularly impacted by losses in construction-related sectors

- Industry climate in steel industry sunny due to growing orders from electrical engineering sector and automotive industry

- All construction segments slipping into negative territory in summer 2023, including construction-related sectors

- 2023 financial year remains difficult for automotive trade and many retail sectors

- Cloudy industry climate in the services sector; sunny only for business consultancy and hospitality

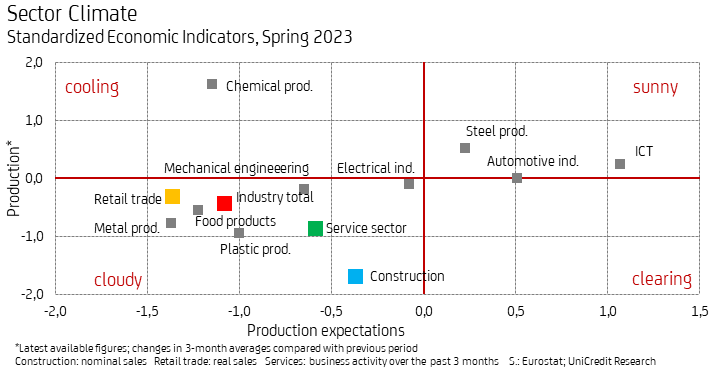

Austria's economic growth has been losing momentum since the start of 2023. The latest industry overview from UniCredit Bank Austria shows that at the beginning of summer, the industry climate clouded over. Q2 saw industry, retail and services all decline against the sector average in terms of production output and business activity compared to the previous quarter. Furthermore, the majority of companies across all sectors remained pessimistic about their production and demand expectations in June. "The results of the latest economic survey signal continued weak economic growth in the coming months. The industry climate for summer 2023 is only sunny in a few large industrial sectors and certain service sectors — these being the steel industry, which is benefitting from the continued upswing in the automotive industry, and manufacturers of information and communication technology in industry", says UniCredit Bank Austria economist Günter Wolf.

(The industry climate indicator is determined based on a comparison of production and sales trends up to May 2023 against the results of the economic survey in June 2023).

Industrial economy particularly impacted by losses in construction-related sectors

In the industrial sector, shortages of primary products and labour were less acute than in the first half of 2023. That said, the number of companies reporting harsher production challenges due to insufficient demand rose to 17% in Q2, putting it roughly at the same level as 2015/2016, a period of low industrial growth. In particular, the order situation is worsening for the industrial sectors that are more reliant on construction, such as the wood and building materials industries, plastic and metal goods manufacturers, and parts of the electrical industry. These latter industries are also suffering the effects of the slowdown in the European investment economy. According to the latest EU forecast, the demand for investments in capital equipment in the EU will grow by only 2.5% in real terms in 2023, compared to 4% in 2022.

Weaker growth in demand for capital goods at EU level is also slowing demand for new machinery from Austria. In June 2023, domestic machinery manufacturers rated their order situation as too low on balance for the first time since 2020. Moreover, companies became more pessimistic in their production expectations in June, signalling a slowdown in growth at a minimum over the coming months. Although machine building output increased by 8% in May 2023 compared to last year, industrial production overall shrank by 0.9%.

The sunny sector climate in the steel industry at the start of summer can be attributed to receiving a sufficiently high number of orders, especially from the automotive industry. In the Austrian automotive industry in June, 30% more companies expected production to increase in the coming months rather than decline. The electrical engineering sector, which is also a big client for the steel industry, likewise saw production expectations rise again by 4 percentage points. However, sales in the steel industry are expected to fall slightly in the second half of 2023 due to declining investments in construction and below-average growth in investments in capital equipment. Nevertheless, the continuing increase in demand from the automotive industry and potentially parts of the electrical engineering sector will prevent further production losses. The rapid expansion of rail infrastructure and alternative energy supplies will require large amounts of steel as well.

