UniCredit Bank Austria Purchasing Managers' Index in July:

Austrian industrial sector scales back production and employment

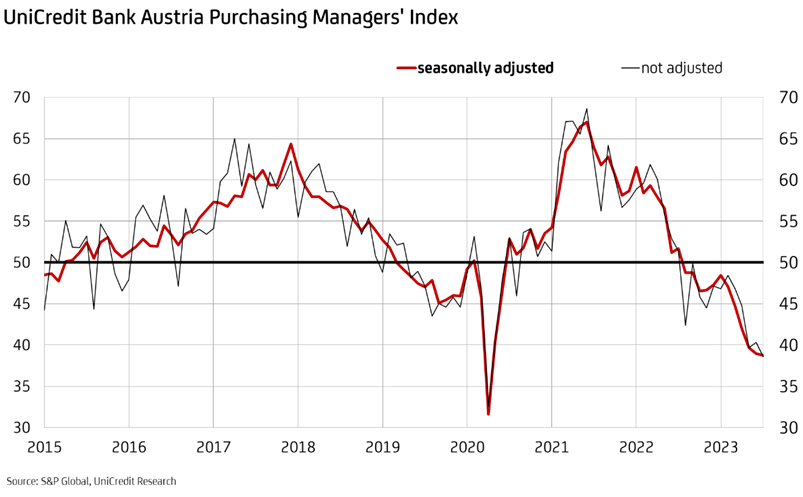

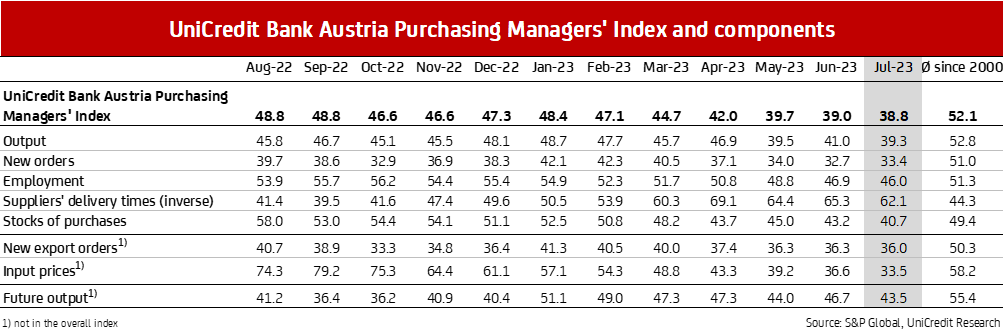

- UniCredit Bank Austria Purchasing Manager's Index falls to 38.8 points in July, undershooting growth threshold of 50 points for twelfth successive month

- Lack of new orders leads to strongest production decline in over three years

- Domestic businesses pushed staff cutbacks in July

- Decline in input and output prices accelerated

- Sales problems resulted in fuller stocks of finished goods despite significant scaling back of purchasing volumes and stocks of purchases

- Weak demand, high costs and changed financing conditions lead to increased pessimism and lowest production expectations of 2023 for the twelve months ahead

The Austrian industrial sector made a shaky start to the third quarter. "The UniCredit Bank Austria Purchasing Managers' Index fell to 38.8 points in July, slipping even further below the threshold of 50 points that signals growth. This is the lowest figure since April 2020", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

"The significant decline in new orders saw production scaled back considerably in Austria in July, with staff cutbacks accelerated. A smaller quantity of purchases helped to ease the supply problems and accelerated the scaling back of stocks of purchases. By contrast, stocks of finished goods increased due to weak demand, which resulted in the lower prices being reflected more rapidly in output prices", says Bruckbauer.

Recession persists in industrial sector

A sustained slump in demand is dominating current performance both in Austria and elsewhere. The eurozone also saw its preliminary Purchasing Managers' Index for the manufacturing industry fall in July. It dropped to 42.7 points — the lowest level since the start of the COVID-19 pandemic. The industrial sectors in the powerhouses Germany and France in particular pushed performance in the eurozone further into the negative range.