All construction segments slipping into negative territory in summer 2023

In recent months, the construction industry has lost the momentum it had in Q1 2023. May saw construction output fall by 4.5% in nominal terms, with construction companies maintaining that their order situation is getting steadily worse. The effects of the economic slowdown are being felt across all sectors. In Q2 this even included construction-related sectors — for the first time since 2020, the majority of companies rated their order situation as being too low in June, with the balance of company ratings standing at -4 percentage points. In nominal terms, May saw construction output fall by 11% in May in residential and commercial construction and by 6.6% in civil engineering. The order situation in the two sectors in June was rated on balance at -18 and -25 percentage points respectively.

The downturn in new residential construction is set to worsen in the second half of 2023 (new building permits have been declining for the past two years, latterly by 36% in Q1 2023). In addition, weak economic growth and the slow decline in construction prices, alongside high borrowing rates, will further reduce demand for new offices and retail buildings too. The only area in which stronger growth momentum can be expected this year is building renovation. This sector should benefit from subsidies for climate protection measures. All in all, after two years of strong growth, output in the construction industry is expected to decrease in 2023, even in price-adjusted terms.

2023 financial year set to remain difficult for automotive trade and certain retail sectors

According to the most recent data, April 2023 saw sales in the automotive trade (including workshops) rise by 4% in real terms, driven by the increase in new car registrations. Between April and June, sales of new passenger cars and presumably also dealership revenue continued to grow. Car dealers remain pessimistic regarding business expectations, however, reflecting the continued weak state of the used-car business and, above all, uncertainties on the market. In Q2 2023, the number of consumers who wanted to buy a car within the next 12 months was significantly lower than the long-term average (the balance of positive and negative responses was -68 percentage points compared to -61 percentage points over the last twenty years). 2023 will see the automotive trade surpass the 1.4% drop in sales compared to the previous year in nominal terms, but it is unlikely to be able to make up for the 11% drop in price-adjusted terms.

In 2023, high price increases in the retail sector, especially from food retailers, secured a nominal sales increase of 5.6% in April. After adjustment for price changes, however, sales fell by 4%, with the strongest losses felt by the building supply and home furnishings sectors, pharmacies, online retail and the fuel trade. The consistently very pessimistic business expectations of retailers in June indicates a slowdown in the sector economy for the second half of 2023. Consumers' willingness to buy is not likely to recover much during the year due to persistently high inflation and real-terms income losses.

Cloudy industry climate in the services sector, with the exception of business consultancy and hospitality

Service providers (excluding public and social services) carried the momentum from the previous year into Q1 2023 and recorded a sales increase of 14% in nominal terms (according to the latest data). As the economic survey shows, the service economy had already cooled off across the board in Q2 and the industry climate clouded over at the start of the summer.

In the transport sector, the 9.2% increase in revenue in Q1 2023 mainly came from passenger transport. Conversely, demand expectations for freight transport and forwarding agents have been in negative territory since Q4 2022 and become even more pessimistic in recent months. Both sectors are losing orders as a result of the weak industrial and export economy. In June, their demand expectations for the next few months fell on balance to -15 and -17 percentage points. Even parcel services, which began 2023 with a slight increase in sales of 4% in Q1, rated the short-term economic outlook more cautiously on balance. With the exception of passenger transport, the sectors are unlikely to record stronger growth in demand in the second half of 2023.

The slowdown in the industrial economy in 2023 has also affected business-related services, as demonstrated by the negative demand expectations of all major industries in the sector in June. Revenue growth in Q1 2023—which was very high in some cases, averaging 8% for freelance services and 18% for other business services—will certainly be lower in the second half of the year. Companies in a few areas such as legal and tax consulting were more optimistic in June. The results of the economic survey across the whole sector indicate a slowdown in sales growth at a minimum in the second half of 2023.

Following 31% sales growth in Q1, the accommodation and hospitality sector is likely to record strong revenue gains in Q2 2023, as measured by the persistently high growth in demand. To date, demand from domestic and foreign guests has been affected very little by the sector's high prices and the economic slowdown in key target markets. It was only in June that demand expectations in the catering sector became much more cautious, indicating that the upturn is losing pace. At the same time, with a gain of 20 percentage points, assessments from accommodation establishments remained on balance well above their long-term average.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Günter Wolf, Tel.: +43 (0)5 05 05-41954;

Email: guenter.wolf@unicreditgroup.at