Following the mixed fortunes experienced by the industrial economy since the start of the year and the continuing deterioration of the situation at the start of H2—including in the key export markets—domestic businesses are increasingly pessimistic in their expectations. "The production expectations index for the next 12 months fell to 43.5 points in July, marking the low point for the year to date. Around a third of the companies surveyed stated that they were expecting production to decrease, with only a fifth expecting production growth. Weak demand, high costs, changed financing conditions and the strongly negative signals from the construction sector fuelled pessimism among Austrian businesses at the start of H2", says Bruckbauer, adding: "All signs currently point to the recession extending well into the second half of the year. Unfortunately there are currently no signs of improvement in the industrial economy, at best of a slowdown of the downward trend. So the hopes remain that the geopolitical environment and the situation with costs and monetary policy will settle down over the coming year and provide fresh momentum for the domestic industrial sector."

Strong slump in demand — affecting domestic demand more than exports

Domestic businesses noticeably scaled back production capacity in July. The production index fell to 39.3 points, the lowest since April 2020 when the first COVID-19 lockdown was implemented to slow the spread of the virus. "A lack of new orders, alongside the sharp decline in backlogs of work and order cancellations resulted in significant production cutbacks in Austria's industrial sector in July. New business from Austria and abroad declined significantly as many customers reduced their inventories in response to the strained environment", says UniCredit Bank Austria Economist Walter Pudschedl. Despite the decline in demand in the export business accelerating slightly once again, the index for new export orders (at 36.0 points) is outperforming the index for total new orders (at 33.4 points), which has been dampened quite considerably by the slump in new orders in the domestic construction sector.

Staff cutbacks picking up pace

As part of their attempts to adjust capacity in the wake of lower utilisation, domestic manufacturing businesses picked up the pace of staff cutbacks again in July. The employment index fell for the third month in a row, dipping to its lowest level in three years at 46.0 points. The staff cutbacks were focused on the consumer goods and intermediate goods sectors, resulting in fewer temporary staff being hired and vacant positions not being filled.

Despite the weakening demand, employment in the sector between January and July 2023 still rose by almost 12,000 people or 1.9% year on year, to an average of almost 645,000 employees. "Due to the excellent performance of the industrial economy last year, demand in the labour market remained very strong in the first few months of this year despite the increasing economic problems, even driving down the unemployment rate to 3.0% in manufacturing. The tide began to turn around three months ago when the unemployment rate in the sector started to rise slightly, driven by the heavily industry-focused federal states of Vorarlberg and Styria", says Pudschedl, adding: "We expect the unemployment rate in manufacturing to rise to an average of 3.3% for 2023 as a whole, compared with 3.1% in the previous year. While this will reduce the gap, the labour market situation in the sector will remain significantly more favourable than in the economy as a whole, where the expected unemployment rate is 6.4%."

Falling demand fuels lower prices

The marked decline in demand is also reflected in current price trends. In July, the cost of primary materials fell for the fifth month in a row. Falling energy prices and various commodities getting cheaper (such as steel) caused the biggest cost reduction in 14 years. Due to lower costs in a weak demand environment and under pressure from increased competition, domestic industrial businesses have also reduced output prices. Since the survey began, only once before have output prices fallen more strongly than in July — that was in March 2009, in a move to counteract a slump in demand. "Underpinned by the sharp drop in input prices, domestic industrial businesses managed to maintain profit margins in a weak demand environment despite the low pricing power in sales. As the cost decline was again stronger than the reduction in output prices, the earnings situation of domestic businesses in July was on average even slightly better than in the previous month", says Pudschedl.

Stocks of finished goods filling up

As a result of persistently weak demand, domestic businesses are once more placing greater emphasis on cautious and cost-conscious inventory management. For the fifth month in a row, a significant reduction in the quantity of purchases led to a reduction in stocks of primary materials and commodities. Due to declining production requirements, however, the reduction in inventories happened more slowly than the reduction in the quantity of purchases, suggesting that purchasing manager underestimated the current weakness of the economy. The increased stocks of finished goods further underline the fact that businesses failed to properly account for the reduced production requirements. In addition to the slowdown in new business, there have been order cancellations from some customers or goods were ordered but not called off. This contributed to an above-average increase in stocks of finished goods for the third month in a row.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at